Top Crypto Gainers Today Nov 17 – Astar Network, Optimism, Injective, Conflux

INJ

INJ

ASTR

ASTR

TOP

TOP

OP

OP

CFX

CFX

Is the market’s volatility keeping you on edge or presenting fresh opportunities? Today, the crypto market cap stands at $3.15 trillion, reflecting a slight dip of -2.5% in the last 24 hours. Despite this, top crypto gainers like Astar, Optimism, Injective, and Conflux are surging against the tide. With the Fear & Greed Index at an Extreme Greed level of 90, it’s clear the market is brimming with bullish sentiment. While 80% of cryptocurrencies struggle, these top gainers are driven by innovation and ecosystem growth, offering savvy investors a chance to make profits.

Biggest Crypto Gainers Today – Top List

Today’s top crypto gainers are turning heads with impressive performance metrics. Astar Network leads with a 9.15% surge to $0.067393, buoyed by its expanding multi-chain ecosystem. Optimism follows closely, climbing 4.34% to $1.74581, fueled by its role in scaling Ethereum. Injective impresses with a 3.34% rise to $26.39, backed by its advanced DeFi infrastructure and 139.30% gain above its 200-day SMA. Meanwhile, Conflux adds 2.57%, reaching $0.156166, driven by innovative moves like the $500M PayFi initiative.

1. Astar Network (ASTR)

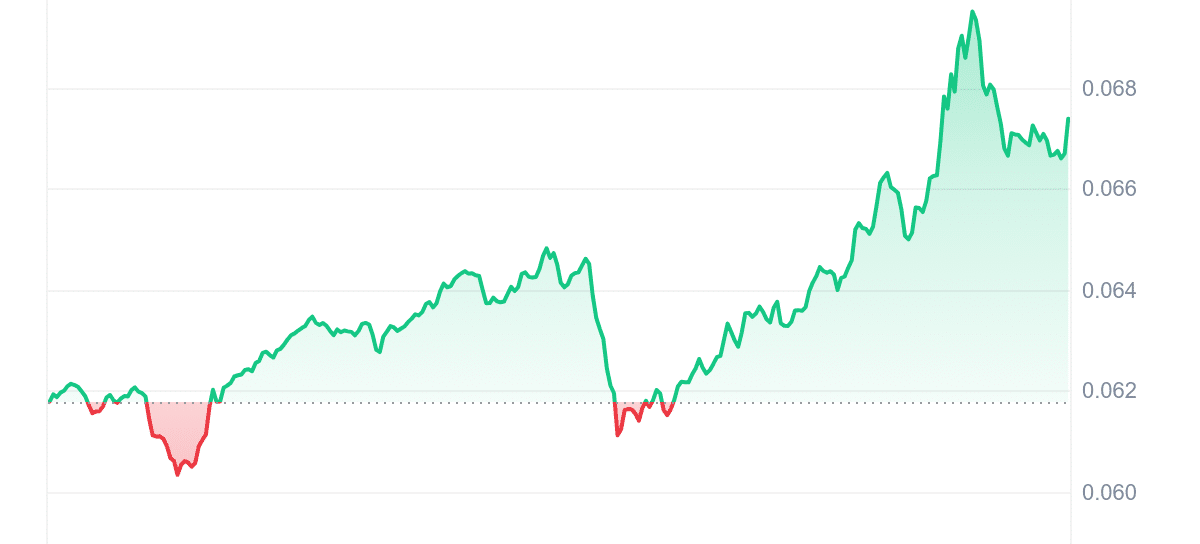

Astar Network leads as the first top gainer on our list, posting an impressive 9.15% surge to $0.067393 in the last 24 hours. This boost aligns with Astar’s efforts to expand its token’s utility, notably through collaborations with projects on Soneium. The network’s ongoing push to position ASTR as a critical asset in Soneium dApps is catching investors’ attention.

Astar offers developers a robust platform to build dApps and layer two solutions. It blends compatibility with Ethereum and Cosmos while serving as a Polkadot Parachain. This multi-chain dApp hub supports DeFi, NFTs, and DAOs, ensuring it remains a versatile choice for developers. Backed by Binance Labs and Coinbase Ventures, Astar’s ecosystem demonstrates scalability and significant growth potential.

The token shows high liquidity with a volume-to-market cap ratio of 0.2671, reflecting strong trading activity. Its 14-day RSI of 57.91 indicates neutral momentum, and with 17 green days in the last 30, ASTR’s recent performance reflects stability with room for growth.

Additionally, Astar trades 16.93% above its 200-day moving average, showcasing upward momentum in its long-term trend. The token’s 10% annual growth further highlights its appeal to investors seeking consistent returns.

2. Optimism (OP)

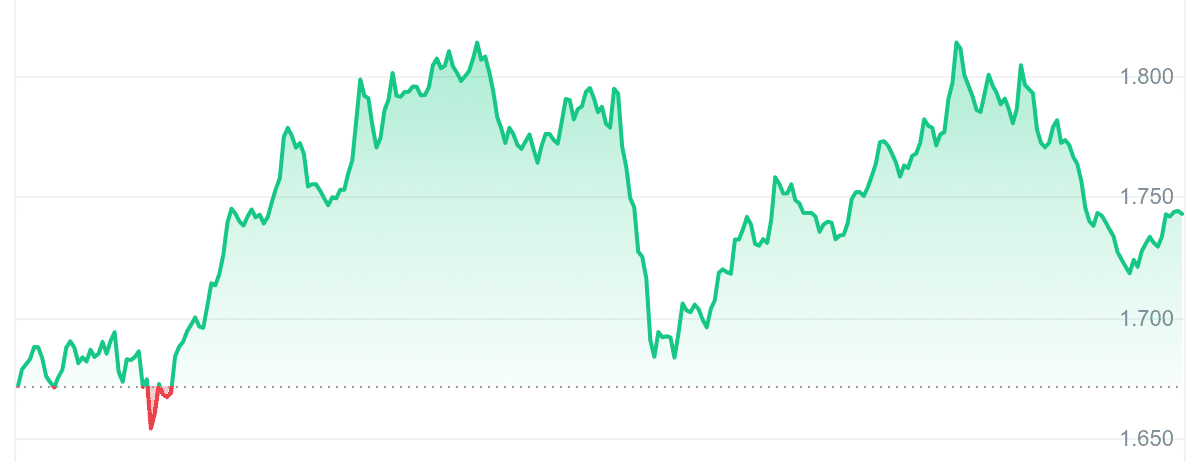

Optimism is the second gainer on our list today, showcasing its resilience in the competitive crypto market. The layer-two blockchain, built atop Ethereum, has seen its price climb by 4.34% in the past 24 hours, reaching $1.74581. With a high liquidity ratio of 0.3794, Optimism demonstrates strong investor activity, solidifying its position as a key player in Ethereum’s scaling solutions.

Optimism’s sustainability-driven approach has fueled its appeal among developers and users. By simplifying transaction processing and eliminating mempools, it offers a seamless user experience. The network’s long-term vision, backed by Ethereum’s robust infrastructure, continues to attract attention.

The network’s design blends simplicity and innovation, leveraging optimistic rollups to enhance transaction efficiency while ensuring security through Ethereum’s consensus. Recent data shows Optimism trading 9.22% above its 200-day SMA, indicating bullish momentum. However, the token remains neutral with an RSI of 56.88, suggesting potential for steady growth without immediate overbought risks.

NEW: Optimism Leads in BlackRock's Multi-Chain Push

Out of the 5 new chains announced for BUIDL today, Optimism is seeing the highest demand, with over $26M in new mints.

Which chain will be next in line for new flows? Let's watch. pic.twitter.com/hUY6L1V1y8

— RWA.xyz (@RWA_xyz) November 13, 2024

Over the past year, Optimism has achieved a 4% price increase, outperforming 22% of the top 100 crypto assets. Its growing adoption underscores its role in shaping Ethereum’s scalability. For investors eyeing a balanced mix of innovation and stability, Optimism stands out as a compelling choice in today’s market.

3. Flockerz (FLOCK)

Flockerz has quickly emerged as a frontrunner in the meme coin market, raising over $2.0 million in its presale as the sector’s market cap surpasses $114 billion. Riding the wave of Bitcoin’s surge, Flockerz has captured the attention of investors, especially with its unique Vote-to-Earn (V2E) mechanism. This model allows $FLOCK holders to earn tokens for participating in governance decisions, setting the project apart from other meme coins driven by centralized developers.

Since launching in September, Flockerz has seen impressive momentum. Investors are flocking to the presale, with a whale recently purchasing 8.8 million $FLOCK tokens for $53,000. The token price is currently at $0.0060053 but will soon increase, making this a prime time for early investors. As the presale continues, more investors recognize the value of being part of a community-driven project.

The Flock has a big reason to celebrate today!

2 million and counting! Let's keep this flock growing strong, nothing can stop us now! 🐦🐦🔥 pic.twitter.com/4DKl7rgBid

— Flockerz (@FlockerzToken) November 16, 2024

What truly sets Flockerz apart is its decentralized governance model. Unlike typical meme coins, holders have a direct say in decisions like protocol changes and budget allocations. Every vote rewards participants with more $FLOCK tokens, reinforcing the community-first approach that drives the project.

With its focus on transparency and security, Flockerz has already had its smart contract audited, offering investors peace of mind. As the first meme coin to fully embrace the V2E model, Flockerz sets a new standard, and other projects may soon follow its lead.

4. Injective (INJ)

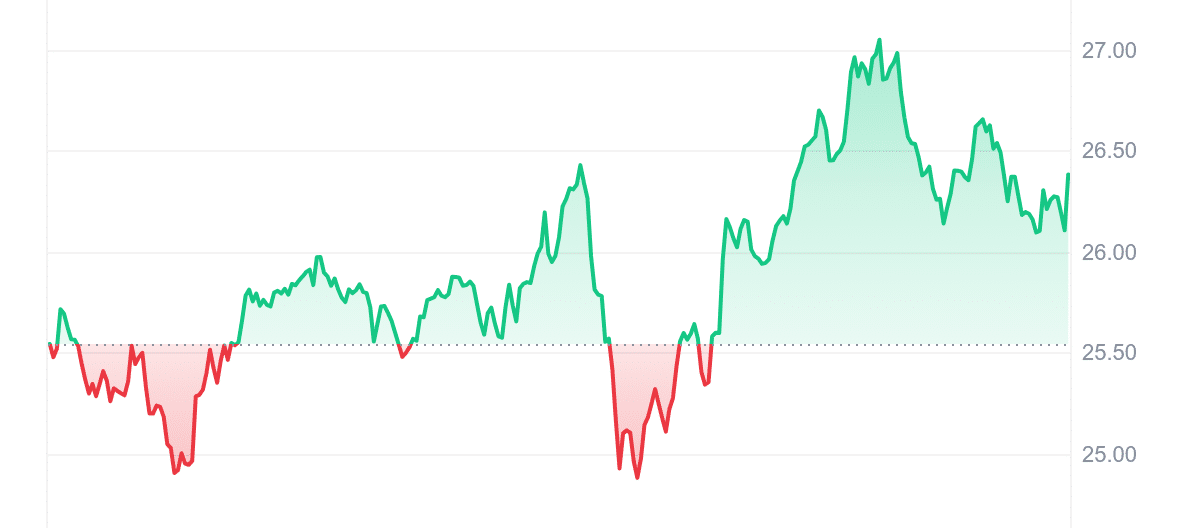

Injective takes the third spot on today’s top gainers list, showcasing a solid 3.34% surge in the past 24 hours. Currently priced at $26.39, this blockchain-focused token is making waves, bolstered by its role in powering next-gen decentralized finance. With advanced infrastructure and interoperability across significant networks like Ethereum and IBC-enabled chains, Injective redefines how financial markets operate.

The recent announcement that Bitkub Exchange in Thailand is integrating INJ marks a pivotal moment. Bitkub’s migration to Injective’s native network underscores growing adoption and trust. This seamless token migration process strengthens INJ’s utility while streamlining its ecosystem. News like this often ignites investor interest, and today’s market performance reflects this optimism.

The largest exchange in Thailand is integrating $INJ#NinjaNovember https://t.co/flQuDAfU26

— Injective 🥷 (@injective) November 15, 2024

Interestingly, INJ is trading well above its 200-day simple moving average, soaring 139.30% higher. Over the past year, it has gained an impressive 65%, signaling long-term solid potential. The market cap-to-volume ratio of 0.1537 indicates high liquidity, ensuring active trading opportunities for investors.

However, the Relative Strength Index (RSI) at 79.76 suggests the token is overbought, hinting at a potential pullback. Despite this, Injective’s unique deflationary model and burn auctions continue to enhance its value proposition.

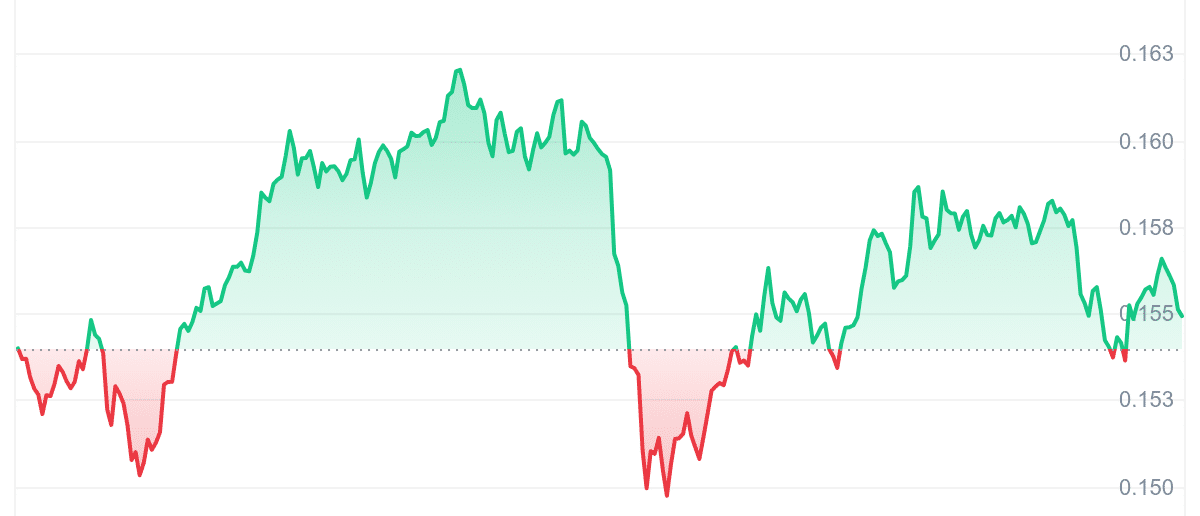

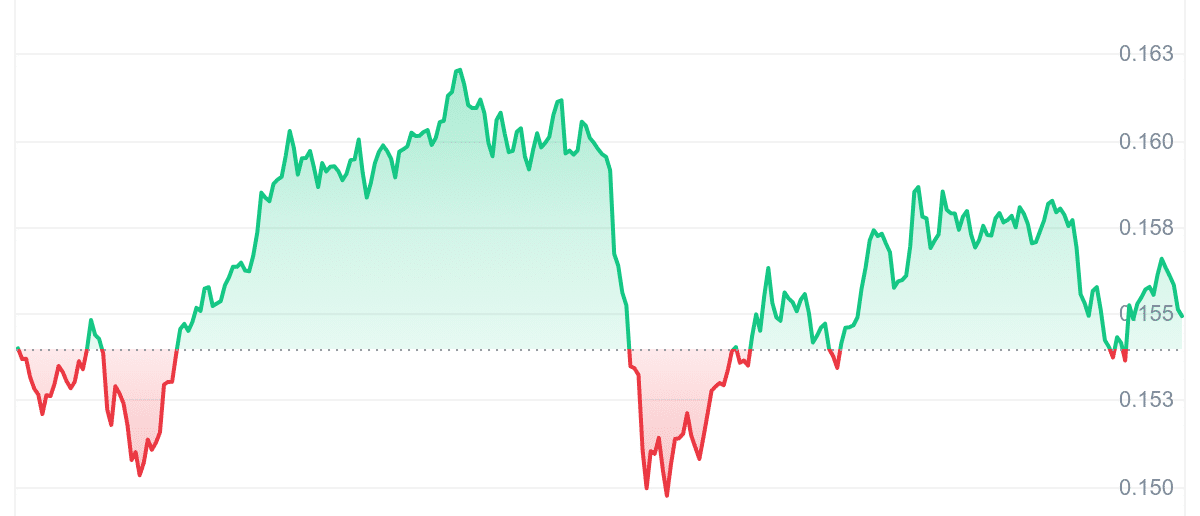

5. Conflux (CFX)

Conflux is today’s last top gainer, showing a 2.57% price increase in the previous 24 hours. The blockchain’s unique Tree-Graph consensus mechanism has made it a scalable and secure alternative to other networks. The project has steadily grown, making it a standout in the crowded blockchain space. Its compatibility with Ethereum’s EVM allows developers to create decentralized applications easily.

Recently, Conflux introduced its PayFi initiative, aiming to transform on-chain payments in Web3. This move has the potential to boost CFX’s adoption significantly. The $500 million ecosystem fund dedicated to expanding PayFi further highlights the project’s commitment to long-term growth. Such developments are expected to drive increased demand for CFX, possibly contributing to its positive price movement.

Looking at its current trading stats, Conflux is sitting at $0.156166, just 5.75% below its 200-day simple moving average. While it’s not experiencing massive volatility, the price has steadily increased by 6% in the past year, suggesting stability. Its market cap-to-volume ratio of 0.2818 indicates high liquidity, making it easier for investors to buy and sell the token.

Conflux’s neutral 14-day RSI of 53.41 suggests the token isn’t overbought or oversold, allowing for potential sideways movement. However, upcoming developments like PayFi could spark another rally.