Top Crypto Gainers Today Nov 30 – Flare, EOS, Kava, THORChain

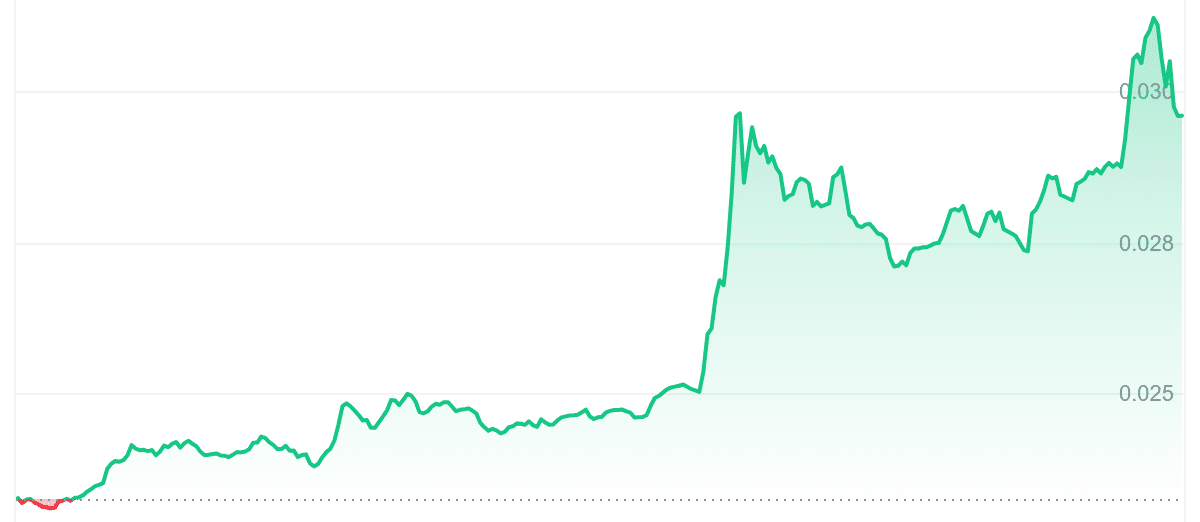

KAVA

KAVA

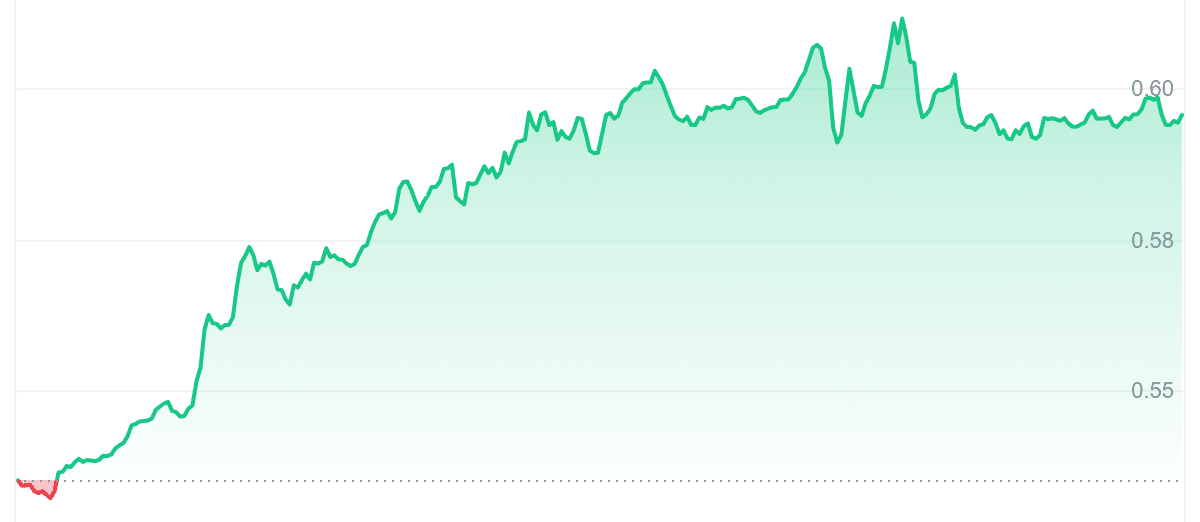

TOP

TOP

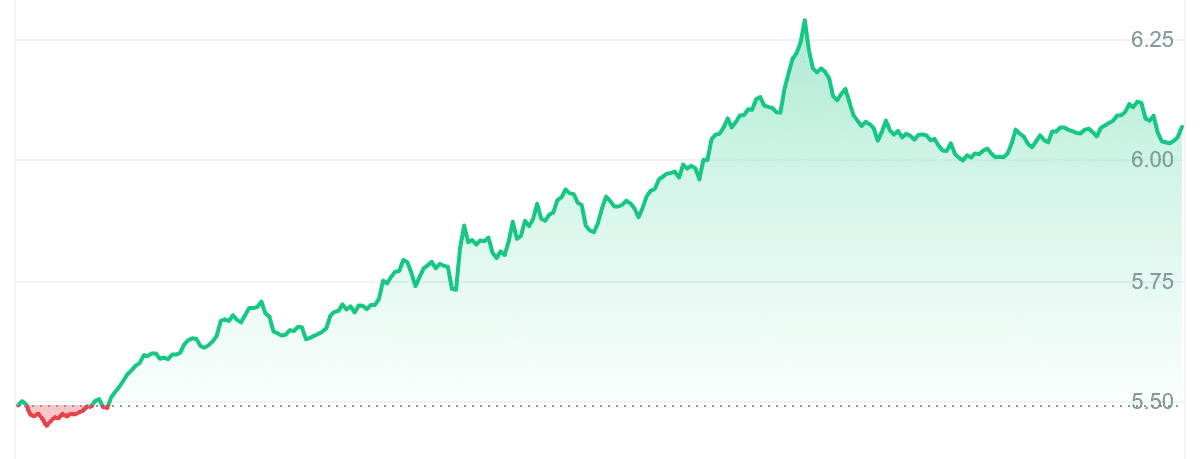

RUNE

RUNE

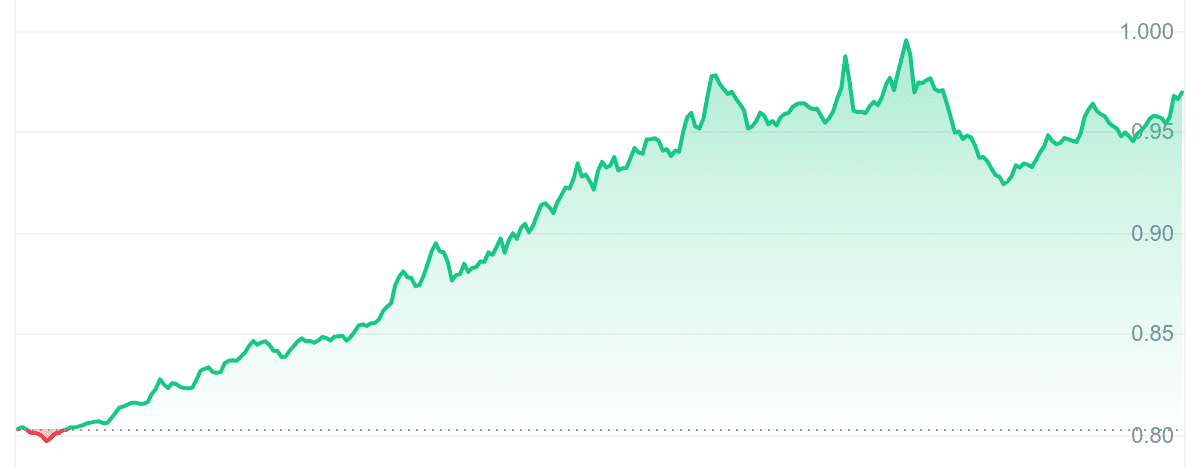

EOS

EOS

FLR

FLR

No matter how many projects emerge, the crypto market remains a hub of ongoing opportunities for investors and innovators. Today is no different, with Flare, EOS, Kava, and THORChain all posting impressive gains.

But the real question is: what’s fueling this growth, and can these tokens maintain their momentum? In this analysis, we’ll dive deep into the technical indicators, price movements, and core strengths behind these surges, giving you a clear picture of what’s driving their success. So, in case you’re looking to diversify or make your next high-potential investment, these tokens are undoubtedly worth your attention.

Biggest Crypto Gainers Today – Top List

The price movements of Flare, EOS, Kava, and THORChain reveal distinct trends, with each token showing notable growth but underpinned by unique factors. Flare’s steady uptrend, marked by consistent growth and strong fundamentals, contrasts with EOS’s recent surge driven by increased visibility.

Kava’s rally reflects the growing interest in its dual-layer blockchain, while THORChain’s rise highlights the demand for decentralized liquidity solutions. Despite their different catalysts, all four tokens demonstrate strong market potential, suggesting sustained momentum if their core developments continue to resonate with investors.

1. Flare (FLR)

Today’s top crypto gainers analysis starts with an impressive performance from Flare, a token that has surged 27.54% in the past 24 hours. This layer-1 blockchain is gaining attention not just for its price movement but also for its game-changing approach to data integration. Recent news about Flare’s plans to create a DeFi hub powered by high-integrity data seems to be fueling investor optimism. With $20.75 million in total value locked and over 1 million active wallets, Flare’s expanding ecosystem is proving hard to ignore.

Solid fundamentals back this surge. Flare’s unique interoperability protocols, including the Flare Time Series Oracle and State Connector, revolutionize how decentralized applications access blockchain and Web2 data. These innovations minimize risks for developers and users, making the network a standout in the DeFi space. Moreover, the upcoming launch of FAssets, a bridge for non-smart contract tokens, promises to attract even more liquidity and utility.

Flare Data Connector (FDC), a key protocol for @FlareNetworks and core to FAssets, is progressing daily 🔥

With the community's support, FDC is now live on Coston and is prepared to launch on Songbird in December.

Data providers, start your engines ☀️ More details on migration:…

— Flare ☀️ (@FlareNetworks) November 29, 2024

From a technical perspective, Flare is trading 3.68% above its 200-day SMA, signaling a steady uptrend. With 18 green days in the last 30 and a manageable volatility of 24%, FLR shows a balanced risk profile. Its RSI of 50.48 suggests a neutral zone, pointing to potential sideways movement in the short term.

Long-term performance adds further confidence. Flare’s price has surged 139% over the past year, outperforming 58% of the top 100 cryptocurrencies. This growth shows its staying power amid fierce competition, solidifying its position as a critical player in the blockchain ecosystem.

2. EOS (EOS)

Building on the excitement stirred by Flare’s surge, EOS is making news with an impressive 20.81% price jump in the last 24 hours. This performance, bolstered by its inclusion in Coinbase’s COIN50 Index, positions EOS among today’s top crypto gainers. With the COIN50 Index hailed as the “S&P 500 of blockchain,” EOS is now in the spotlight for retail and institutional investors. This heightened visibility could explain the token’s recent momentum.

EOS’s liquidity is another key strength, with a market cap-to-volume ratio of 0.8195, signaling robust market activity. Furthermore, its 14-day RSI of 72.89 suggests overbought conditions, a factor that may lead to price corrections. However, the token’s 62.67% surge above the 200-day SMA at $0.59 underscores long-term solid growth potential. This high activity and historical strength duality presents both opportunities and risks for traders.

Over the past year, EOS has climbed 42%, outperforming a quarter of the top 100 crypto assets by market cap. Though it has not outpaced the majority, its consistent upward trajectory reinforces its resilience. Moreover, its 24% volatility in the last month suggests a relatively stable trading environment, offering a measure of predictability for cautious investors.

EOS Network & Ecosystem: The inclusion of #EOS in the COIN50 Index has significantly expanded exposure to a broader retail and corporate audience.

With @coinbase positioning the index as the "S&P 500 of blockchain," institutional and retail investors alike will become more…

— EOS Network (@EOSNetworkFDN) November 29, 2024

With its Delegated Proof of Stake model and community-driven foundation, EOS represents a decentralized, developer-friendly platform set for future adoption. As EOS continues to attract interest with its blend of innovation and performance, investors will find value in examining its potential as a long-term portfolio addition.

3. Catslap (SLAP)

In just one week, Catslap has skyrocketed by an impressive 1,800%, turning heads across the crypto space. Its playful Slapometer game and viral cat-themed branding have captured attention worldwide. To celebrate hitting 10 million slaps, the team burned an equal number of SLAP tokens—a bold move to reduce supply and boost long-term value. With whispers of a potential CEX listing gaining traction, Catslap is proving it’s more than just another meme coin.

Next burn milestone: 25,000,000 slaps

Get slappin: https://t.co/WIxjg08wEb pic.twitter.com/XQyziaon4U

— CatSlap (@CatSlapToken) November 30, 2024

Since its debut on Uniswap on Nov 21, SLAP has delivered a jaw-dropping 5,800% return within just three days before experiencing a slight pullback. Despite this, it’s still trading at $0.0022, with more than 7,600 holders helping to push its market cap past $20 million. Though representing just 0.11% of the total supply, the recent token burn underscores the team’s commitment to a sustainable, value-driven project.

However, Catslap isn’t just fluff—it’s packed with serious features. The Slapometer game has quickly become a fan favorite, and the buzz around a potential “Slap-to-Earn” system could provide even more utility for SLAP holders. With its staking platform already offering a generous 40% annual yield, more than 284 million tokens are locked in by eager investors.

Backed by a clean audit from SolidProof, a 10-year vesting plan for the team, and a growing partnership with Best Wallet, Catslap is setting itself apart. Don’t miss out—seize this opportunity now!

4. Kava (KAVA)

Back to our analysis of today’s top crypto gainers, Kava has stepped up as another impressive performer in the market. Its price climbed 10.61% in the last 24 hours, bringing it to $0.59362. This surge reflects growing interest in Kava’s dual-layer blockchain, which combines Cosmos’ speed and interoperability with Ethereum’s developer-friendly environment.

Security remains a cornerstone for Kava, which uses a Tendermint-based proof-of-stake mechanism with rigorous validator requirements. Combined with audits from firms like CertiK and Quantstamp, Kava offers investors a sense of reliability. As it leverages Cosmos and Ethereum ecosystems, its current rally hints at growing interest in its long-term scalability and developer-friendly design.

Kava’s liquidity is solid, with a volume-to-market cap ratio of 0.1214, signaling healthy trading activity. However, its 14-day RSI sits at 68.93, placing it in a neutral zone. While it’s not overbought, we might see some sideways movement in the near future following this surge. What’s worth noting is Kava’s impressive track record of 19 green days in the last 30, demonstrating a consistent positive trend.

$MVX is officially LIVE on @KAVA_CHAIN! ☀️

Bridge your $MVX into the KAVA ecosystem using @squidrouter + @axelar interchain tech – seamless & secure!

Starting next epoch, LPs can earn lucrative rewards on @KinetixFi with 2⃣ new pools:

🔸 MVX/WETH

🔸 MVX/KAIDon’t miss out! pic.twitter.com/7hGXzlGv4r

— Metavault ♏️ (@MetavaultTRADE) November 27, 2024

Despite this short-term strength, Kava’s long-term outlook is more nuanced. It’s currently trading 32.34% above its 200-day SMA of $0.448563, signaling upward momentum, but the token is still down 23% year-over-year. Additionally, it has underperformed most of the top 100 crypto assets, ranking in just the third percentile.

5. THORChain (RUNE)

Moving from Kava, THORChain has also captured attention as a significant gainer in today’s market. The price of RUNE surged by 10.05% in the past 24 hours, reaching $6.05. This rise is primarily fueled by increasing demand for THORChain’s decentralized liquidity protocol, which facilitates cross-chain swaps across major networks like Bitcoin and Ethereum without compromising asset control.

Moreover, THORChain continues to innovate with features like its slip-based fee system, which is designed to reduce impermanent loss for liquidity providers. By utilizing deterministic swap ordering, it also eliminates risks like front-running and sandwich attacks, further enhancing its appeal as a secure cross-chain platform. These technical advantages position THORChain as a leader in decentralized liquidity.

In addition to its solid price performance today, RUNE stands out with its strong liquidity, boasting a 0.1790 volume-to-market cap ratio. This indicates robust trading activity, and with its 14-day RSI of 47.85, the token sits comfortably in neutral territory. As such, there is potential for further stability or sideways movement rather than an immediate downturn, which is positive for investors.

THORChain:

120 validators running nodes for BTC & every other chain with >3x value staked than external assets secured. No backdoor, no multisig. Permissionless 16/20 MPC signer set. 100% open source, onchain. Battle tested moving BTC at scale for the largest wallets in the space https://t.co/nHBIeEkNds— THORChain (@THORChain) November 25, 2024

Although the token has seen a slight 6% dip in the past year, THORChain is trading 22.78% above its 200-day SMA. This suggests a potential for further upward movement, with the network’s security and liquidity continuing to attract attention.

Overall, THORChain’s position as a cross-chain liquidity hub and its technical strengths and recent performance make it a token worth monitoring as it charts its next steps.