Top Crypto to Invest in Right Now – Aave, Hedera, Alchemy Pay

CRV

CRV

ACOIN

ACOIN

HBAR

HBAR

TOP

TOP

ACH

ACH

As Bitcoin stabilizes above $100,000, the cryptocurrency market is experiencing mixed movements among altcoins. Some are gaining momentum, while others face resistance levels that could determine their next direction. Traders closely analyze technical indicators and broader market trends to identify potential opportunities.

With shifting price dynamics, selecting the top crypto to invest in right now requires a careful look at market performance, liquidity, and long-term potential. This article explores key altcoins based on recent trends, resilience, and potential breakout signals.

Top Crypto to Invest in Right Now

Alchemy Pay has recently obtained registration from the Australian Transaction Reports and Analysis Centre (AUSTRAC) as a Digital Currency Exchange Provider, marking a regulatory milestone for the platform. Meanwhile, Hedera is currently valued at $0.302, experiencing an 8.04% gain over the past month. On the other hand, investor interest in BEST remains strong, with the project raising over $8 million in its ongoing presale.

1. Best Wallet Token (BEST)

Best Wallet is introducing a crypto wallet designed to streamline blockchain interactions. Unlike traditional wallets that require users to connect multiple external apps, Best Wallet integrates several blockchain services into a single platform. Users can trade cryptocurrencies, stake tokens, access presales, manage NFTs, and even use a crypto debit card without leaving the app.

$8M RAISED. BW FAMILY IS BUILT DIFFERENT. 💎

This is your ONLY shot to get in early and secure exclusive benefits before time runs out!

Don't miss it. Join now! 🔥

📲 https://t.co/he5kzraFJw pic.twitter.com/RY1V35MhFe— Best Wallet (@BestWalletHQ) January 27, 2025

A key feature of Best Wallet is its native token, which provides several benefits. Token holders receive trading fee discounts, higher staking rewards, and governance rights, allowing them to participate in decision-making. The token is also linked to promotions from partner projects. Priced at $0.023775 during its presale, it has raised over $8 million, reflecting investor interest.

Best Wallet aims to simplify the crypto experience, which has often been fragmented and complex. Many existing wallets offer only essential functions, requiring users to navigate multiple platforms for trading, staking, and other activities. This app takes a different approach by bringing everything together in one interface, resembling the convenience of centralized exchanges while maintaining decentralization.

The project aims to offer a seamless blockchain experience. However, as with any emerging platform, users should evaluate its security, usability, and long-term viability. While the integrated approach could reduce friction in crypto transactions, adoption and execution will determine its effectiveness. Best Wallet presents an alternative for those seeking an all-in-one crypto wallet that could reshape how users interact with blockchain technology.

Visit Best Wallet Token Presale

2. Curve DAO Token (CRV)

Curve is a decentralized exchange (DEX) on the Ethereum blockchain that focuses on the efficient trading of stablecoins. The platform aims to reduce trading costs by offering low slippage and fees when users swap one stablecoin for another.

Curve uses liquidity pools, essentially reserves of tokens provided by users. These pools use smart contracts, or automated programs, to handle trades without the need for traditional order books. Each pool in Curve has unique benefits and risks tailored to various stablecoin pairs or other cryptocurrencies with low volatility.

Additionally, Curve allows token staking, where users can lock their tokens in the system for a period to earn additional rewards. This process supports the governance and stability of the Curve ecosystem.

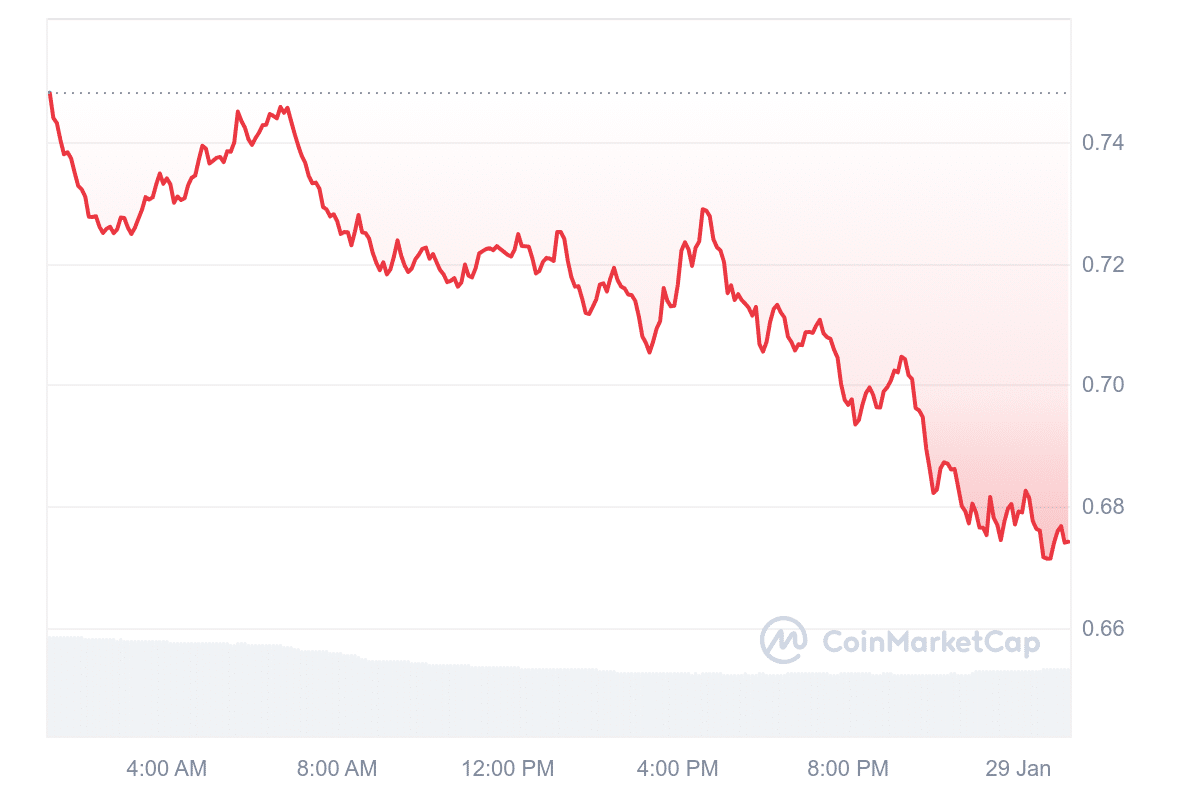

At press time, the Curve DAO Token (CRV) trades at $0.6742, marking a 10.05% decrease over the last day. Market sentiment is bearish, with the Fear & Greed Index at 72, indicating greed.

The token trades 12.06% above its 200-day simple moving average, suggesting some resilience. With an RSI of 42.83, CRV shows a neutral position, potentially moving sideways in the near term. This indicates a market where traders might expect less price movement.

3. Aave (AAVE)

Aave is a decentralized finance protocol that operates on blockchain technology. It allows users to lend and borrow cryptocurrencies. Instead of directly matching lenders with borrowers, Aave pools all funds together. This system means instant access to funds without waiting for a match.

One of Aave’s standout features is its stable interest rates, which provide predictability for both lenders and borrowers. Another unique aspect is the “flash loan,” where users can borrow funds without collateral but must repay within the same transaction. This can be useful for arbitrage or other quick financial maneuvers.

Aave on @gnosischain hits an all-time high 👀

The DeFi Renaissance is multichain. pic.twitter.com/sA8aFRYyOy

— Aave (@aave) January 24, 2025

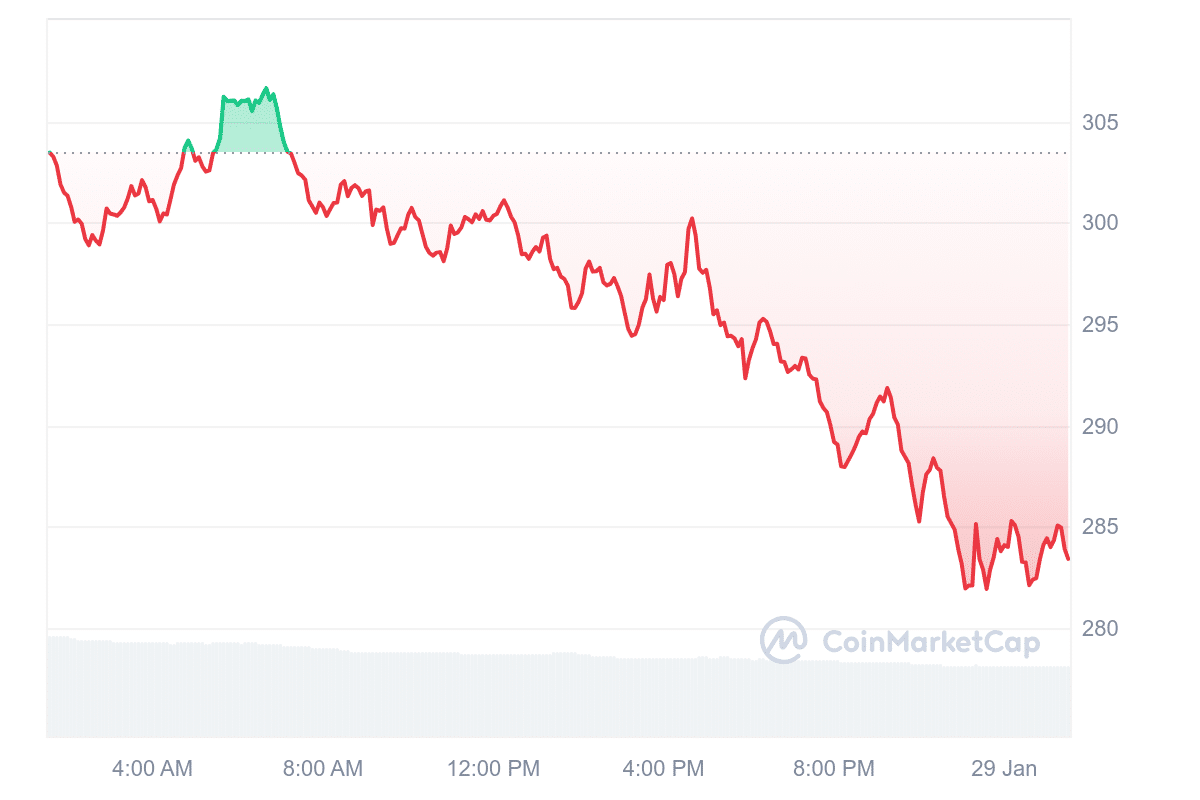

Currently, Aave holds a significant position in DeFi, with over $5 billion in assets locked in its protocol. Today, Aave’s price is $283.09, with a market cap of around $4.29 billion. Despite a recent 6% drop in the last 24 hours, it’s trading above its 200-day simple moving average, suggesting a positive long-term trend.

The 14-day RSI at 52.73 indicates a neutral market condition, potentially leading to sideways trading. Analysts predict a modest increase, forecasting the price to hit $311.65 next month.

4. Alchemy Pay (ACH)

Alchemy Pay has recently secured registration from the Australian Transaction Reports and Analysis Centre (AUSTRAC) as a Digital Currency Exchange Provider. This registration allows Alchemy Pay to offer secure and efficient services for converting traditional money into cryptocurrencies within Australia.

They can now work directly with local payment facilitators, providing competitive pricing for Australian users. This step aligns Alchemy Pay with other major players in the industry who follow similar regulatory guidelines.

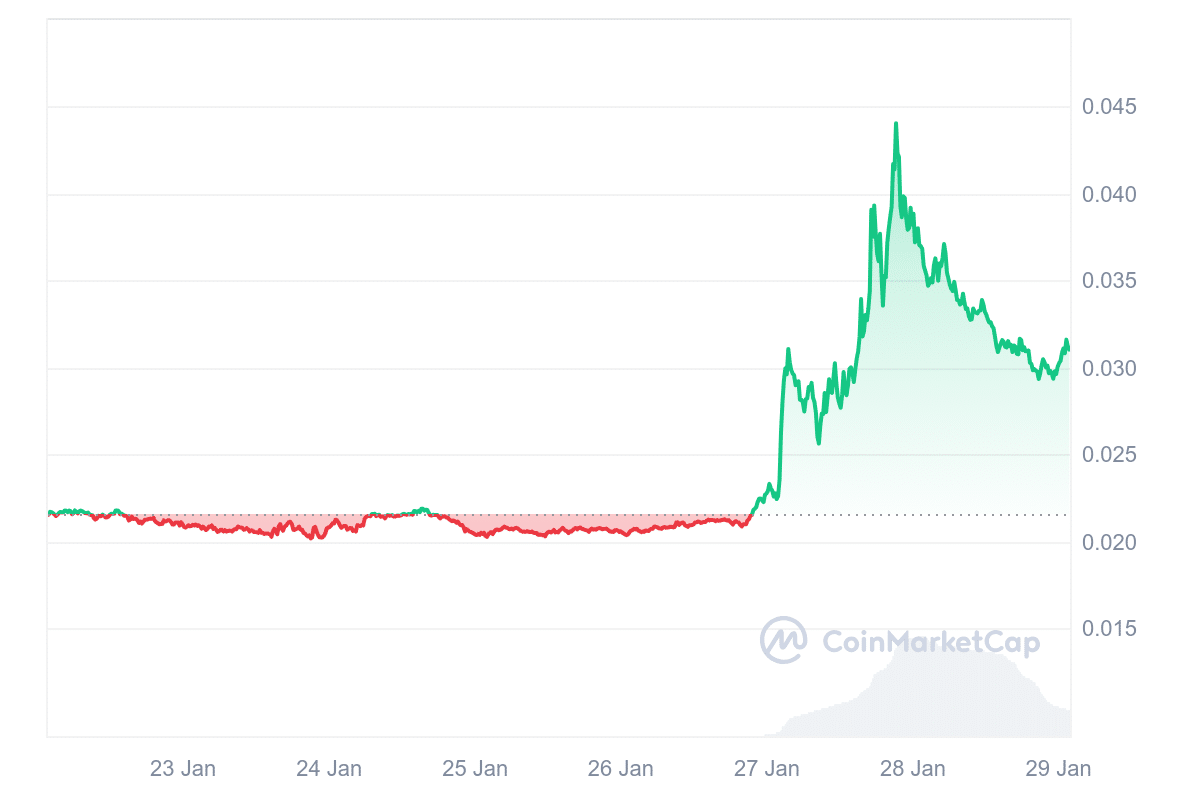

Currently, the ACH token trades at $0.03121, showing a significant increase of 44.44% over the past week and 20.59% in the last month. Market sentiment for ACH is bullish, with the Fear & Greed Index at 72, indicating greed among investors.

🎉🇦🇺 Big news from #AlchemyPay!

We’re now officially registered as a Digital Currency Exchange Provider with AUSTRAC in Australia, enabling us to bring secure and seamless fiat-to-crypto payment services to Australian users. 🌏🚀

👉 Learn more: https://t.co/GZVwLCoE3q$ACH pic.twitter.com/JfUvBmdoUJ

— Alchemy Pay|$ACH: Fiat-Crypto Payment Gateway (@AlchemyPay) January 27, 2025

The token is trading 63.90% above its 200-day Simple Moving Average, suggesting strong performance relative to its long-term trend. However, its 14-day Relative Strength Index (RSI) at 46.49 points to a neutral condition, indicating potential sideways movement in price.

Meanwhile, predictions estimate that ACH might rise by 96.24%, reaching $0.058522 by February. This reflects optimism in the market and highlights the volatility inherent in cryptocurrency investments. Alchemy Pay’s recent regulatory approval and market performance underscore its growing role in bridging fiat and crypto economies.

5. Hedera (HBAR)

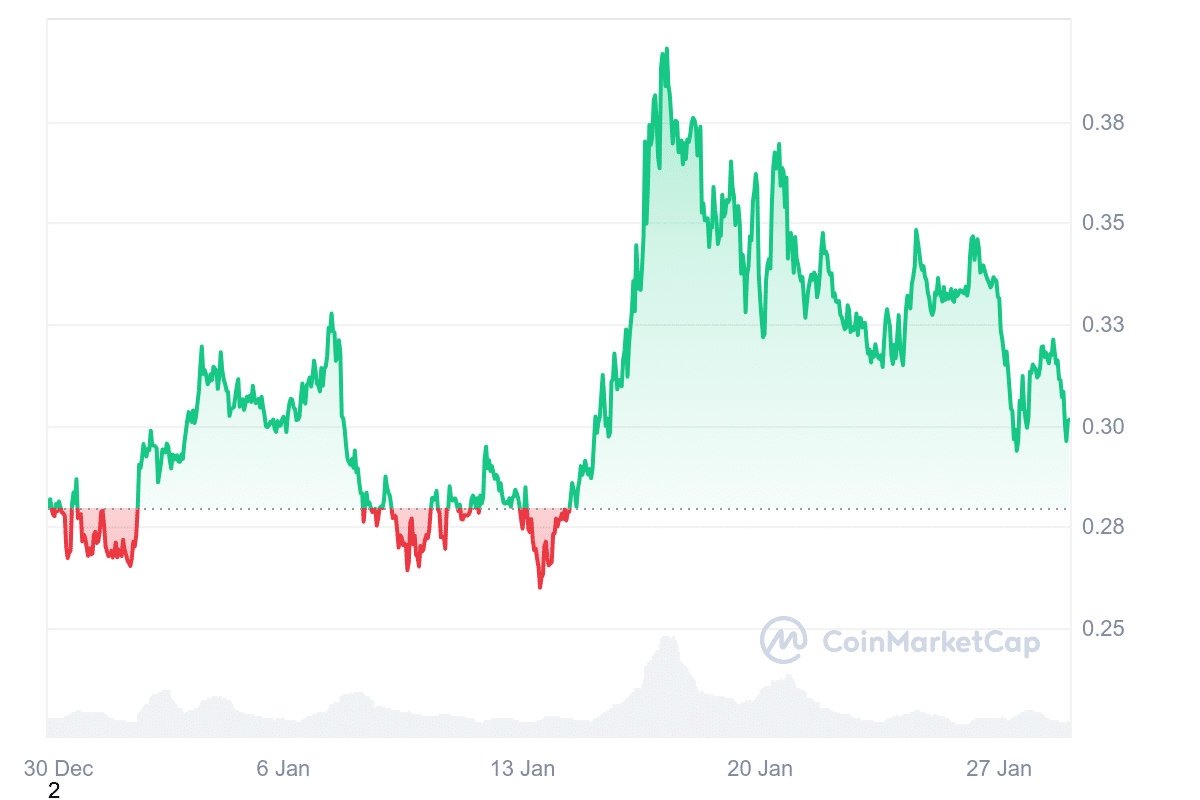

Hedera is currently priced at $0.302, reflecting a 1.99% decline in the past 24 hours. However, it has gained 8.04% over the past month. The network is designed to support decentralized applications (DApps), focusing on efficiency, security, and scalability.

Unlike traditional blockchains, Hedera uses a unique Hashgraph consensus mechanism to improve transaction speed and reduce energy consumption. Institutional interest in Hedera has been increasing, highlighting its appeal as a platform for enterprise-level applications.

It offers a framework that supports tokenization and smart contracts while maintaining high transaction throughput and stability, positioning it as an alternative to blockchain networks that face scalability and congestion issues.

Technical indicators show that Hedera is performing above its 200-day simple moving average (SMA), trading 82.83% higher than the SMA value of $0.170. This suggests long-term growth potential. Meanwhile, the Fear & Greed Index is 72, indicating market optimism.

The 14-day Relative Strength Index (RSI) is 58.85, meaning the token is in a neutral zone and could continue trading sideways. Liquidity remains strong relative to its market capitalization, suggesting ease of trading.