Top Cryptocurrencies to Buy Now – Usual, Toncoin, Cosmos

ACS

ACS BTC

BTC TOP

TOP USUAL

USUAL ATOM

ATOMBitcoin recently broke out of a long-term cup and handle formation, signaling a potential price target of $125,000. The cryptocurrency surged past its $70,000 resistance level, confirming the pattern’s validity. Following the Federal Reserve’s decision to maintain interest rates, Bitcoin climbed to $105,066 after a brief dip to $101,800. This movement indicates renewed market confidence, with analysts expecting further gains.

If Bitcoin maintains this momentum, the broader crypto market could follow, influencing altcoins. Investors seek opportunities beyond Bitcoin, focusing on projects with strong fundamentals and growth potential. This article analyzes some of the top cryptocurrencies to buy now.

Top Cryptocurrencies to Buy Now

Meme Index has raised over $3 million during its ongoing presale, with the token currently valued at $0.0157183. Meanwhile, Access Protocol has teamed up with 852Web3Magazine, aiming to reshape reader engagement with digital and print media. USUAL has experienced notable gains, surging 51.34% in the past 24 hours and rising 14.34% over the past week.

1. Usual (USUAL)

Usual is a decentralized platform that issues fiat-backed stablecoins while redistributing ownership and governance through its USUAL token. USUAL is the governance token, giving holders a stake in the protocol’s infrastructure and treasury management. Furthermore, USUAL has intrinsic value linked to the protocol’s revenue model, aiming to align incentives and promote growth.

The token’s design focuses on increasing the adoption of USD0, the Usual stablecoin, by integrating a distribution model that supports ecosystem expansion. This approach seeks to create sustainable decentralization within the DeFi space. By ensuring that governance and rewards are tied to protocol activity, Usual attempts to foster long-term participation.

🏦 Yesterday, $1.15M in USD0 rewards just hit the wallets of USUAL stakers!

This is an average of 170% APY, directly paid in USD0.

With up to 100% of protocol revenues redistributed, staking USUAL puts rewards directly in your hands: so what are you waiting for? pic.twitter.com/TBpxgSs3ky

— Usual (@usualmoney) January 28, 2025

Recently, the market has seen a significant price increase for USUAL, with a 51.34% rise in the past 24 hours and a 14.34% gain over the last week. The token trades at $0.4331, approaching its recent cycle high. The market sentiment remains bearish despite strong trading activity, as indicated by a 24-hour volume-to-market cap ratio of 4.88.

Moreover, the Fear & Greed Index registers at 70, suggesting investor sentiment leans toward greed. Projections indicate a potential price increase of 230.45%, reaching approximately $1.25 by March.

2. Toncoin (TON)

Toncoin is a decentralized layer-1 blockchain. The network is open-source and supported by multiple contributors, including the Switzerland-based TON Foundation. Currently, Toncoin is trading at $4.80, with a 24-hour trading volume of $375.90 million and a market cap of $11.94 billion.

It holds a 0.33% share of the total cryptocurrency market. Its price has increased by 0.49% in the past day. Although the market sentiment appears bearish, the Fear & Greed Index indicates a greed level of 70.

Moreover, Toncoin trades well above its 200-day simple moving average (SMA), sitting 136.61% higher than the $2.03 mark. Over the past month, the cryptocurrency has experienced 15 green days, indicating consistent upward movement. Its 14-day Relative Strength Index (RSI) is at 47.69, suggesting neutral momentum with potential sideways trading.

Due to its market cap, the cryptocurrency is highly liquid, making it easier to buy and sell without significant price fluctuations. One notable aspect is its negative yearly inflation rate of -28.03%, meaning the supply is decreasing rather than expanding, which can affect its value over time. Meanwhile, Coincodex price prediction estimates a 229.12% increase, potentially reaching $15.86 by March.

3. Cosmos (ATOM)

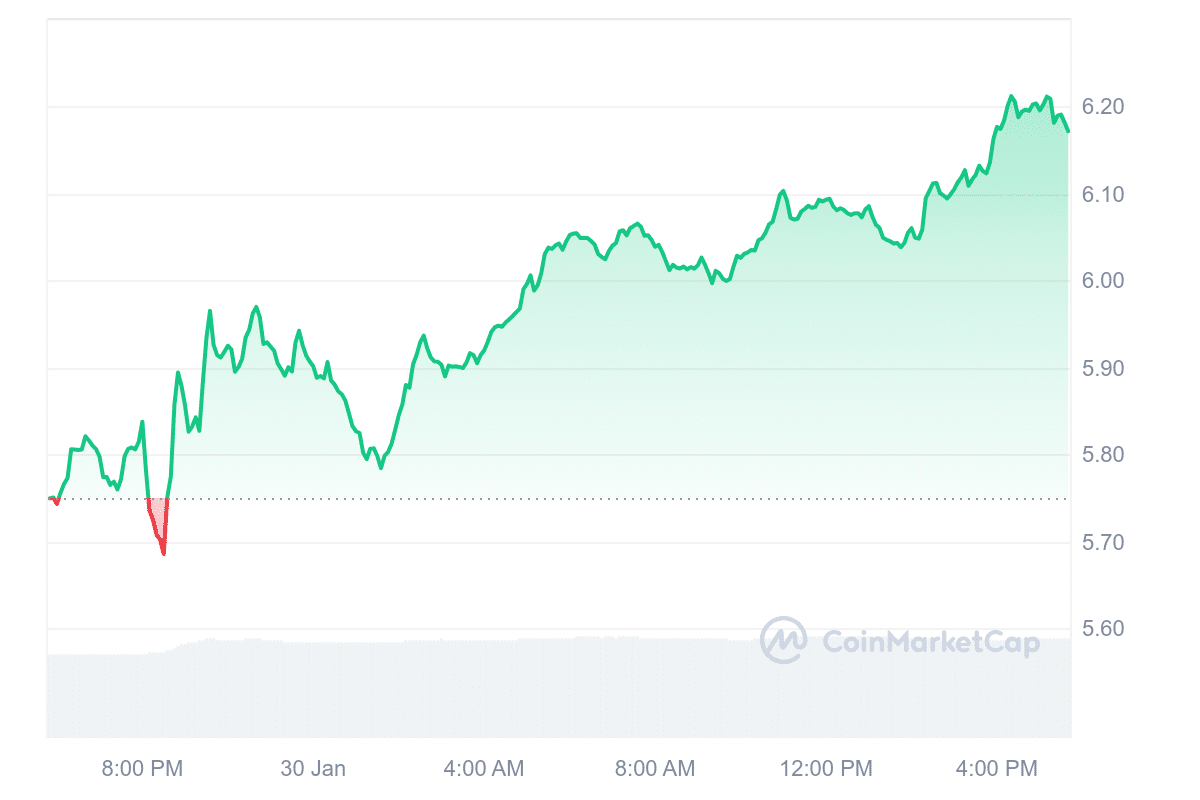

Cosmos (ATOM) is currently priced at $6.18, with a 24-hour trading volume of $240.56 million and a market cap of $2.42 billion. The price increased by 7.58% in the last 24 hours. Its trading volume relative to the market cap is 0.0997, suggesting strong liquidity. The 14-day Relative Strength Index (RSI) is 53.39, indicating neutral market conditions with potential sideways movement.

Market sentiment is bearish, while the Fear & Greed Index shows a reading of 70, meaning investors lean toward greed. Cosmos aims to address blockchain industry challenges such as slow transaction speeds, high costs, and limited scalability. It uses a system of interconnected blockchains rather than a single-chain structure.

This design allows networks to communicate and operate efficiently. Unlike Bitcoin’s proof-of-work system, which requires significant energy, Cosmos offers an alternative approach that reduces environmental impact.

Cosmos is modular framework is a key feature, which simplifies blockchain development. This makes it easier for developers to build decentralized applications without extensive technical expertise. Additionally, the Interblockchain Communication (IBC) protocol enables different blockchains to share data and work together, reducing fragmentation in the industry.

4. Meme Index (MEMEX)

Meme Index (MEMEX) has raised over $3 million in its ongoing presale. The token is currently priced at $0.0157183, but the price will rise as the presale moves to the next stage. The project introduces a decentralized platform for investing in meme coins through diversified index funds.

This approach reduces risk by spreading investments across multiple meme coins rather than relying on a single token. Unlike traditional meme coin investments, which depend on the performance of individual tokens, Meme Index offers structured portfolios.

These indexes adjust based on market trends, helping to limit losses if one meme coin drops in value. This diversification strategy could appeal to investors seeking exposure to the meme coin market without the high risk of individual tokens.

Early investors can stake their MEMEX tokens, earning an annual percentage yield (APY) of 726%. Staking allows holders to lock up their tokens and receive additional rewards. However, high APY rates often come with risks, such as market volatility and potential changes in staking rewards.

852Web3Magazine, Hong Kong’s leading crypto community and organizer of flagship events like @Consensus2025 and @ABS_Summit, is now part of Access Protocol.@852web3 is redefining how readers engage with digital and physical content through subscription-based Web3 learning. pic.twitter.com/LxGJcwcrxy

— Access Protocol (@AccessProtocol) January 24, 2025

Some analysts find the Meme Index’s model useful for simplifying meme coin investments. By offering a managed approach, the platform could attract those who want exposure to the meme market without actively managing individual holdings.

5. Access Protocol (ACS)

Access Protocol has partnered with 852Web3Magazine, a key player in Hong Kong’s crypto community, to change how readers interact with digital and print content. This partnership integrates blockchain-based subscription models into Web3 education, allowing users to access exclusive insights through token-based subscriptions.

By featuring Access Protocol in its physical magazine at Consensus, 852Web3 provides exposure to a global audience. The collaboration positions Access as a potential tool for content monetization, aiming to streamline how creators earn revenue while offering users a more engaging experience.

852Web3Magazine, Hong Kong’s leading crypto community and organizer of flagship events like @Consensus2025 and @ABS_Summit, is now part of Access Protocol.@852web3 is redefining how readers engage with digital and physical content through subscription-based Web3 learning. pic.twitter.com/LxGJcwcrxy

— Access Protocol (@AccessProtocol) January 24, 2025

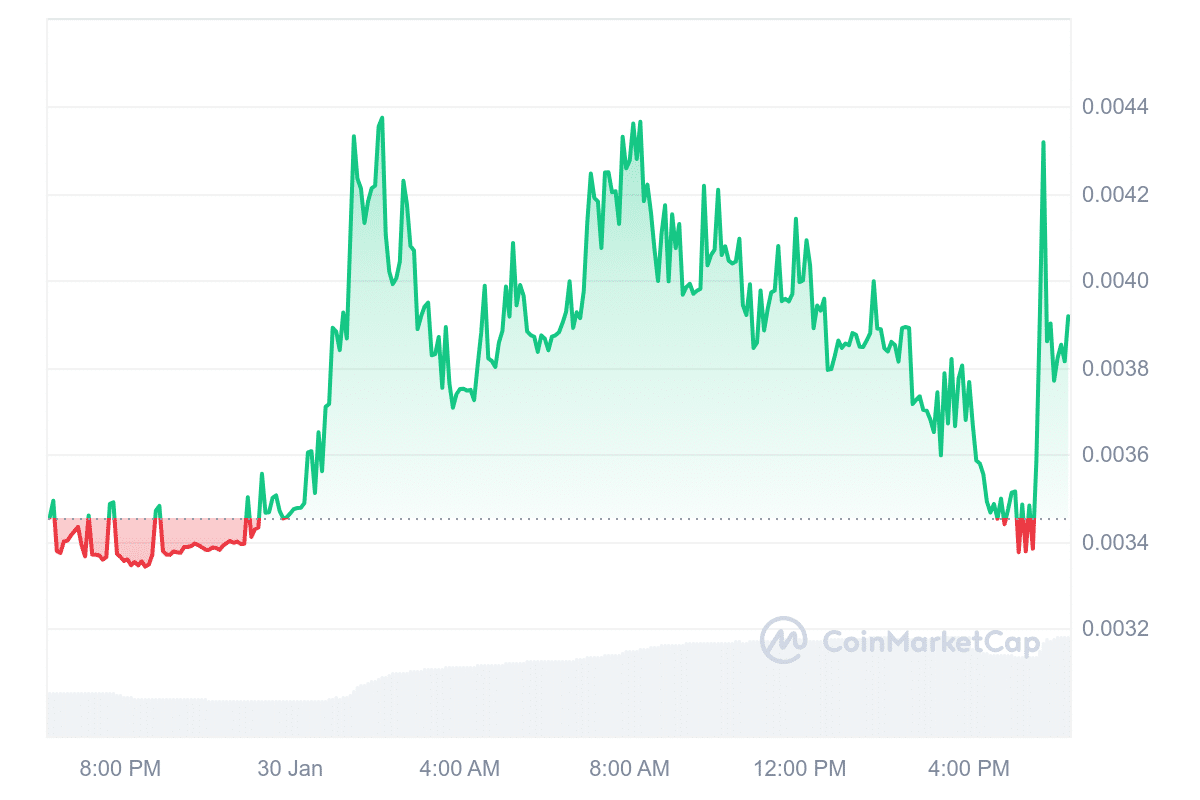

This development coincides with the recent growth of the ACS token. Currently priced at $0.003918, ACS has increased by 12.69% in the past 24 hours. It is trading 39.89% above the 200-day simple moving average of $0.00277, showing an upward trend.

The token has maintained strong liquidity and recorded 17 positive trading days in the last month. Market indicators, including a Fear & Greed Index score of 70, suggest a favorable sentiment. Access Protocol’s model reflects a broader shift in digital content monetization, replacing traditional paywalls with blockchain-based access. This structure benefits creators and users, fostering a decentralized information-sharing approach.