Top Cryptocurrencies to Invest in Now November 14 – dogwifhat, Notcoin, Aave

AAVE

AAVE

NOT

NOT

TOP

TOP

SNX

SNX

CEO

CEO

HashKey Group CEO Xiao Feng suggests that Donald Trump’s pro-crypto stance may influence China to reconsider its cryptocurrency ban. Feng believes that if the U.S. moves forward with supportive crypto policies, the resulting competition could prompt China to reevaluate its position, potentially reviving its crypto market.

The crypto community in the U.S. anticipates substantial growth under Trump’s leadership. His administration has signaled plans to strengthen the American crypto sector, aiming to secure a leading position in the global market. Possible changes include the removal of SEC Chair Gary Gensler, which could pave the way for regulatory reforms, marking a significant shift for U.S. crypto. Following news of favorable regulatory changes, the crypto market is experiencing a wave of price rallies. As expected, investors are searching for the top cryptocurrencies to invest in now.

Top Cryptocurrencies to Invest in Now

dogwifhat recently saw a notable price surge, jumping over 40% in a single day. This increase came after its listing on Coinbase. In other market updates, Aave is currently trading at $170.65, marking a 2.55% decline over the past 24 hours. Meanwhile, Pepe Unchained’s presale has garnered $29 million so far.

1. dogwifhat (WIF)

dogwifhat recently experienced a significant price surge of over 40% within a day. This rise followed news of its listing on Coinbase, which often boosts interest and liquidity due to increased accessibility for traders. This latest listing saw the token reach a recent high of $4.68, edging closer to its all-time high of $4.83 from March, a level attained during a bullish solid phase.

Moreover, dogwifhat’s market sentiment remains positive, supported by data from the Fear & Greed Index, which sits at 88, reflecting “Extreme Greed.” This indicates high investor interest and confidence. Additionally, dogwifhat’s 30-day volatility rate stands at a relatively stable 11%, marking a decrease from previous levels and suggesting moderated price swings over the past month.

The liquidity of dogwifhat appears high, with a volume-to-market-cap ratio of 2.2388. This metric signifies the token has substantial trading volume relative to its market capitalization, currently valued at $4.12 billion. In line with this, the 24-hour trading volume for WIF stands at approximately $9.23 billion, an indicator of active trading interest.

2. Pepe Unchained (PEPU)

Pepe Unchained‘s presale will conclude in 30 days, aligning its anticipated launch date with December 13, 2024. The project has drawn significant interest as large investors position themselves in anticipation of its listing on high-profile crypto exchanges.

Recent momentum for PEPU has accelerated following the success of the Pepe token, which experienced notable gains after a listing on Coinbase. This has seemingly raised investor expectations for Pepe Unchained’s listing potential.

At the time of writing, Pepe Unchained’s presale has raised $29 million, contributing to the growth of the meme coin sector, which now exceeds a total valuation of $100 billion. Pepe Unchained differentiates itself within this space by aiming to be the first Layer 2 blockchain dedicated to meme coins.

It offers a range of features to enhance its ecosystem, including a decentralized exchange (DEX), a dedicated block explorer, development grants, staking options, and a bridging system for blockchain interoperability. One unique feature of PEPU is its staking mechanism, which is available to early buyers who can lock their tokens through the staking smart contract upon purchase.

The platform structures staking rewards to be distributed over two years, with the first rewards claimable after the presale ends. This distribution period, set to conclude in May 2026, aligns with the tokenomics designed to incentivize long-term holding and engagement with the platform.

3. Notcoin (NOT)

Notcoin originated as a viral game on Telegram, showcasing a unique entry point for a cryptocurrency by blending gaming with blockchain technology. This initial foundation provided Notcoin with an active and engaged community, which has grown as the coin evolved. Although the coin’s initial use focused on gaming, it now has broader applications, including transactions on platforms like Telegram, illustrating its adaptability in various digital environments.

For developers, Notcoin offers a platform to showcase Web3 projects, connecting builders with its user base through targeted campaigns. This collaborative approach encourages community among developers and users, creating a space for Web3 innovation and discovery within the Notcoin ecosystem.

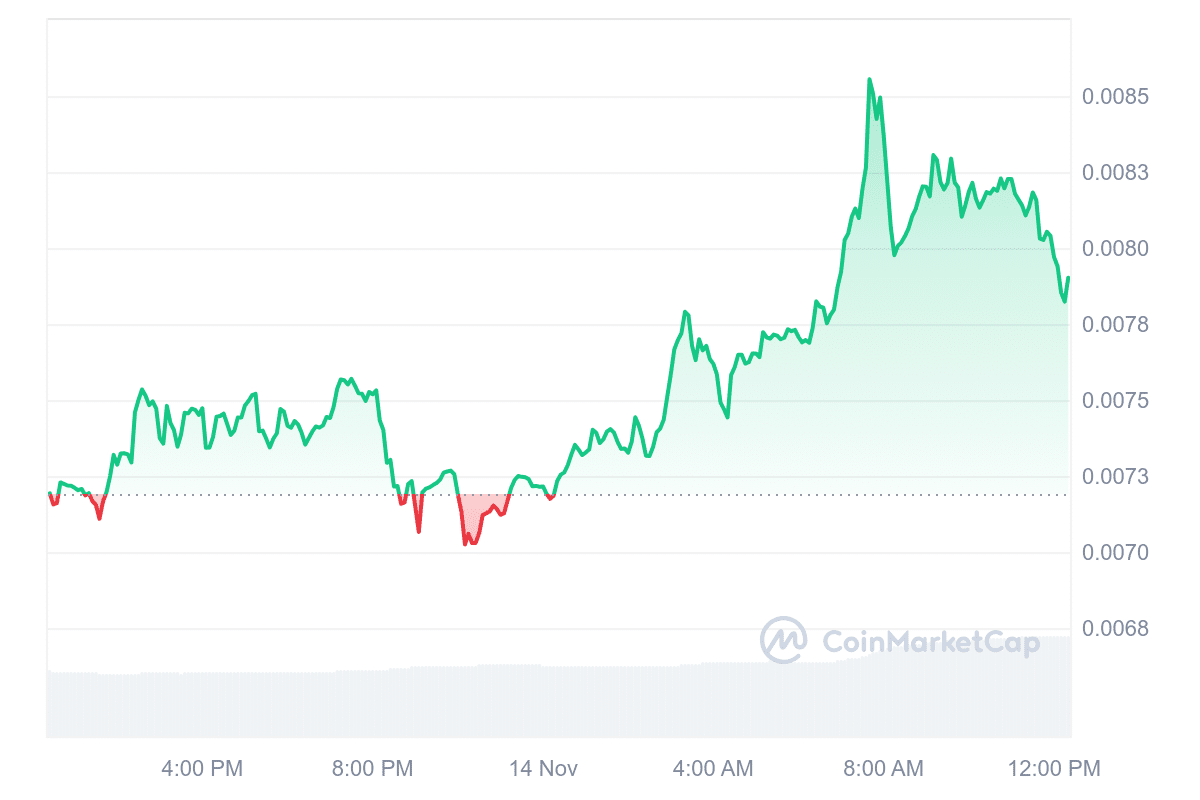

At press time, Notcoin is priced at $0.007902, showing a 9.89% increase in the last 24 hours. Over the past week, Notcoin recorded a gain of 21.16%, indicating strong recent performance. The current sentiment around Notcoin remains positive, with the Fear & Greed Index at 88, reflecting extreme greed.

a year ago we launched Notcoin beta for 500 people at TON conference

one year later, there's no people in crypto who hasn't heard about Notcoin, most of them have mined it, and some lucky 11.5 million have become Notcoin holders

now the next year is coming

long live Notcoin 🌅

— Notcoin (@thenotcoin) November 14, 2024

Notcoin displays high liquidity with a volume-to-market cap ratio of 1.15. With a market cap currently at $798.76 million and a 24-hour trading volume of $918.60 million, the token is actively traded, suggesting sufficient liquidity and investor interest.

Based on Coincodex price predictions, Notcoin is anticipated to rise by 225.20% within the next month, potentially reaching a value of $0.026583. While these projections indicate an optimistic outlook, it is crucial to remember that the cryptocurrency market remains volatile, with trends often shifting quickly.

4. Aave (AAVE)

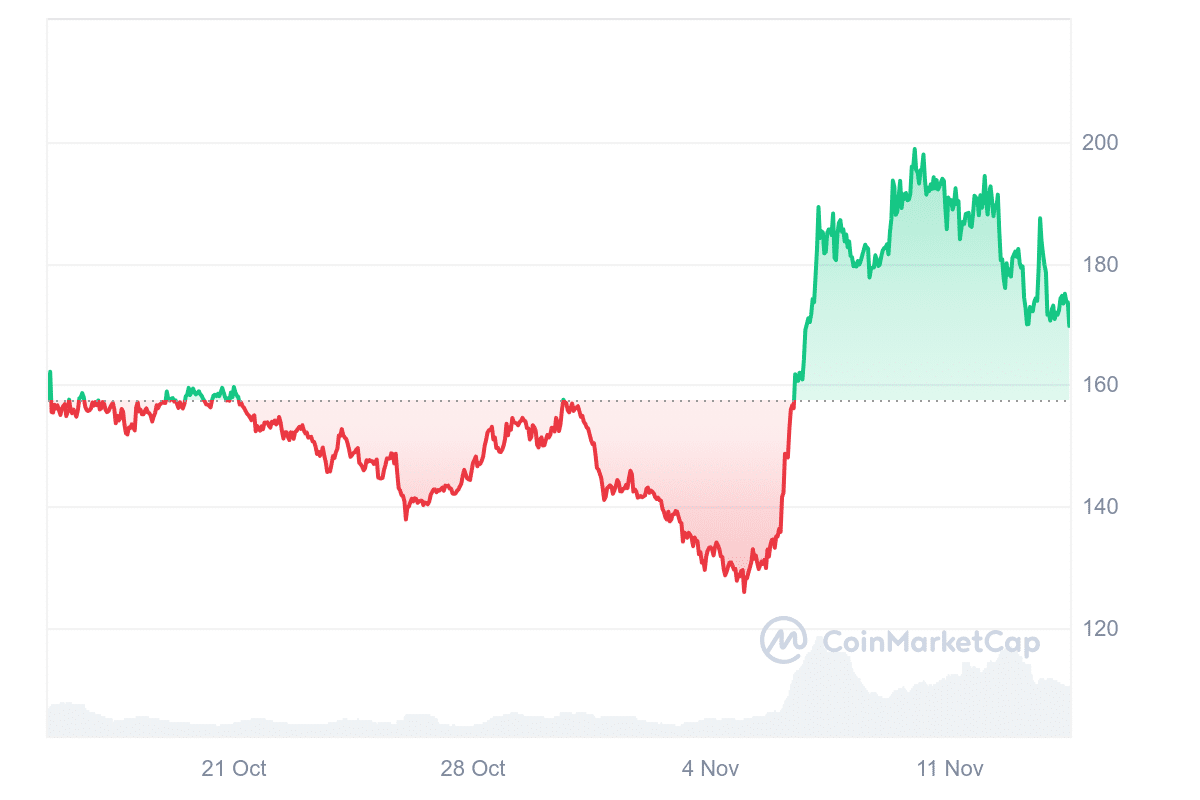

As of today, Aave (AAVE) is trading at $170.65, reflecting a 2.55% price decline over the last 24 hours. However, the token has shown positive momentum, with a 30-day gain of 6.99%. Over the past year, Aave has demonstrated significant growth, increasing by 83% and outperforming 55% of the top 100 crypto assets, suggesting stronger-than-average performance.

The general sentiment for Aave remains bullish, indicating that investors are optimistic about the token’s potential. This sentiment aligns with the current “Extreme Greed” reading on the Fear & Greed Index, which stands at 88. Extreme Greed levels often signal increased buying activity, though they can also indicate a potential market top, depending on broader trends.

In technical terms, Aave is trading well above its 200-day Simple Moving Average (SMA), currently 117.72% higher than the SMA, which stands at $78.04. This distance from the long-term moving average supports the bullish trend and may indicate ongoing investor confidence.

The 14-day Relative Strength Index (RSI) is currently at 60.18, a neutral position. This RSI level suggests that price movements could continue sideways in the short term while the token isn’t overbought or oversold. Aave’s high liquidity, reflected by its market capitalization, further strengthens its position as a significant asset in the crypto space.

5. Synthetix (SNX)

Synthetix is a decentralized exchange that enables users to trade synthetic assets, or “synths,” which track the value of real-world assets like commodities or currencies. Using synths, users can gain exposure to asset price movements without holding the actual asset, providing a flexible way to diversify portfolios.

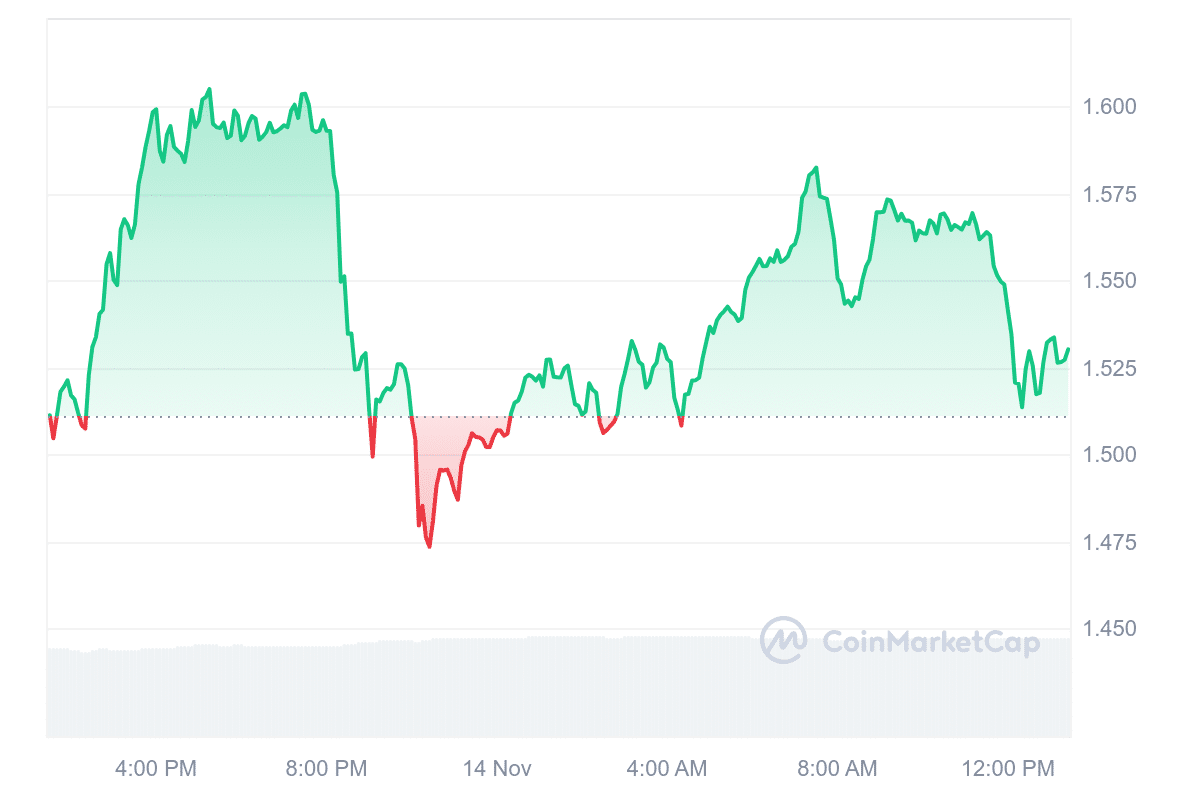

The platform also offers a staking feature, where holders of its native token, SNX, can earn a share of transaction fees generated on the Synthetix Exchange, adding an incentive for participation in the network. Currently, Synthetix is priced at $1.53, reflecting a 1.27% increase over the last 24 hours.

The acquisition of @Kwenta_io by Synthetix is underway in the first major strategic move since the referendum.

Synthetix will regain ownership of its ecosystem-leading front end in a token-for-token transaction in a bid to expand offerings and market share.

Full details ⬇️… pic.twitter.com/wirwXTnLoZ

— Synthetix ⚔️ (@synthetix_io) November 8, 2024

In the past week, it has gained 2.08% and shows a 3.31% increase over the last 30 days. Market sentiment remains neutral despite the recent price increases, with the Fear & Greed Index at 88, signaling high enthusiasm but potential caution in the market. Synthetix has consistently performed, with gains on 15 out of the past 30 days.

The 14-day Relative Strength Index (RSI) is 42.82, indicating a balanced, sideways trading pattern without strong upward or downward pressure. The platform’s trading volume relative to its market cap is at a solid 0.5211, suggesting relatively high trading activity and good liquidity.