Top Cryptocurrencies to Invest in Now September 19 – Sei, Algorand, Hedera

PEPE

PEPE

HBAR

HBAR

PEPE

PEPE

PEPE

PEPE

SEI

SEI

The cryptocurrency market is developing significantly, with numerous digital assets emerging as attractive investment options. The global crypto market capitalization currently is $2.17 trillion, reflecting a 5.01% increase in 24 hours. Additionally, the total trading volume has surged to $98.83 billion, marking a notable 27.18% intraday rise. Several altcoins are experiencing positive momentum today, showcasing substantial gains.

Recent advancements in technology, strategic partnerships, and dynamic market developments are capturing the attention of investors eager to seize potential opportunities. This article explores some of the top cryptocurrencies to invest in now that are making waves, emphasizing their unique characteristics, market trends, and the potential impact they could have on the future of digital finance.

Top Cryptocurrencies to Invest in Now

ZetaChain’s token, ZETA, has seen significant price activity recently. According to the latest figures, its value has risen by 18.21% in the past 24 hours, reaching $0.6881. Meanwhile, Pepe Unchained has drawn interest from the crypto community, especially after its presale raised $13.8 million. Additionally, Sei’s integration with Nucleus has introduced Ethereum (ETH) yield opportunities into its ecosystem.

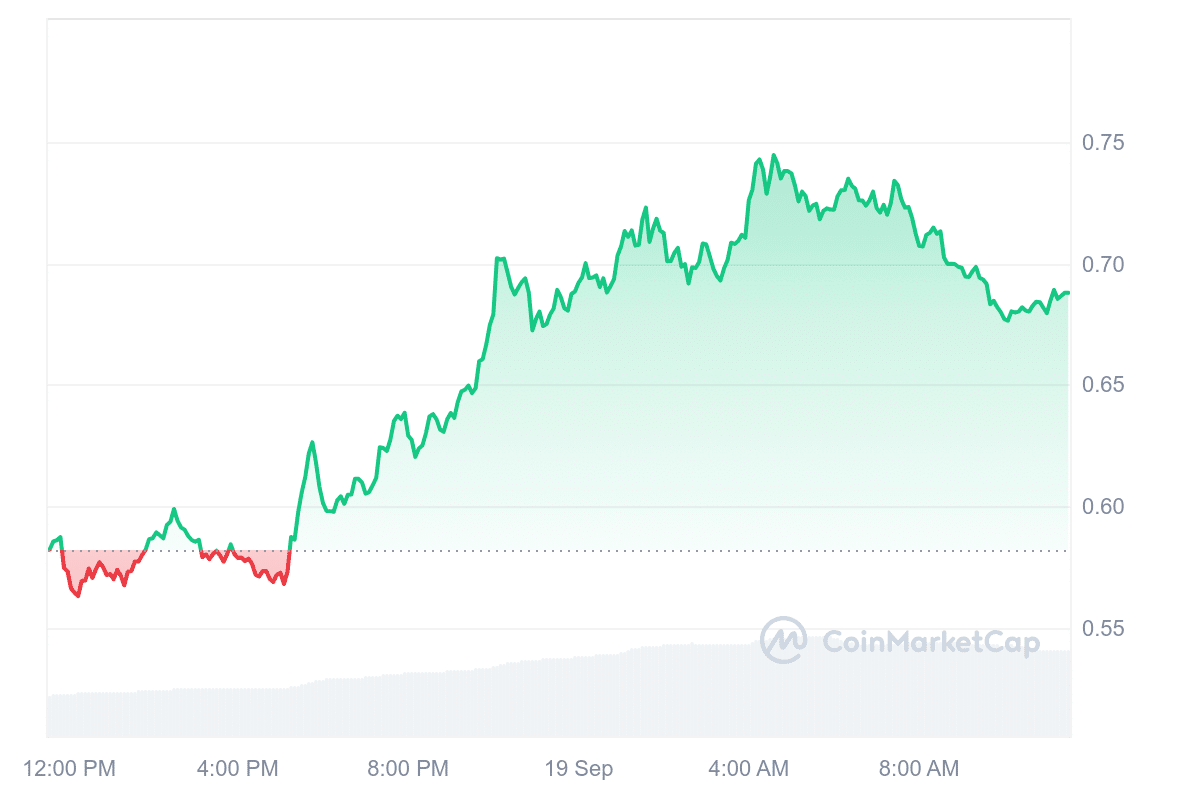

1. ZetaChain (ZETA)

ZetaChain is designed to enhance interoperability between different blockchains and layers. Its primary function is to enable seamless cross-chain value transfers and message delivery. Additionally, it supports native omnichain smart contracts, allowing developers to build cross-chain applications on any network, including proof-of-work (PoW) blockchains.

As a Layer 1 protocol, ZetaChain seeks to facilitate decentralized applications across various networks. Recently, it has been expanding its ecosystem, including launching a DEX and testing a stablecoin backed by Bitcoin (BTC) reserves.

From a performance perspective, ZetaChain’s token, ZETA, has experienced notable price movement. As of the latest data, the token’s value increased by 18.21% over the last 24 hours, reaching $0.6881. This rise came with a significant increase in trading volume, which grew by 102.67%. Prior to this surge, the price consolidated around $0.55, indicating strong momentum leading up to the breakout.

ZetaChain (mainnet) which enables Universal Apps that span all chains from native Bitcoin and Ethereum to Cosmos, Solana and beyond is now available natively on Coinbase. https://t.co/zwLuwFPmp6

— ZetaChain (@zetablockchain) September 19, 2024

Support for ZETA currently sits at $0.5548, where buying pressure has accumulated. The next immediate resistance is at $0.75. If the token surpasses this resistance, it could potentially target $0.77 soon. However, this level may also be a consolidation point if upward momentum slows.

Furthermore, the overall market sentiment surrounding ZetaChain remains positive, with a bullish outlook. ZETA has recorded 15 green days over the last 30 days, indicating price growth on 50% of those days. Liquidity appears strong based on its market cap, ensuring smoother trading activity. According to recent predictions, ZETA’s price could reach $2.23 within the next month.

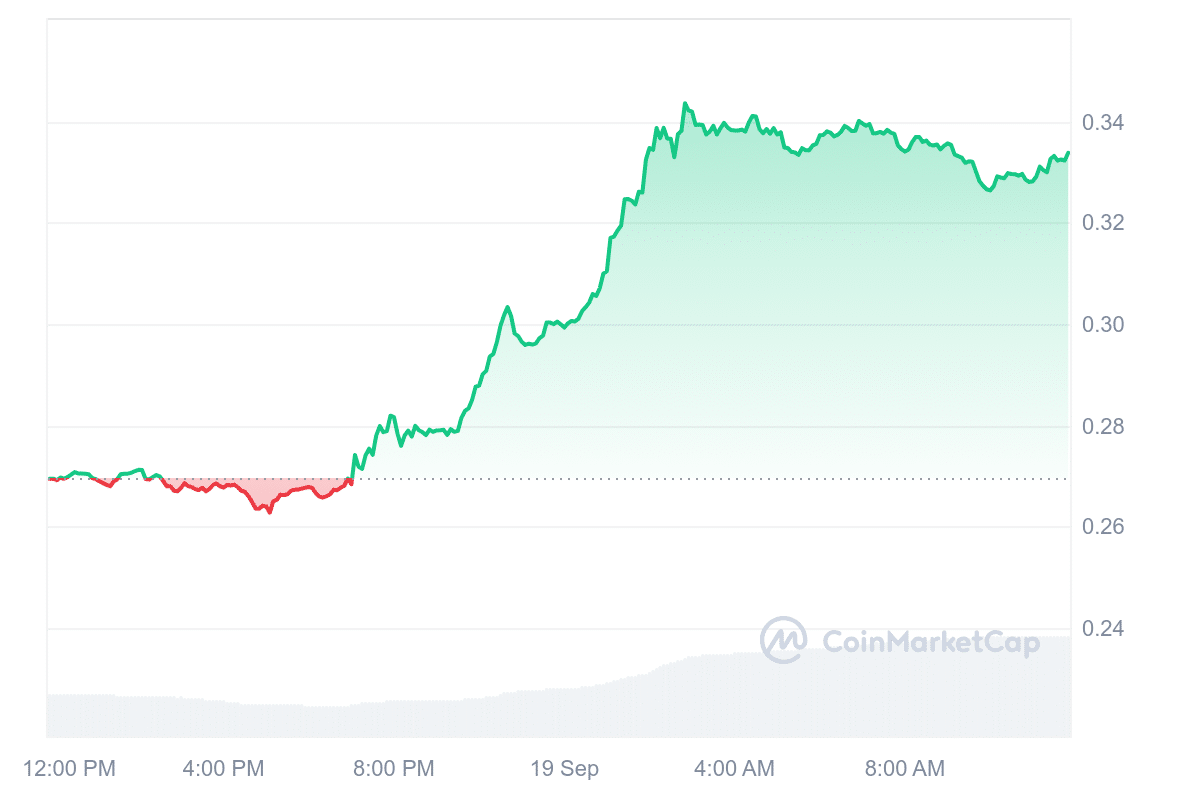

2. Sei (SEI)

Sei is a sector-specific Layer 1 blockchain designed specifically for decentralized exchanges. Its main focus is optimizing trading processes to give exchanges a performance edge. This approach sets Sei apart as a specialized platform, different from general-purpose blockchains, by targeting the needs of the trading sector within decentralized finance.

In terms of collaboration, Sei has formed partnerships within the crypto industry to support its development. These partnerships help Sei grow and demonstrate a collaborative approach to innovation. Recently, Sei integrated with Nucleus, bringing Ethereum (ETH) yield opportunities to its ecosystem.

With this integration, users can mint Super Seiyan ETH ($ssETH), which provides additional ecosystem benefits and is usable across decentralized applications within the Sei network. On the technical front, Sei’s price movement has been notably bullish.

Its price recently reached $0.3338, reflecting a 23.84% increase in 24 hours. Trading volume surged by 128%, indicating strong buying interest. This price increase followed a consolidation phase, where Sei traded below $0.28 before experiencing a breakout. The market sentiment is currently positive, as the token has shown 15 green days out of the last 30, suggesting ongoing bullish momentum.

Introducing Super Seiyan ETH ($ssETH) to the Sei ecosystem!

We're excited to announce that @nucleusearn is bringing ETH yield to Sei, expanding the opportunities for users in the Sei ecosystem. With this integration, Sei users can now mint Super Seiyan ETH ($ssETH) through… pic.twitter.com/U9XN7PvlHv

— Sei 🔴💨 (@SeiNetwork) September 17, 2024

Beyond technical indicators, SEI’s recent price surge can be attributed to its growing role within DeFi. According to recent updates, a new liquidity pool within Sei’s DeFi ecosystem doubled in the past day, highlighting increased activity and interest.

As Sei continues to attract attention for its technical capabilities and expanding presence in DeFi, investors are keeping a close eye on its performance. Its recent price action and market interest reflect optimism.

3. Pepe Unchained (PEPU)

Pepe Unchained has garnered attention within the crypto community, particularly due to its presale success, raising $13.8 million. This coin, branded with the popular Pepe meme, introduces itself as a Layer-2 solution built on Ethereum. Layer-2 networks, like PEPU, aim to enhance transaction processes on blockchain networks by offering faster speeds and lower fees than traditional Layer-1 networks.

Currently, PEPU tokens are priced at $0.0098, but this rate is set to increase within 48 hours as the presale progresses. Interested buyers can purchase the token using cryptocurrencies like ETH, USDT, or BNB. The project also offers staking rewards for ETH and USDT transactions.

To broaden accessibility, users can make purchases via bank cards, which may appeal to individuals who are newer to crypto or prefer traditional payment methods. Furthermore, by building on the Ethereum network, PEPU is positioning itself as an advanced alternative to older blockchain technologies.

This approach focuses on improving transaction efficiency, appealing to investors who prioritize technological advancements in the crypto space. The project’s roadmap details several stages of development, with the expectation that token value may rise as it hits these milestones.

We're making rapid progress on the $PEPU token raise and Layer 2 Mainnet launch!

The Pepe Unchained developers have built something special, and we can’t wait to roll it out to the public. pic.twitter.com/NMDQ1ZRnmN

— Pepe Unchained (@pepe_unchained) September 18, 2024

The PEPU presale follows a tiered pricing model, meaning the cost of tokens will gradually increase over time. Therefore, investors seeking early returns may consider entering sooner rather than later to take advantage of lower prices.

4. Algorand (ALGO)

Algorand is a decentralized blockchain network that supports various applications, from financial services to digital assets. Its architecture emphasizes three core principles including security, scalability, and efficiency. These features are crucial for enabling blockchain to serve real-world applications effectively.

Furthermore, Algorand’s design also aims to foster trust by ensuring reliable performance, making it suitable for computations that demand consistent results. Its primary objective is to enhance transaction speed and reduce inefficiencies common in older blockchain systems like Bitcoin. Unlike Bitcoin, which relies on an energy-intensive mining process, Algorand operates on a pure proof-of-stake (PoS) consensus mechanism.

In this system, participants validate transactions based on the number of ALGO tokens they hold, eliminating the need for mining and significantly reducing energy consumption. Additionally, this design lowers transaction fees, making the network more cost-effective for users.

Following the success of our global hackathon, we are officially launching regional hackathons in France, Nigeria and Vietnam!

It's time to build impactful solutions on Algorand that address regional challenges and set the stage for success in the global ecosystem.

🇫🇷🇳🇬🇻🇳 pic.twitter.com/eEAJM8kNI2

— Algorand Foundation 🐍 |📍TOKEN2049 (@AlgoFoundation) September 18, 2024

At the time of writing, Algorand’s native cryptocurrency, ALGO, experienced a 6.87% decline, with its price hovering around $0.1303. The coin holds a market capitalization of $1 billion and a 24-hour trading volume of $31 million.

Moreover, ALGO has shown positive momentum over the past week, reflecting the potential for a future price increase. The Relative Strength Index (RSI) also indicates a possible upward trend in ALGO’s price, suggesting it may be positioned for a breakout.

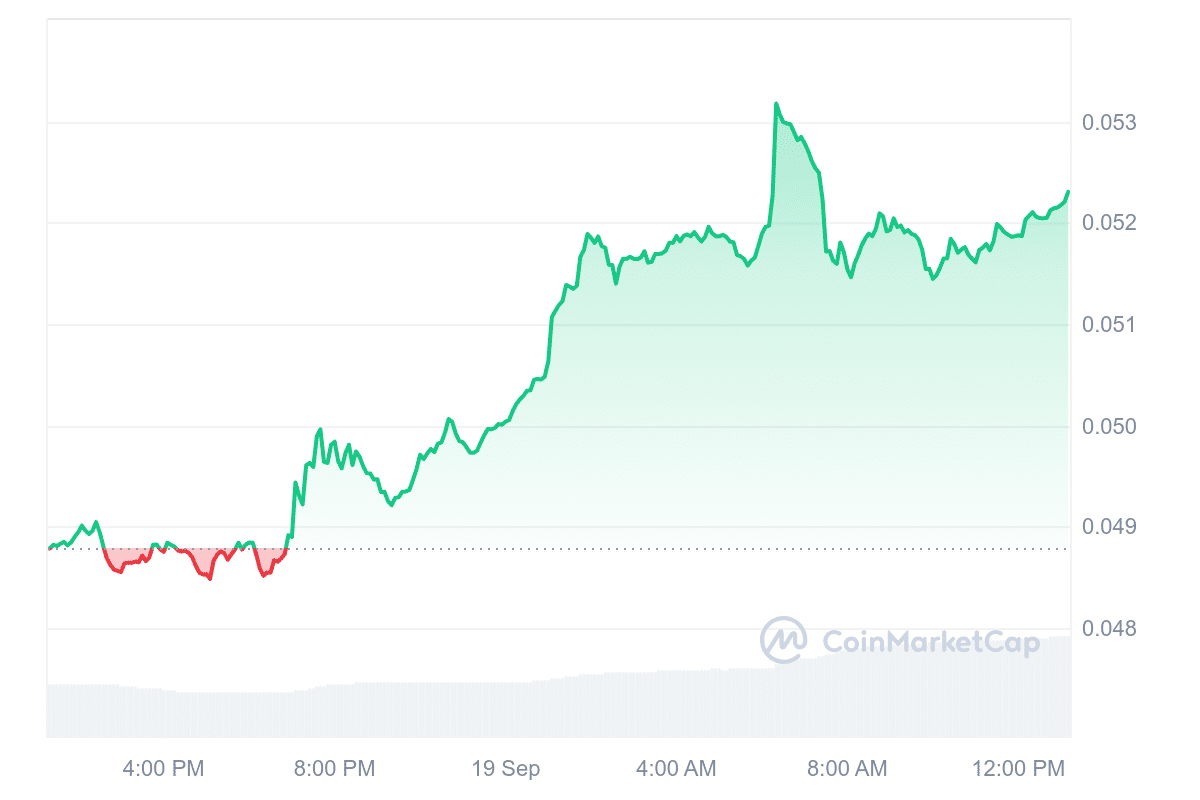

5. Hedera (HBAR)

Hedera recently partnered with Ripple and Aptos Labs as part of the newly established MiCA Crypto Alliance. This initiative, led by the DLT Science Foundation (DSF), aims to help blockchain firms navigate the evolving regulatory environment in the European Union.

The primary focus of the alliance is to provide resources and support for crypto companies to comply with the EU’s Markets in Crypto-Assets (MiCA) regulations. These regulations require firms to disclose their climate impact and meet various compliance standards.

1/3 #Hedera is excited to join @Ripple and @Aptos Foundation as Founding Members of the MiCA Crypto Alliance, with technical support from DLT Science Foundation. 🔗To learn more or get involved: https://t.co/UJVxCzmXGH pic.twitter.com/f4L1rvu5ur

— Hedera (@hedera) September 16, 2024

The alliance promotes collaboration among blockchain companies within the EU’s regulatory framework. This collaborative effort helps companies comply with regulations while encouraging innovation in blockchain technology.

1/3 #Hedera is excited to join @Ripple and @Aptos Foundation as Founding Members of the MiCA Crypto Alliance, with technical support from DLT Science Foundation. 🔗To learn more or get involved: https://t.co/UJVxCzmXGH pic.twitter.com/f4L1rvu5ur

— Hedera (@hedera) September 16, 2024

Hedera’s current price is $0.0523, up 7.13% in the past 24 hours. Over the last year, the price has risen by 4%. The asset is considered to have high liquidity, largely due to its market capitalization, and is actively traded on platforms such as Binance.

According to Coinglass data, Hedera has seen a noticeable rise in trading activity, which coincides with its involvement in the MiCA Crypto Alliance. This suggests growing investor confidence in Hedera, driven by its strategic approach to aligning with EU regulations.