Trending Coins on GeckoTerminal – Just a chill guy, WINTER ARC, Gen Z Quant, The Huzz

QNT

QNT

PEPE

PEPE

$PEPE

$PEPE

PEPE

PEPE

PEPE

PEPE

Bitcoin (BTC) recently surpassed the $94,000 mark, reaching a new all-time high of $94,002.87 approximately ten hours ago. This milestone comes shortly after the much-anticipated launch of U.S. spot Bitcoin exchange-traded fund (ETF) options on NASDAQ.

The price surge followed a brief dip to $91,059.66, underscoring the current market volatility. The introduction of spot Bitcoin ETF options is expected to drive significant investments into the digital asset space. According to CoinMarketCap, Bitcoin is trading at $92,422.31, having increased nearly 1% in the last 24 hours. Meanwhile, tokens across other chains are printing gains. This article curates the most trending coins on GeckoTerminal.

Trending Coins on GeckoTerminal

The price of CHILLGUY on the Raydium exchange is currently 0.3214, marking a substantial 652.74% increase in the last 24 hours. WINTER is trading at 0.01388 on Raydium, reflecting a sharp rise of 3,124.2% in the same period. Quant is priced at 0.03457, showing a dramatic increase of 23,569% in the past 24 hours.

Meanwhile, Pepe Unchained (PEPU) has generated significant interest in the cryptocurrency market, having raised over $40 million in its presale just 23 days before its exchange debut. Bitcoin has also surged to a new high above $94,000, with investors closely monitoring developments involving Trump.

1. Just a chill guy (CHILLGUY)

CHILLGUY has seen significant price activity recently. The current price of CHILLGUY on the Raydium exchange is 0.3214, reflecting a notable increase of 652.74% over the past 24 hours. Its 24-hour trading volume has reached 270.13 million, with 241,000 transactions. This indicates heightened market engagement and strong trading activity.

Short-term movements show varied trends. Over five minutes, the price declined slightly by -1.05%. In the last hour, it rose by 5.49%. Over six hours, it increased by 24.94%. Over the past day, the price has surged by 616.92%. The chart, divided into 15-minute intervals, offers a detailed view of these fluctuations. It ends with a closing price of 0.3094, showing a modest 1.14% gain in the final interval.

The chart reveals several distinct phases of activity. At the start, the price exhibited little movement and low trading volume. This reflects a need for strong market interest or a potential accumulation phase. Midway through the chart, a sharp breakout occurred, with the price rising steeply. This was supported by increasing green candles and higher trading volume, suggesting strong buyer momentum.

Volume trends align with these price movements. During the breakout, trading volume spiked significantly, confirming the strength of the upward momentum. However, during the consolidation phase, volume tapered off, reflecting reduced enthusiasm among traders. In the final rally, volume rose again, pointing to renewed interest in the market.

2. WINTER ARC (WINTER)

WINTER is trading on Raydium at 0.01388, reflecting a sharp 3,124.2% increase in the last 24 hours. Over the same period, its trading volume reached 52.49 million, with 134.4K transactions recorded. A closer look at its recent price and volume movements provides a clearer understanding of the market dynamics.

In the 15-minute chart intervals, the most recent closing price was 0.01195, marking a 4.70% decline in the last timeframe. The total trading volume during this period stood at 642.75K, lower than some of the earlier, more active phases.

The price initially remained flat, showing limited activity and negligible volume. This phase likely reflected low market interest or gradual accumulation. A rapid upward movement followed, with the price rising from near 0.010 to just above 0.030. This bullish rally was accompanied by a surge in volume, signaling strong interest among traders.

As the price approached 0.030, upward momentum slowed. Resistance at this level became evident, with long upper wicks pointing to significant selling pressure. Following this, the price began to reverse. It entered a period of consolidation, with alternating rises and drops, before moving into a sharper decline toward 0.011.

3. Gen Z Quant (Quant)

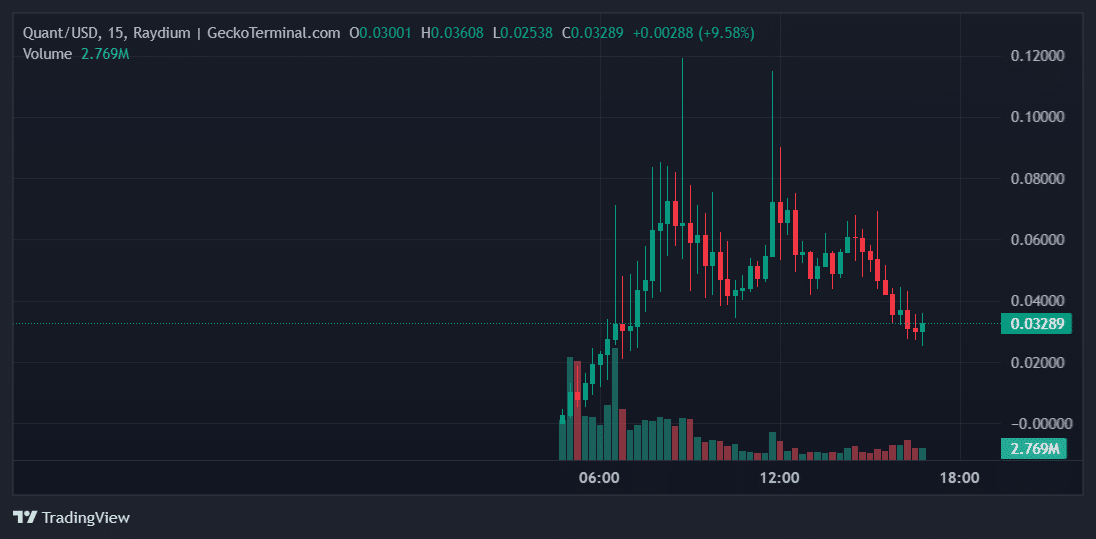

Quant is currently priced at 0.03457 on Raydium, showing a significant 24-hour increase of 23,569%. Over this period, trading volume has reached 318.93M, with 195,880 total transactions recorded. Per the recent 15-minute intervals, the price closed at 0.03289, reflecting a 9.58% gain in the latest timeframe. During this interval, the trading volume was 2.769M, indicating a high level of market activity.

The price movement shows distinct phases. The session began with a sharp upward trend, with the price rising from 0.025 to a high of 0.03608. This was supported by increasing trading activity, reinforcing the upward momentum’s strength.

The price faced challenges mid-session, climbing higher and peaking near 0.08. This resistance is evident from extended wicks on the chart, signaling higher-level profit-taking. Following this peak, the price consolidated, alternating between small gains and losses. Over time, selling pressure dominated, causing the price to decline toward 0.032.

4. The Huzz (HUZZ)

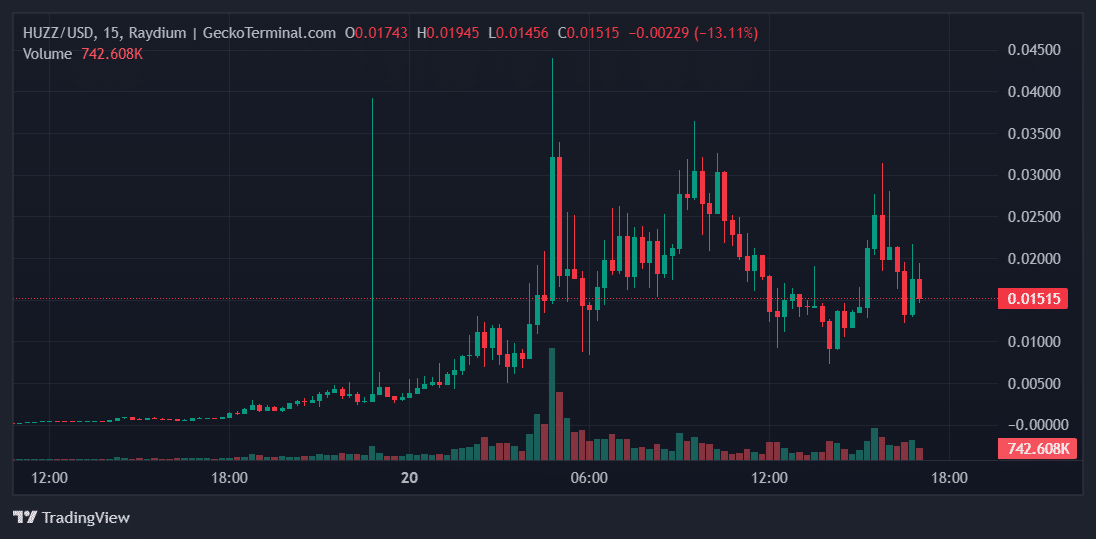

HUZZ displayed notable trading activity on Raydium, with the current price at 0.01709. This marks an impressive 1,822.3% increase in the last 24 hours. During the same period, trading volume reached 85.43 million across 198,830 transactions. The analysis is based on 15-minute candle intervals, offering detailed insights into short-term price movements. Trading volume during this timeframe was substantial, reaching 742,608 units, which reflects active participation.

The price began with a phase of limited movement, characterized by smaller candles and lower trading activity, which suggests a period of reduced market engagement or price stability. Following this, a sharp increase in both price and volume occurred, likely due to significant buying activity or external market developments.

During this surge, the price briefly touched an intraday high of approximately 0.045 before pulling back. The pullback hints at profit-taking or the presence of resistance at higher levels. After the spike, an uptrend emerged, evident from a pattern of higher highs and lower lows. The trend was further supported by increasing trading volumes, pointing to growing bullish momentum.

5. Pepe Unchained ($PEPU)

Pepe Unchained (PEPU) has quickly gained attention in cryptocurrency, surpassing $40 million in its presale just 23 days before its exchange launch. Daily investments have topped $1 million, with tokens priced at $0.01294. A key factor in the project’s appeal is its plan to allocate 7.5% of the token supply for exchange liquidity, ensuring smoother trading once PEPU hits exchanges.

The project’s technology features a Layer-2 scaling solution, which offers faster and cheaper transactions than Ethereum, giving it an edge in the competitive meme coin market. Additionally, Pepe Unchained introduces the “Pump Pad,” a platform enabling users to create their meme coins without coding. The platform also includes safeguards like locked liquidity pools and a no-tax policy on trades. A cross-chain bridge will allow transfers between Ethereum and the Pepe Chain, expanding its utility.

Pepe Unchained’s staking protocol offers attractive rewards, with APYs of 73%. Over 2.1 billion PEPU tokens have already been staked. The project has also launched a developer grants program to encourage innovation within its ecosystem.