Trump's Criticism of Fed Amplifies Rate Cut Debate

CHAIR

CHAIR

TRUMP

TRUMP

READ

READ

DON

DON

RSRV

RSRV

- Trump's Truth Social post criticizes Fed's rate policy, urging cuts.

- Trump demands Fed Chair Powell's dismissal.

- Market volatility rises amid rate policy uncertainty.

Trump posted on Truth Social, sharply criticizing the Federal Reserve and its Chair, Jerome Powell, calling for immediate interest rate cuts. This coincides with ongoing economic uncertainties and differing policies between the U.S. and European Central Bank.

This criticism of the Fed adds to the debate over U.S. monetary policy, influencing market volatility and highlighting the tension between political and economic priorities.

Trump's Call for Rate Cuts Amid Economic Uncertainty

Former President Donald Trump recently criticized the Federal Reserve and its Chair, Jerome Powell, on Truth Social for delayed policy action. He argued that the Fed should cut interest rates, mirroring the ECB's approach. Trump emphasized that economic indicators, such as dropping oil prices, highlight the need for rate cuts. Immediate action was urged.

Trump's remarks surfaced amid market uncertainty about rate decisions. His call for Fed rate cuts echoes frustration among market participants who desire alignment with the ECB's proactive stance. Persistent rate policy complaints continue to influence investor sentiment, heightening market unpredictability.

The financial community's reactions to Trump's comments were mixed, with some acknowledging the pressure on the Fed to adapt its monetary strategy. ECB's approach under Christine Lagarde receives attention for its perceived proactivity, contrasting with current Fed policies. The broader market awaits further central bank responses.

Market Volatility and Historical Monetary Policy Divergence

Did you know? Comparing the Fed's and ECB's monetary strategies, historical divergence has often led to intensified market volatility and influenced global economic trends.

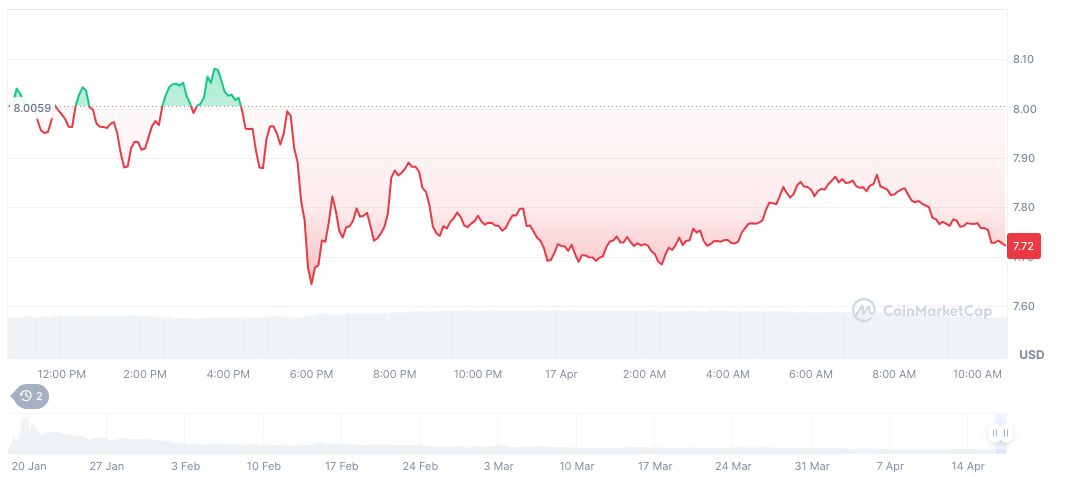

According to CoinMarketCap, the OFFICIAL TRUMP token (TRUMP) displays volatility, trading at $7.73 with a market cap of 1.55 billion dollars. Over the past 90 days, the token showed a 19.12% increase despite recent declines of 3.42% in the last 24 hours and 29.79% over 30 days. Analysts at Coincu highlight potential economic shifts if the Fed adjusts its policy, as Trump's comments pressure both regulatory and market dynamics.

Analysts at Coincu highlight potential economic shifts if the Fed adjusts its policy, as Trump's comments pressure both regulatory and market dynamics. Long-term growth strategies hinge on navigating this complex monetary landscape, emphasizing the need for cohesive international economic coordination. Below is a relevant tweet for more context:

"The Fed should have lowered interest rates a long time ago, just like the European Central Bank. It should have been done a long time ago, and now the Fed should definitely cut interest rates. Powell should be fired as quickly as possible." — Donald Trump, Truth SocialRead original article on coincu.com