TymeBank becomes Africa’s 9th unicorn with $250m raise and $1.5bn valuation

BANK

BANK

NEO

NEO

CEO

CEO

A South African-born fintech, Tyme Group has raised $250 million in a Series D funding round. The digital bank controlled by South African billionaire Patrice Motsepe has seen its valuation rise to $1.5 billion following the capital raise which includes a $150 million investment from Latin America’s most valuable financial company, Nu Holdings.

The funding has now made Tyme one of Africa’s tycoons with M&G Catalyst Fund chipping in $50 million while existing shareholders invested the remaining $50 million for the $250 million funding. According to the digital bank, its current backers include Tencent Holdings, Gokongwei Group, and Norrsken22.

Its latest capital raise sees Tyme join Nigeria’s Moniepoint as one of the African fintechs to achieve unicorn status this year. The funding also marks a significant comeback in investors’ flair for fintechs following a slowdown caused by rising global interest rates.

“It is a unique vote of confidence in our business by the world leaders in our industry, essentially. Motsepe’s African Rainbow Capital Investments will remain Tyme’s lead shareholder with a 40% stake. Our status as South Africa’s only black-owned and black-controlled commercial bank actually remains in place” said Coenraad Jonker, CEO and co-founder of Tyme.

Nubank’s parent company, Nu Holdings is the world’s biggest standalone digital bank, possessing over 110 million customers across Brazil, Colombia, and Mexico. “They do not have plans to organically grow into Southeast Asia and its investment is really the bet that they are taking as Nubank in Southeast Asia and Africa,” said Jonker.

In addition, Nubank’s investment in Tyme Group aligns with its broader strategy for expansion and taps into the growth potential of emerging markets outside its home – Latin America. Being the largest digital banking platform outside Asia, its market’s potential has been recently threatened competitively with the likes of Neo gaining some market grounds.

“Nubank revolutionized financial services and having them as a shareholder will help build rapport to our model, execution, and expansion plans, both financially and through business counsel. We are focused on improving the financial lives of millions of people in our region, and we are energized by this round of investments to keep pushing forward.” Jonker added.

Deciding to expand its horizons into Asia and Africa provides Nubank with a chance to replicate its style used in previous markets with a similar strategy. The company focuses on large unbanked populations, growing smartphone adoption, and rising demand for accessible financial products.

For Tyme, its latest funding makes the fintech company pass the $1-billion threshold that marks a unicorn.

Tyme’s operational steps going forward

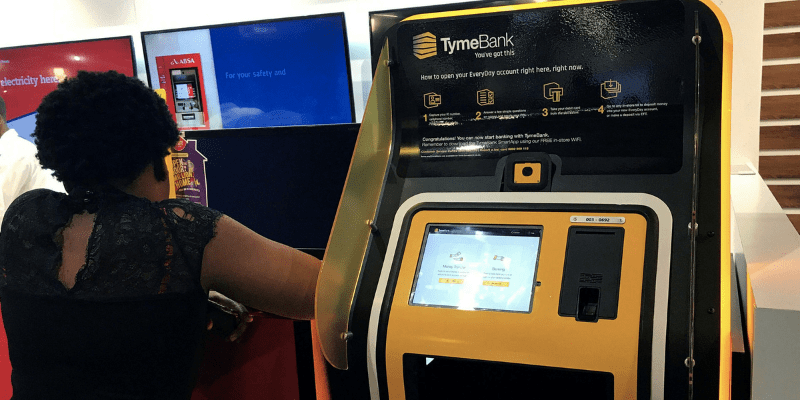

Tyme Group, founded in 2019 and headquartered in Singapore operates as TymeBank in South Africa. The Africa subsidiary has been a key driver of Tyme’s growth where it has racked up more than 10 million customers.

It also operates in the Philippines via a joint venture with Gokongwei Group where it launched in 2022, marking its entry into Asia. According to Jonker, the fintech firm has more than 15 million customers across the group and plans to expand further into Vietnam next year. However, it started offering merchant cash advances in the country during the second quarter.

Tyme recently incorporated into Indonesia and is also looking at acquisition targets. Likewise, the company plans to spend tens of millions of dollars in order to gain an Indonesian banking license. “Job number one is to become the top retail bank in the Philippines. The next job is to repeat that in Indonesia,” Jonker said.

The digital bank looks to enter a competitive arena with existing big companies such as Bank Mandiri and Bank Rakyat Indonesia, as well as several banks backed by the region’s top tech companies.

“The next three to four years, we will be a lot more focused on our customers and on excellence and execution in the market and making sure we get the shape of the business right for listing, which includes making sure that in South Africa we operate the business at the return on equity level above 30%,” Jonker said.

The latest fundraiser will likely be the last for Tyme Group as the lender begins preparations for an initial public offering by the end of 2028.

Also Read: TymeBank reaches 10 million users.