VanEck Launches New Crypto Stock ETF Called NODE

ADA

ADA

SEC

SEC

ETF

ETF

DOGE

DOGE

ETF

ETF

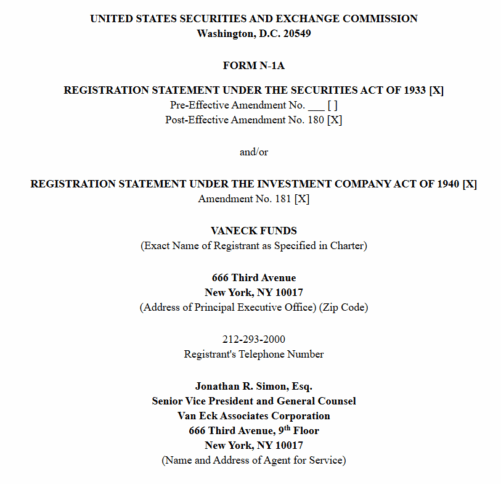

VanEck is launching a new ETF that will focus on companies working in the crypto space. It’s called the VanEck Onchain Economy ETF, and it will start trading on May 14, 2025, after getting approval from the U.S. Securities and Exchange Commission (SEC).

This new ETF, with the ticker symbol NODE, won’t invest in cryptocurrencies like Bitcoin or Ethereum directly. Instead, it will invest in 30 to 60 companies that are involved in the digital asset world.

That includes crypto exchanges, mining companies, data centers, energy providers, chip makers, gaming companies, and others who are building tools for the future of digital finance.

VanEck’s Matthew Sigel, who’s in charge of digital asset research, said on X, “The global economy is shifting to a digital foundation. NODE offers active equity exposure to the real businesses building that future.”

This ETF is actively managed, which means a real person (not just a computer) will choose which stocks to include. Sigel himself will be managing the fund. He’ll be picking from more than 130 companies involved in the digital asset space.

NODE plans to put at least 80% of its money into what VanEck calls “Digital Transformation Companies.” These are companies using blockchain or digital tools in a big way. It might also invest up to 25% in things like exchange-traded crypto products, futures, or other investment tools linked to digital assets.

To do this legally while staying within U.S. tax rules, VanEck is using a subsidiary in the Cayman Islands. This allows the fund to invest in certain products that U.S. law normally restricts for ETFs.

The management fee for NODE will be 0.69%, and it’s a non-diversified fund. That means it can put more money into fewer companies, rather than spreading it out too thin.

VanEck first filed for NODE in January 2025, and now that the SEC has approved it, the fund is ready to hit the market. This comes as more investors want access to crypto-related companies without buying crypto themselves.

VanEck already runs other crypto-focused funds, including a spot Bitcoin ETF, and has applied for others tied to Solana and Binance Coin.

Also Read: Cardano and Dogecoin Bounce Back with Bullish Signs