What Is Babylon? A Singapore Bridge for BTC and PoS Security

BABY

BABY

BTC

BTC

IDLE

IDLE

READ

READ

SECURITY

SECURITY

| Key Points: - Babylon enables Bitcoin staking without wrapping, bridging, or custodial risk. - BTC holders earn PoS rewards while maintaining full self-custody. - Staking becomes Bitcoin’s third native use case after holding and payments. |

Babylon introduces a new infrastructure that bridges the decentralized strength of Bitcoin with the growing ecosystem of Proof-of-Stake (PoS) blockchains. The protocol enables Bitcoin staking without wrapping, bridging, or custodial risk, allowing BTC holders to participate in PoS security and earn native rewards — while keeping their assets on the Bitcoin network.

The mechanism extends Bitcoin’s utility beyond passive storage to active economic engagement. Babylon’s framework preserves core Bitcoin principles such as self-custody and decentralization, marking a shift in how Bitcoin’s capital base can contribute to blockchain security.

What Is Babylon?

Babylon is a Layer 1 chain and infrastructure suite that facilitates Bitcoin staking as a service for PoS blockchains.

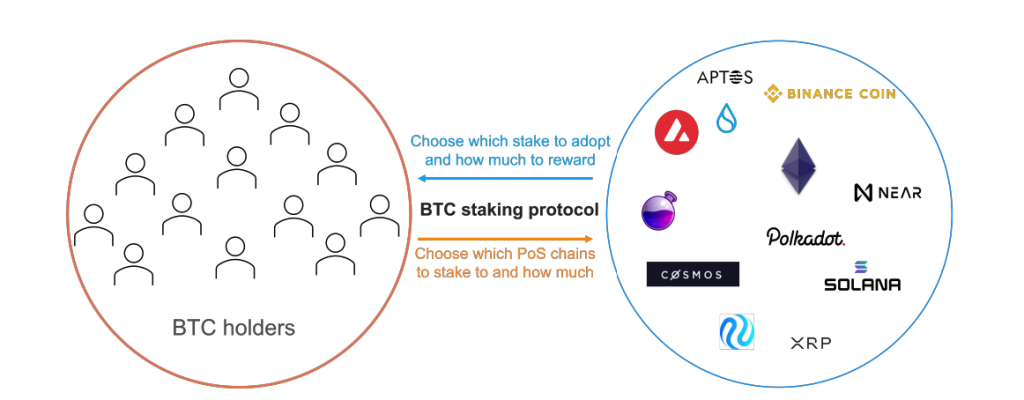

Unlike conventional approaches, Babylon does not require BTC to be bridged or wrapped. Instead, it keeps Bitcoin on its native chain while enabling it to participate in PoS networks. This unlocks a new mechanism where:

- PoS chains benefit from Bitcoin’s liquidity and decentralized credibility.

- Bitcoin holders gain access to yield without sacrificing control over their assets.

Fisher, one of the core thinkers behind BabyIon, explains it best with a metaphor: “Babylon is like Singapore.” Just as Singapore sits at the intersection of key global trade routes, Babylon positions itself between two blockchain universes, the Bitcoin world and the altcoin world, facilitating value flow between them while capturing strategic value in the process.

Why Babylon Exists: The Problem With Idle BTC

Despite a market capitalization of over $600 billion, most Bitcoin remains idle, contributing neither to financial activity nor to network security beyond mining. Key reasons for this include:

- Bitcoin’s architecture is Proof-of-Work, not stake-based.

- Staking and DeFi participation often require asset bridging or custodianship, introducing third-party risk.

BTC is primarily used in four ways:

- As a store of value

- For payments (limited scope)

- For lending (involving custodial risk)

- Via bridges (carrying smart contract or centralized risk)

These uses conflict with Bitcoin’s decentralization ethos. Babylon addresses this challenge by enabling yield generation through native staking, without compromising asset custody or trust assumptions.

Bitcoin Staking as a Native Use Case

Babylon positions staking as Bitcoin’s third native use case, following holding and payments. It achieves this by:

- Keeping BTC in users' wallets throughout the process.

- Eliminating bridges and wrapping, avoiding exposure to external systems.

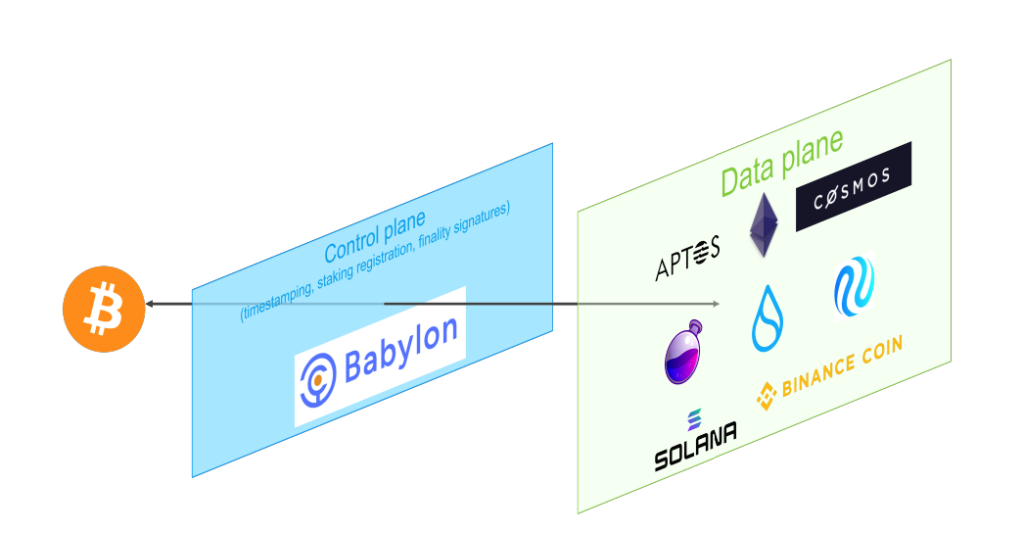

- Leveraging Extractable One-Time Signatures (EOTS) to allow trustless slashing — a method for penalizing malicious behavior.

- Utilizing Bitcoin’s timestamping for fast unbonding, without reliance on off-chain consensus.

Such a design enables BTC to become a security primitive — powering restaking-like functions for PoS chains and providing financial yield while staying fully native and decentralized.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |