What is BRETT Crypto, and How to Use It to Earn Crypto Profit?

BRETT

BRETT

Inspired by Matt Furie’s comic character Brett (a peer of Pepe the Frog), BRETT crypto is more than just another internet joke turned token. It’s a community-driven asset with real traction on Base, Coinbase’s Layer 2 network. In this article, we’ll cover what BRETT is, what makes it relevant, and how users are engaging with it to generate profit.

What Is BRETT Crypto?

BRETT is a meme coin deployed on the Base blockchain, Ethereum’s Layer 2 solution developed by Coinbase. While its origins are clearly rooted in internet culture, BRETT has evolved into a symbol of the Base community, often compared to how SHIB or DOGE represented their respective chains.

- Supply: 10 billion tokens

- Chain: Base (Layer 2 on Ethereum)

- Liquidity: 85% added to a locked pool for one year

- Governance: Decentralized, with DAO involvement

- Backstory: Based on Boy’s Club by Matt Furie (same universe as Pepe)

Its appeal lies in both its simplicity and community energy. There’s no complex utility or tech — and that’s the point. In a landscape of overly engineered DeFi platforms, BRETT has embraced a cultural narrative instead.

Info Box

The crypto market is shifting rapidly in 2025. With CoinRabbit, you can explore the questions everyone’s asking—like should I sell Dogecoin and how Bitcoin ETFs are impacting the space. Don’t miss the chance to master Jupiter Wallet, sharpen your skills on how to read crypto charts, and find out once and for all: is crypto a good investment in 2025?

How to Earn Crypto Profit with BRETT

While BRETT isn’t built with utility-based staking like some Layer 1 tokens, there are still a few legitimate ways users are profiting from its rise.

BRETT (Based) crypto price chart. Source: coinmarketcap.com

1. Trade BRETT Volatility

Given BRETT’s meme status and growing popularity, price swings are common. Traders can benefit from:

- Swing trading during market spikes and dips

- Arbitrage between centralized exchanges (CEXs) and Base-based DEXs

- Using limit orders and TA-based setups to manage entries and exits

2. Provide Liquidity on DEXs

Several decentralized exchanges on the Base network (like Aerodrome or Uniswap on Base) allow you to add liquidity to BRETT pairs. In return, LPs (liquidity providers) earn:

- Swap fees from token trades

- Possible token incentives or farming rewards

- Occasional airdrop eligibility depending on platform programs

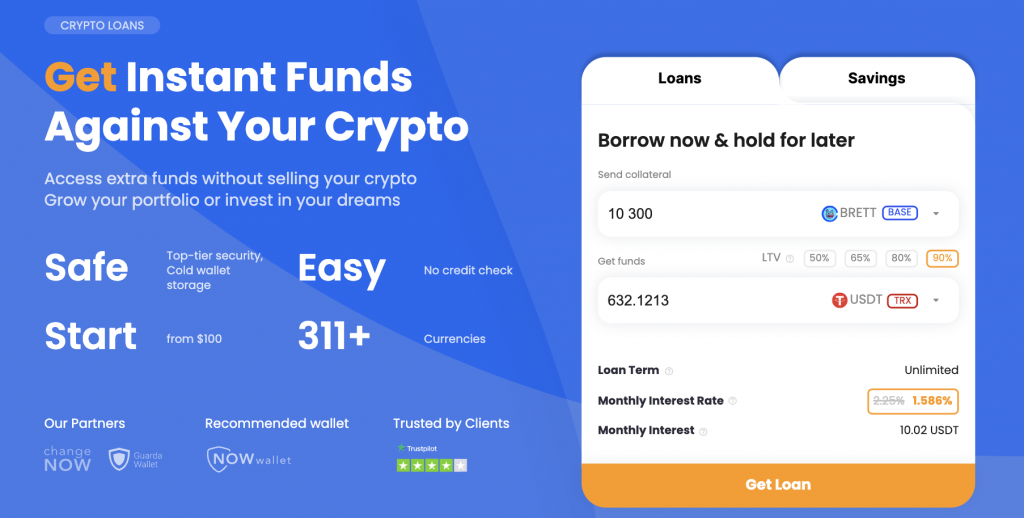

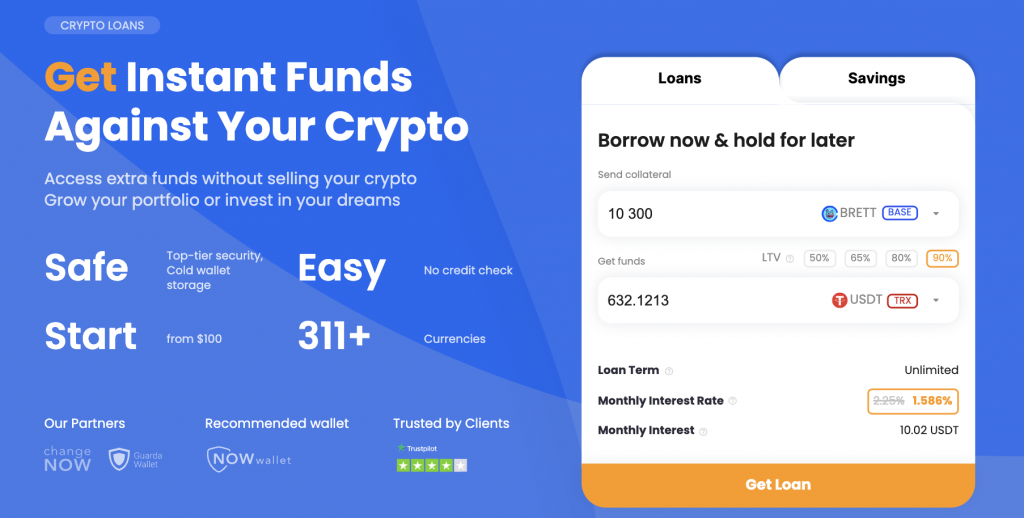

3. Use BRETT as Collateral

Some crypto platforms, such as CoinRabbit, offer the option to use BRETT crypto as collateral. Instead of selling your tokens, you can lock them up and receive stablecoins like USDT or USDC—giving you access to liquidity without losing exposure to future price movements.

Benefits:

- Get instant liquidity while still holding your BRETT

- Stay positioned for potential price appreciation

- No credit checks or paperwork required. Receive your funds in 10 minutes

What Is a BRETT Crypto Loan?

A BRETT crypto loan lets you borrow stablecoins like USDT or USDC without having to sell your BRETT tokens. You simply lock your BRETT as collateral, and based on its current market value, you receive a loan—while still keeping ownership of your tokens.

Key Benefits of a BRETT Crypto Loan

💰 Stay Invested in BRETTRather than selling your BRETT holdings during a market dip or consolidation phase, you can borrow against them—retaining full exposure to any future price upside.

💰 No Capital Gains Tax TriggerSelling crypto may create a taxable event depending on your jurisdiction. Borrowing against BRETT, however, isn’t classified as income, making it a potentially more tax-efficient way to access liquidity.

💰 Avoid Market ImpactOffloading a large BRETT position could affect market price or signal weakness. With a loan, you can tap into stablecoins quietly, without negatively influencing token value.

💰 No Credit ChecksCrypto lending platforms don’t require credit scores, paperwork, or bank intermediaries. The collateral itself guarantees the loan, eliminating the need for traditional credit assessments.

💰 Freedom to Use Funds as You WishOnce you receive USDT or USDC from the loan, the funds are yours to use—whether that’s to reinvest, pay bills, trade, or hedge other positions.

How to Get a BRETT Crypto Loan in 4 Simple Steps

Step 1. Choose BRETT as Collateral

Start by visiting the CoinRabbit crypto loan platform. In the loan calculator, select BRETT crypto as your collateral. This means your BRETT tokens will be used to secure the loan, allowing you to borrow without selling them.

Step 2. Enter the Amount of Your BRETT Tokens

Next, enter how much BRETT you’d like to pledge. The calculator will instantly display the maximum loan amount you’re eligible for based on the current market value of your BRETT. Decide how much liquidity you want, then click “Get Loan” to proceed.

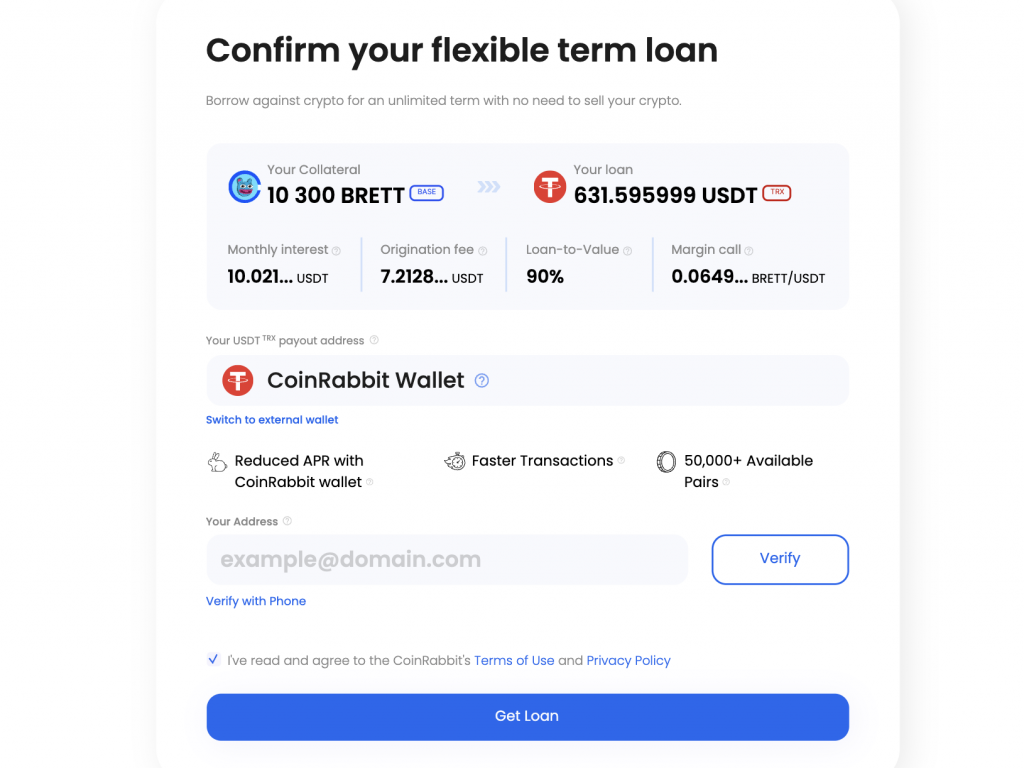

Step 3. Confirm Loan Details

Carefully review the loan terms—including loan amount, interest rate, LTV ratio, and repayment conditions. Make sure the details suit your needs. You’ll also be asked to provide your stablecoin wallet address (for USDT or USDC) and confirm your email for verification.

Step 4. Transfer Your BRETT Collateral

Once everything is confirmed, transfer your BRETT tokens to the wallet address provided by the platform. As soon as your collateral is received, the loan will be processed and sent to your wallet—quickly and with no credit checks or unnecessary paperwork.

Final Thoughts

Ready to make your BRETT work harder without letting it go? Explore borrowing options today and take a closer look at how crypto-backed loans fit into your strategy.

Disclaimer

The information provided in this article is for educational and informational purposes only and should not be construed as financial advice. Cryptocurrency investments carry a high level of risk, and it is essential to conduct thorough research and consult with a qualified financial advisor before making any investment decisions. The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of any financial institution or organization. We do not take responsibility for the platforms we recommend. Always invest responsibly and consider your individual financial situation before making investment choices.