What is EtherVista, Pump.fun’s Competitor on Ethereum

ETH

ETH

EUL

EUL

X

X

DEX

DEX

VISTA

VISTA

EtherVista is a new token launcher DEX on Ethereum, a direct competitor to Pump.fun memecoin launcher on Solana.

The blockchain-based platform aims to build a decentralized system for digital assets, offering a vast range of services to provide users with a secure, efficient, and transparent way to manage and trade digital assets.

Here’s all you need to know about the token launcher DEX.

What is EtherVista?

EtherVista is a decentralized exchange that introduces a new approach to liquidity management and token launches built on the Ethereum network.

According to the team behind the project, EtherVista is a new standard for Decentralized Exchanges, built for Ethereum and Layers 2s.

The EtherVista Standard

In the official whitepaper shared via X, the team describes “The EtherVista Standard: Rethinking Decentralized Exchange Dynamics for Sustainable Blockchain Growth.”

The whitepaper is dated August 26, 2024, and it features an author called “Vitalik Nakamoto”, the name being a mix referring to Bitcoin’s creator Satoshi Nakamoto, and Ethereum’s founder Vitalik Buterin.

The whitepaper’s abstract addresses, Automated Market Makers (AMMs) which currently encounter a notable challenge, struggling to effectively encourage the long-term success of blockchain projects.

According to them, the problem stems from the fact that token creators are encouraged to prioritize profits by rapidly withdrawing liquidity and discreetly selling tokens.

Liquidity providers tend to prefer short-term providers, withdrawing and selling liquidity as the token value surges. This is an issue that hampers the growth of projects designed for long-term success, the EtherVista team notes.

Addressing this challenge is crucial as the current AMM model lacks the incentives to foster continuous growth and resilience in the blockchain ecosystem.

Setting a Custom Fee Paid in ETH

Unlike the current AMM standard which incurs a 0.3% fee on every swap paid in tokens, the EtherVista standard is the first to set a custom fee paid only in the native ETH.

According to the project’s whitepaper, the fee is cleverly distributed among all liquidity providers and token creators within a specific pool. Everyswap uses a novel mechanism that allows them to distribute rewards to millions of users with minimal gas costs.

The creator fee is a protocol fee that can be assigned to a smart contract and treasury.

Use Cases and Features

Various use cases include the following:

- Auto-buys

- Staking rewards

- Other DeFi applications

Features of the model include:

- Market makers and creators benefit from volume rather than token price

- The model allows incentivizing longevity over short-sighted price action

- Investors benefit from the delayed liquidity removal mechanism, preventing developers from q quick rug-pull

- The approach mitigates the risk of sudden market upheaval while boosting overall investment success

EtherVista is set to expand beyond traditional pools, moving towards building ETH-BTC-USDC pools to offer:

- Lending

- Futures

- Fee-less flash loans

Overall, according to its official whitepaper, EtherVista aims to become an “all-in-one decentralized application.”

Mathematics Behind EtherVista Model

The technical overview of EtherVista involves a description of how the liquidity provider fee is distributed.

The EtherVista pair smart contract maintains a sequence of ascending numbers known as Euler amounts, and these values are updated each time native ETH is transferred to the pair contract.

Each Euler amount is determined by adding the previous one to the ratio of the fee to the current total supply of liquidity provider tokens (LP). The initial Euler amount is set to zero.

The essence of their mathematical approach lies in the following:

- Ability to accurately determine the share each user receives per individual swap

- The acuity remains at its peak regardless of the continuous changes in the total supply of LP tokens

Pool Configuration and Protocol Fee

According to the official website, the individual who initiates the liquidity provision becomes The Creator and has writing access to configure pool settings.

This includes determining the following:

- Pool fees

- Protocol address

- Metadata

The most important parameter is the protocol-assigned smart contract address; while this is optional, it defaults to the Creator’s address.

This address receives ETH from the protocol fee, managed via the smart contract’s custom logic, enabling an endless range of DeFi apps that were not previously possible on the current AMM standards.

This new form of revenue generation shifts the focus from largely prioritizing short-term gains and price action to prioritizing the following:

- Activity

- Longevity

- Utility

Creators can define on-chain metadata for their token, including details such as website URL, logo, project description, social media, and chat URLs. All this data allows creators to present their projects effectively while ensuring that users can access verified, secure info, reducing the risks of phishing attacks.

Besides the pool and protocol fees, a fixed $1 fee is allocated to the ongoing development of the EtherVista DEX and VISTA token.

The fee will fund the implementation of the following:

- Feeless flash loans

- Futures

- Lending

- Support potential CEX listings and marketing initiatives

The EtherVista Platform

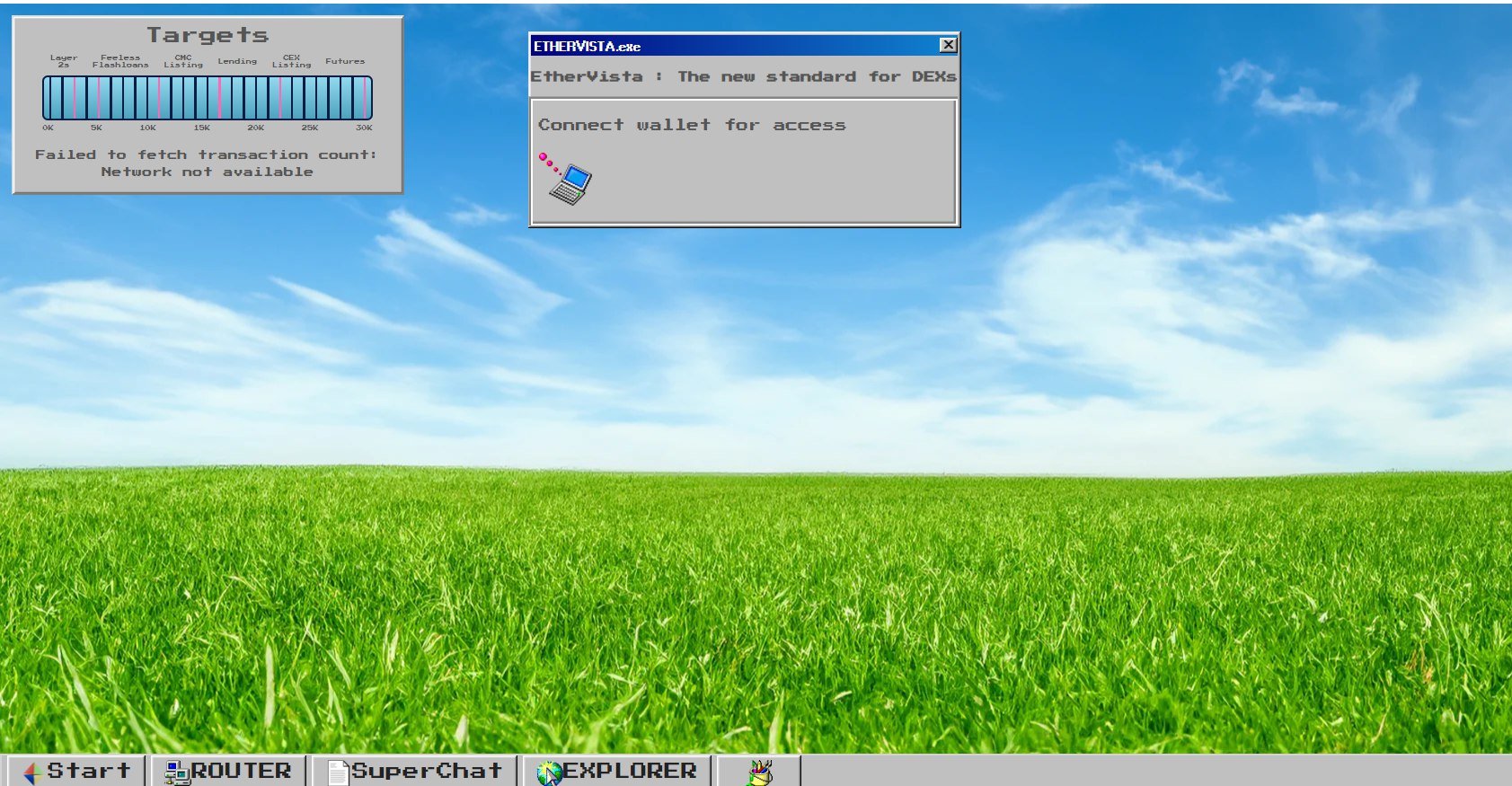

The EtherVista platform has an old-school look reminiscent of previous versions of Windows.

As mentioned above, EtherVista offers flash loans, futures, and lending which can be found by navigating to the Start Button, down left.

There’s also a SuperChat button present, and as noted by the team behind the project via their X post revealing the official whitepaper, this is a global live chat integrated directly into the DEX platform, enabling users to exchange information quickly.

According to official notes, access to SuperChat is tier-based, depending on the number of VISTA tokens held by a user.

Creators wishing to limit their token trading exclusively to EtherVista can restrict the ERC20 transfer from function to the EtherVista router address, a variable stored within the factory contract address.

VISTA Token

VISTA is the native currency of the DEX and it has a capped supply of 1 million tokens. It’s a value-compounding deflationary token.

The protocol’s smart contract implements an on-chain process in which each burn event not only decreases the circulating supply but also raises the token’s price floor.

The effect is sustained via the continuous acquisition and destruction of tokens financed by fees generated within the protocol for every transaction.

In a post on X, the team behind EtherVista noted that as of September 3, 2024, 2.17% of the total supply has been bought and burned forever.

VISTA’s benefits include the following:

- It acts as a hedge against inflation, by tying activity to supply reduction and price floor growth

- It strengthens VISTA’s value with every transaction

- It drives sustained growth and scarcity

VISTA Public Testnet Goes Live

The team behind EtherVista announced via X on September 4 that the VISTA public testnet is now live. Users should sign in and receive an allocation of VISTA while supplies last, according to the team. Also, gas will be required upon wallet signature.

EtherVista, the Pump.fun of ETH?

EtherVista is described as the Pump.fun, the Solana memecoin generator, but on Ethereum.

Ethereum DeFi users are complaining about the lack of innovation on the mainnet, and EtherVista’s novel LP and fee mechanism aims to address this by exploring the market gap.

EtherVista recently released its whitepaper, promoting a fair launch with a liquidity lock of 5 days following an analysis that most rugs take place between 2 to 4 days. As of September 2, the coin pumped over $15 million market cap, according to official data.

Also, EtherVista announced plans to deploy on Ethereum L2s and upcoming features such as ETH-BTC-USDC pools, lending, and flash loans.

The project has a deflationary model, and it remains to be seen whether it can grow in value over time.

Also, attention was attracted by EtherVista a few days ago, following reports highlighting that a trader managed to gain a staggering profit by capitalizing on the launch of the platform.

Via a strategic approach, involving the distribution of VISTA tokens across seven different wallets, the trader sold off his holdings, after investing $5,000 to secure over 5% of EtherVista’s total supply and converted the profits into Ethereum within 48 hours, getting a total profit of $670,000. This translates into a 130x return.

Pump.fun had its own achievements, with a notable one being that the platform managed to reach $100 million in revenue in just 217 days, becoming the fastest-growing app by revenue in the history of crypto.