Will Ethereum Reach $14k? Top Analysts Reveal Shocking 2025 Price Targets!

ETH

ETH

BULLISH

BULLISH

2024

2024

TOP

TOP

PEL

PEL

- Recent 8% Weekly Gain Fuels Speculation; Analysts Predict Ethereum Could Hit All-Time Highs by Year’s End.

- Bullish Market Sentiments Propel Ethereum; Analyst AlejandroBTC Forecasts Price Reaching $14k by March 2025.

Ethereum (ETH) has been a focal point of discussion, particularly with predictions about its price movements. Recently, Ethereum’s performance has mirrored the general upbeat trend seen in the cryptocurrency market, particularly following Bitcoin’s positive trajectory.

At present, Ethereum is trading at $3,389.53, with a market capitalization surpassing $408 billion. Although these figures are robust, they still fall short of Ethereum’s all-time high (ATH) of nearly $4.7k recorded in November 2021.

Despite this, the prevailing market optimism fueled by the broader bullish sentiment has led several analysts to forecast that Ethereum could not only revisit but possibly exceed its ATH soon.

ATH before EOY

$7K in January

$14K in MarchScreenshot this pic.twitter.com/PrfUnEnrVs

— Alejandro₿TC (@Alejandro_XBT) November 24, 2024

Renowned cryptocurrency analyst AlejandroBTC has suggested ambitious targets for Ethereum, proposing it could reach as high as $7k by January 2025 and $14k by March 2025.

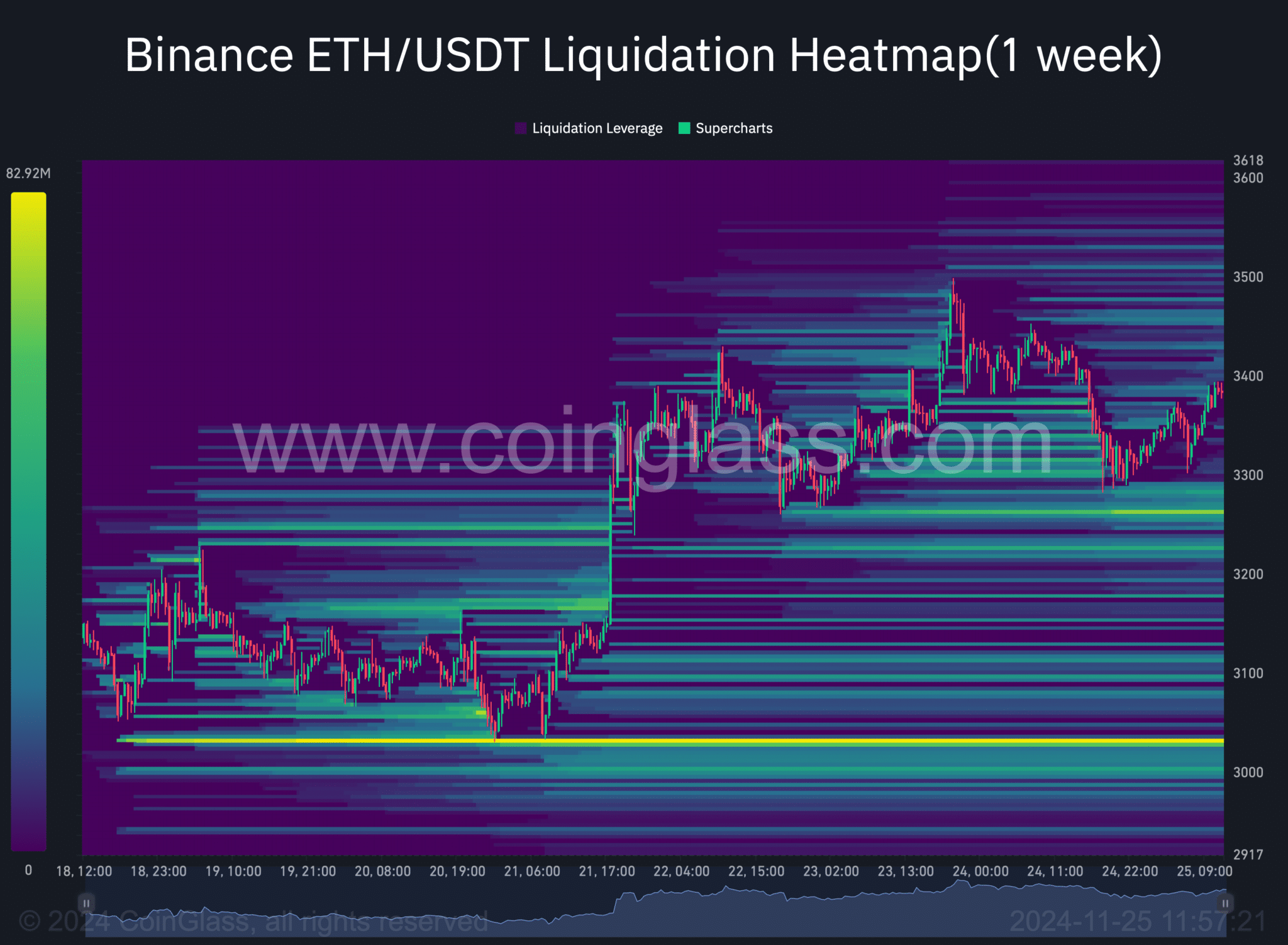

To achieve these figures, Ethereum would first need to overcome immediate resistance levels which are proving challenging. Currently, Ethereum faces a significant resistance at $3.4k.

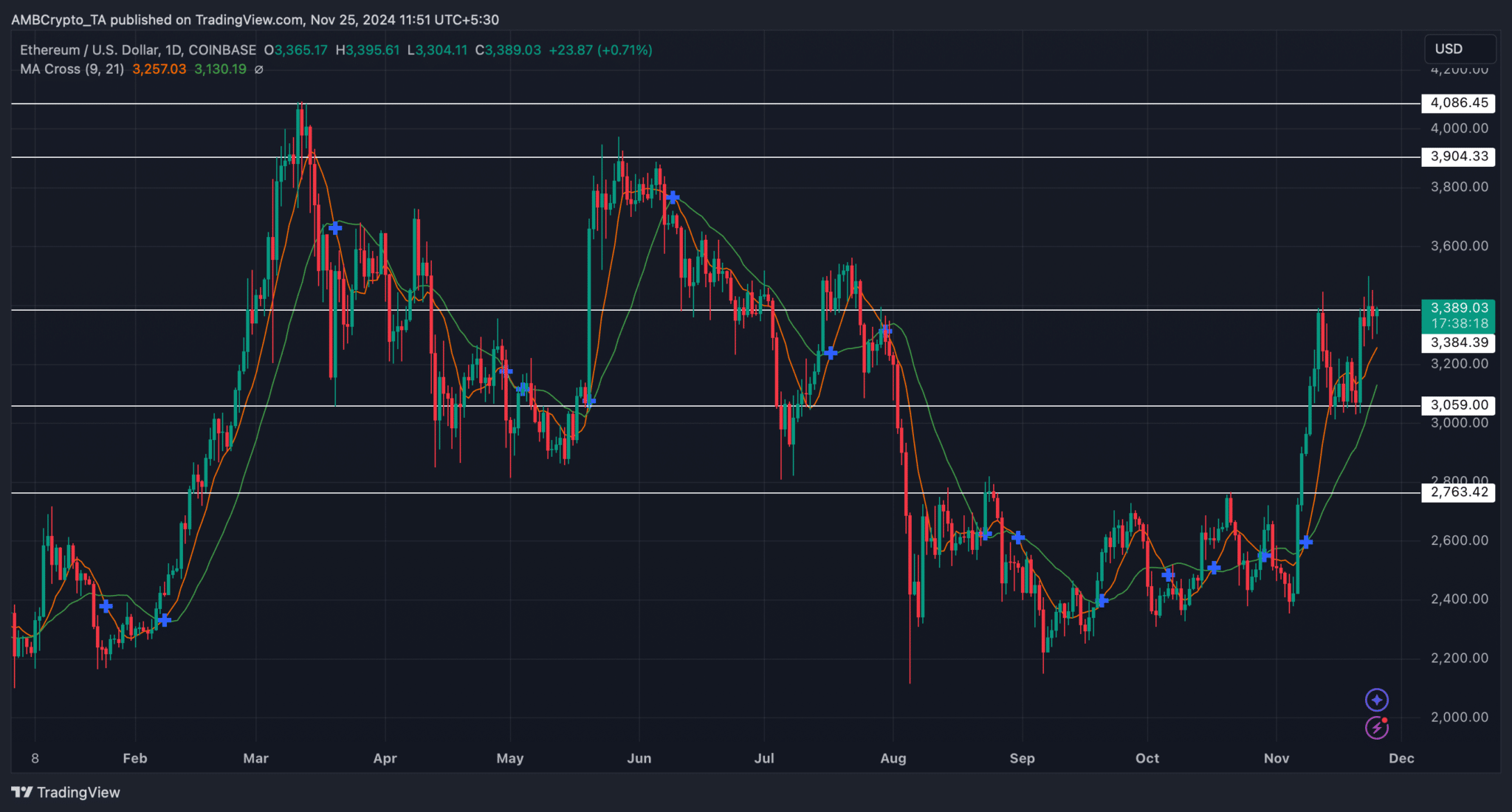

Further analysis using the Moving Average (MA) Cross indicator, which is often used to gauge market momentum, indicates a bullish setup. The 9-day MA is positioned above the 21-day MA, hinting at potential upward movement if Ethereum can breach the $3.4k resistance level.

Should Ethereum successfully pass this hurdle, the next targets could be $3.9k and then the March high of $4k. Surpassing these levels could pave the way for retesting its ATH.

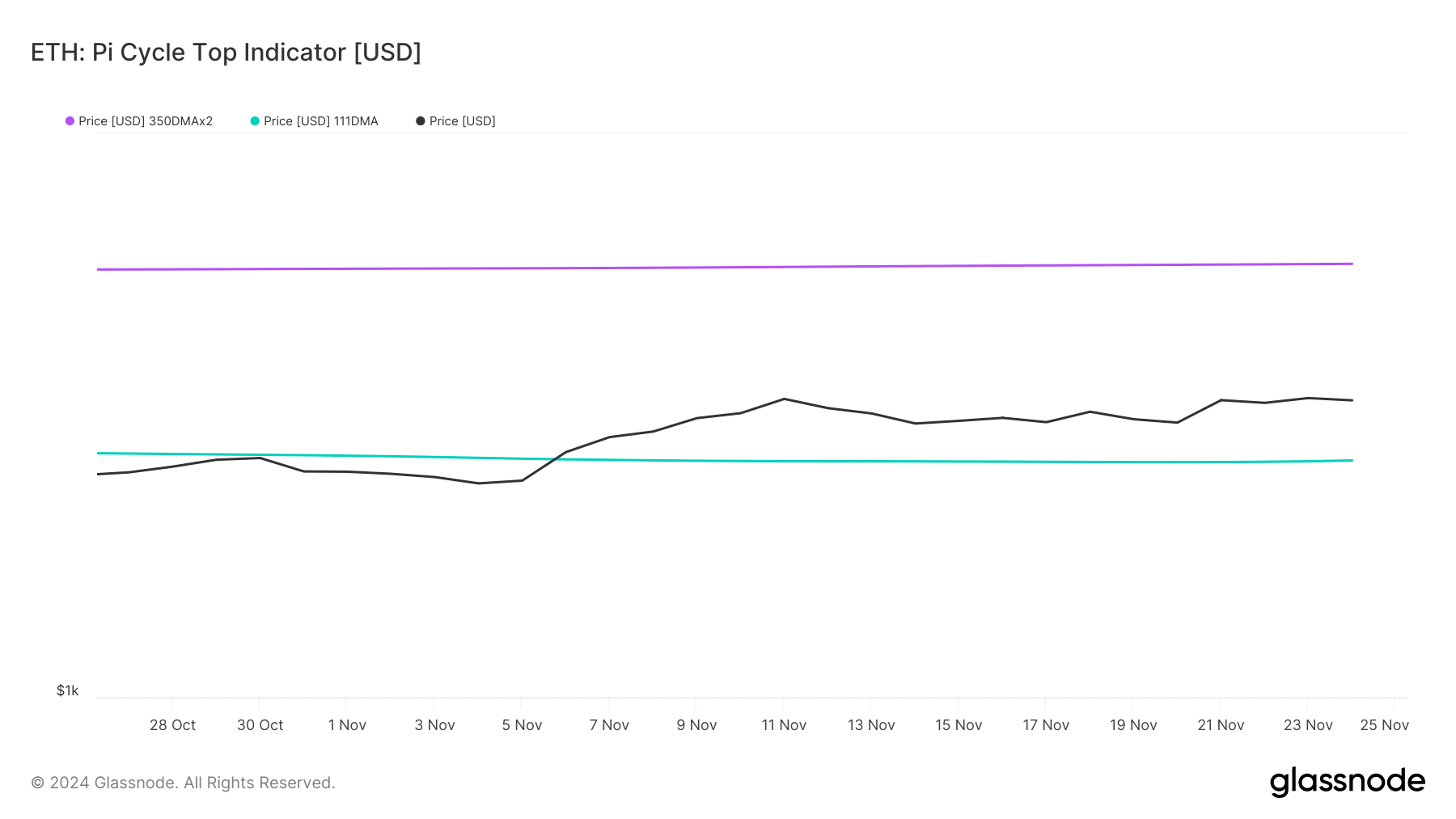

In terms of market cycles, the Pi Cycle Top indicator, which is designed to pinpoint potential market peaks, has identified a possible market top for Ethereum at $5.8k, suggesting a significant upside potential from current levels.

However, as with all investments, caution is warranted. While the prospects appear favorable, market are notoriously unpredictable. A downturn or correction could see Ethereum retract to support levels around $3.03k.

Investors and market participants will need to stay informed and agile, ready to adapt to rapid changes that are characteristic of cryptocurrency markets. The blend of technical indicators and market sentiment points towards exciting times ahead for Ethereum, though the journey is likely to be anything but linear.

Ethereum (ETH) is trading at $3,454.20 USD, reflecting a 2.69% gain, and is testing key resistance at $3,500 USD. A breakout above this level could drive ETH toward $3,700 – $3,800 USD, while immediate support lies at $3,350 USD, with stronger support at $3,200 USD.

Technical indicators like the RSI (at 67) suggest ETH is nearing overbought territory, hinting at possible consolidation or minor pullback.

The MACD remains bullish, supported by rising trading volume. Overall, ETH’s trend remains positive, with potential for further gains if resistance is breached and broader market conditions remain favorable.

The post Will Ethereum Reach $14k? Top Analysts Reveal Shocking 2025 Price Targets! appeared first on ETHNews.