XRP Defies Bears, Surges Over 450% Amid Liquidation Imbalance

BULLISH

BULLISH

XRP

XRP

XRP, one of the most prominent cryptocurrencies, continues to defy expectations, particularly in the futures market.

Recent data from CoinGlass reveals that perpetual futures liquidations for XRP have reached staggering levels, signaling an intense tug-of-war between bullish and bearish traders.

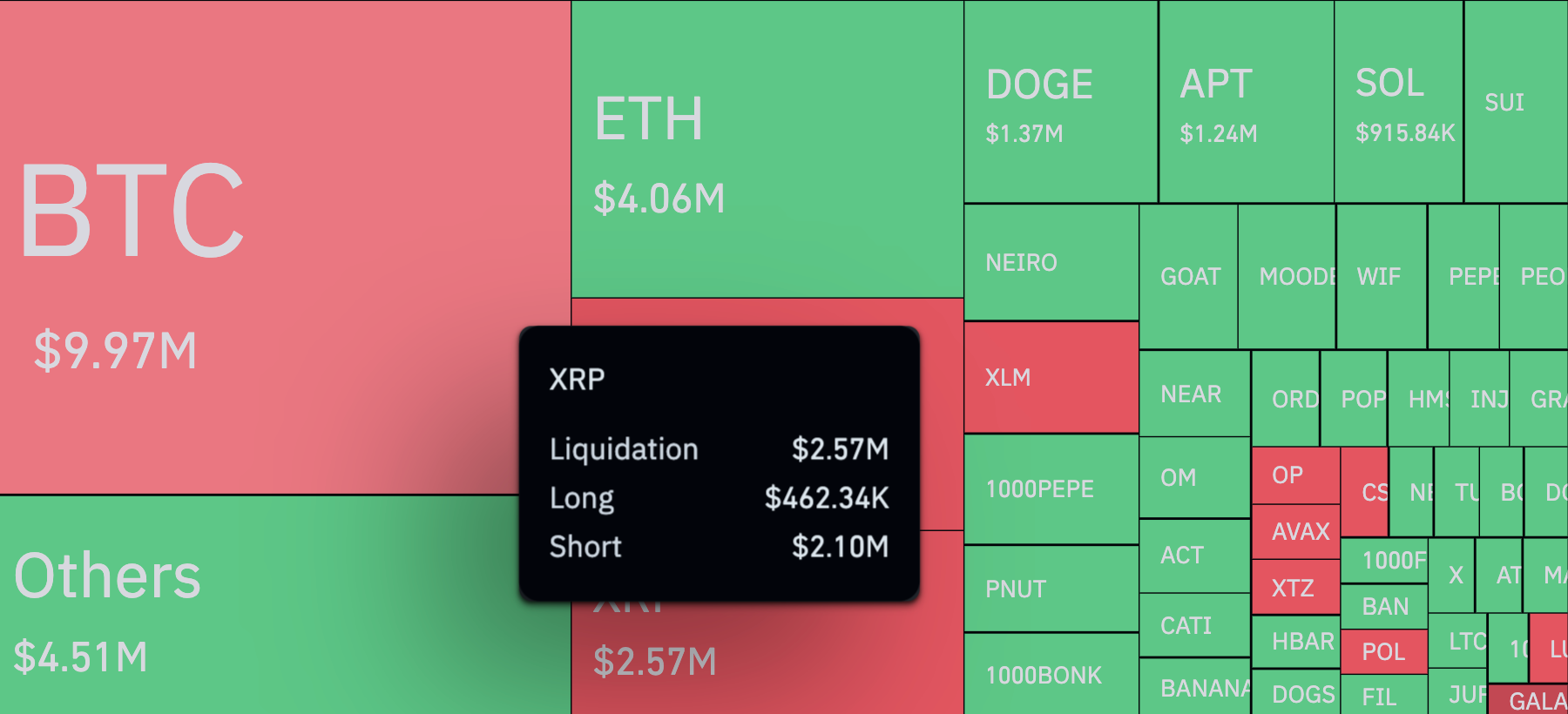

Over the past few hours, XRP has seen $2.57 million in liquidations, ranking fourth in the crypto derivatives market by volume.

The Liquidation Imbalance: Short Sellers Under Pressure

A closer examination of the liquidations reveals an unusual pattern. While only 17.9% of the liquidations stemmed from long positions, the vast majority originated from short positions. This imbalance is striking, with short liquidations outpacing long liquidations by a factor of 4.54 or 454%.

This stark difference can be attributed to two key factors- XRP’s persistent price growth and bearish persistence. The token’s price has been relentlessly upward, catching bearish traders off guard. On the other hand, many traders are doubling down on short positions, expecting a reversal. However, this strategy has backfired, as the forced liquidation of these positions is further fueling XRP’s rise.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

XRP’s Price Surge: A Feedback Loop of Growth

During this short four-hour period, XRP’s price experienced a dramatic increase, rising by 6.34% and reaching a peak of $1.15. This surge was largely driven by the liquidation of over $2 million in short futures positions. The forced closure of these bearish positions creates a self-reinforcing cycle, where the upward momentum attracts more buying pressure, further pushing the price higher.

Shorting XRP under current market conditions is proving to be a high-risk strategy. Bearish traders attempting to anticipate a peak in the token’s price are liquidated as the price continues to climb. As long as this dynamic persists, XRP’s growth shows no signs of slowing down.

Bulls Reign Supreme on XRP

XRP’s recent performance highlights a critical lesson for traders: fighting against a strong bullish trend can be costly. With bearish positions repeatedly liquidated, the cryptocurrency’s upward trajectory is reinforced. Unless market dynamics shift dramatically, XRP appears poised to continue its ascent, leaving short-sellers scrambling to adjust their strategies.

This ongoing battle in the futures market is a testament to XRP’s resilience and the volatility inherent in the crypto world. For now, the bulls are firmly in control, and the token’s rise seems far from over.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News

The post XRP Defies Bears, Surges Over 450% Amid Liquidation Imbalance appeared first on Times Tabloid.