XRP Futures Break Records: Bulls Take Charge of the Market

BULLISH

BULLISH

MAJOR

MAJOR

IMX

IMX

XRP

XRP

RISE

RISE

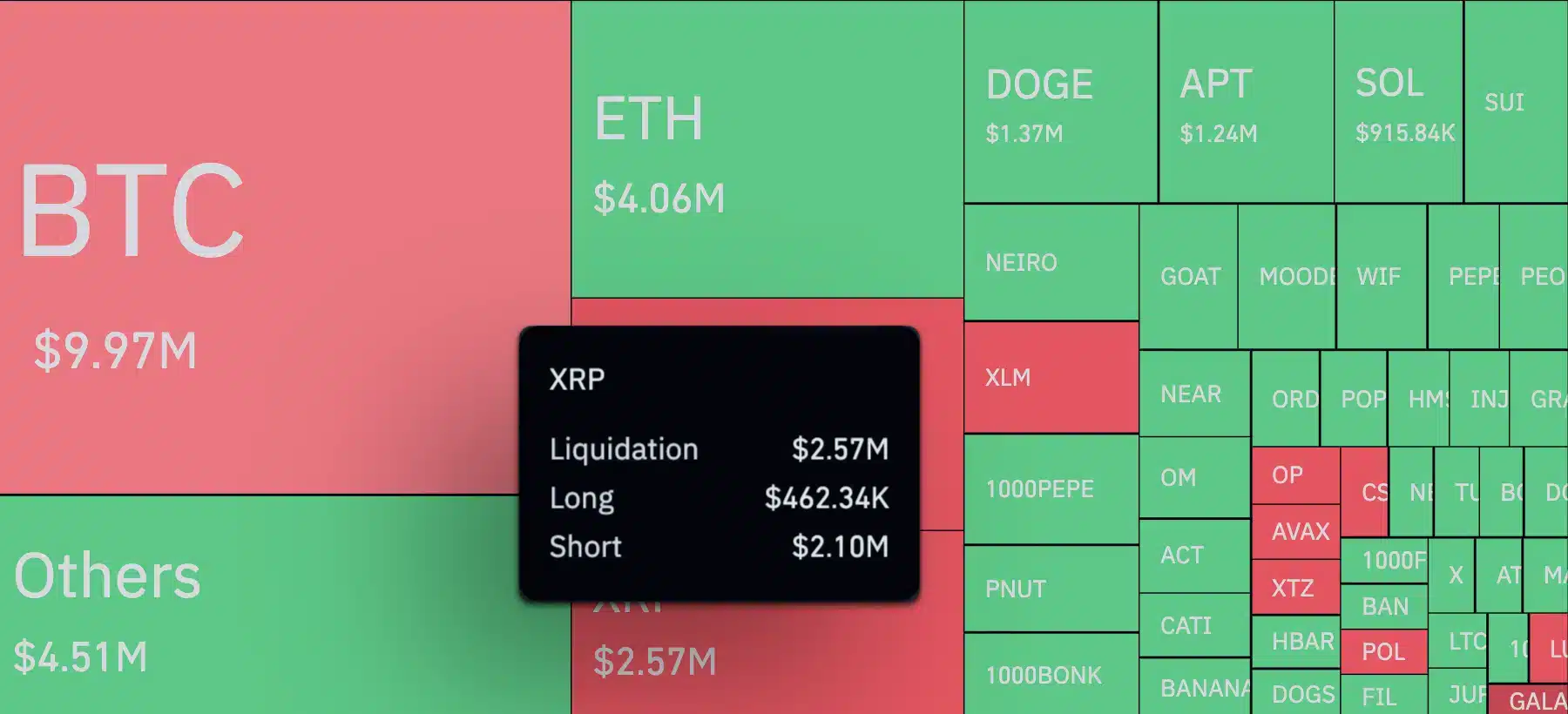

The cryptocurrency market is buzzing with activity, and XRP has taken center stage in the futures trading arena. With a massive $2.57 million in liquidations, XRP has wiped out 454% more short positions than long ones, showcasing its robust upward momentum. Supported by favorable developments in Ripple’s ongoing lawsuit, XRP is emerging as a long-term investment prospect rather than a tool for short-term speculation.

A Closer Look at XRP Futures: Shorts Under Pressure

Recent data from CoinGlass reveals significant liquidations in XRP futures, ranking the token as the fourth-largest by trading volume in the crypto derivatives market. Over the past few hours alone, XRP recorded a staggering $2.57 million in liquidations, driven primarily by short positions.

Interestingly, only 17.9% of liquidations came from long positions, while the remaining majority stemmed from shorts. This imbalance highlights a strong bullish sentiment in the market. The rising price of XRP caught bearish traders off guard, forcing many to close their positions, which further fueled upward price momentum.

Price Momentum and Bullish Feedback Loops

XRP’s price surged by 6.34% in just four hours, reaching $1.15. This increase was largely driven by the liquidation of over $2 million in short positions, creating upward pressure on the token. As more bearish traders doubled down on their positions, the subsequent liquidations created a positive feedback loop, amplifying XRP’s growth.

In the current market scenario, shorting XRP is proving to be a high-risk strategy. As the price continues to climb, bears are being liquidated one after another, further contributing to the token’s bullish trajectory. Traders attempting to predict a price peak may face significant losses if they underestimate this dynamic.

XRP’s Strong Performance Highlights Market Volatility

The consistent liquidation of short positions demonstrates how costly it can be to bet against a strong uptrend like XRP’s. As long as the market dynamics remain favorable, XRP shows no signs of slowing down. Its impressive performance underscores the volatility inherent in crypto markets, where bulls currently hold the upper hand.

Institutional Interest Fuels XRP’s Growth

XRP’s price surge isn’t solely driven by derivatives market activity. Increasing institutional interest and growing adoption also play a crucial role. Ripple’s ongoing legal battle with the SEC has seen positive developments, restoring confidence in the token. Major exchanges have also relisted XRP, further boosting its appeal among investors.

Additionally, XRP’s technological infrastructure and its growing use in international payment systems enhance its long-term potential. These factors make XRP a compelling investment option, beyond just speculative trades.

The Impact of XRP’s Rise on the Crypto Market

XRP’s strong performance in the futures market sheds light on the high volatility and intricate dynamics of the cryptocurrency space. The surge, supported by massive short liquidations, solidifies XRP as a dominant force in the market. Investors must carefully evaluate their strategies, as the upward trend shows no signs of abating.

For more insights and updates on XRP and other top cryptocurrencies, stay tuned to Turkish NY Radio.