XRPL Community Debates Custodial Risks as DeFi Infrastructure Expands

BULLISH

BULLISH

DEFI

DEFI

XRP

XRP

CEO

CEO

FLR

FLR

- XRPL’s new smart contracts and oracles enabled $80M+ DeFi TVL, while RLUSD stablecoin surpassed $100M in market circulation.

- Flare CEO Hugo Philion cautions centralized XRPFi projects risk becoming “Celsius 2.0,” stressing decentralization as critical for long-term viability.

A prominent XRP Ledger (XRPL) contributor has warned against using custodial decentralized finance (DeFi) platforms for XRP holdings. The pseudonymous developer @Vet_X0, who operates a validator node and founded the XRPL-based NFT marketplace XRP Cafe, stated that storing XRP in centralized DeFi systems contradicts the network’s objectives.

“We can’t put our XRP in custodial XRPL DeFi hyped by influencers” he wrote, urging community members to build non-custodial alternatives that redefine financial infrastructure.

We can't put our XRP in custodial XRPL DeFi hyped by influencers. Instead…

Our purpose is to reinvent the foundation on which global finance is built.

Your support and active involvement in building the value web is mission critical – thank you.

— Vet (@Vet_X0) February 14, 2025

@Vet_X0’s comments follow recent technical upgrades to XRPL, including the addition of native smart contracts and on-chain price feeds. These tools enable developers to create DeFi applications without relying on third-party custody.

Data from analytics platform DefiLlama shows XRPL’s DeFi sector now holds over $80 million in total value locked (TVL), with its primary stablecoin, RLUSD, surpassing $100 million in circulation.

Hugo Philion, CEO of Flare Network—a blockchain initially developed within the XRP ecosystem—echoed concerns about centralization risks. Philion compared poorly designed XRP-based DeFi projects to “Celsius 2.0,” referencing the collapsed crypto lending platform that froze user funds in 2022. He emphasized that protocols lacking decentralized architecture could replicate past failures, stating this reasoning partly motivated Flare’s development as a separate network.

The debate highlights tensions between rapid DeFi growth and XRPL’s foundational principles. While new tools allow developers to launch services faster, critics argue shortcuts involving centralized components undermine long-term reliability.

XRPL’s TVL growth suggests demand for DeFi services among XRP holders, but key voices within the community continue advocating for restraint. Their position asserts that technical compromises for short-term gains could erode trust in decentralized finance models.

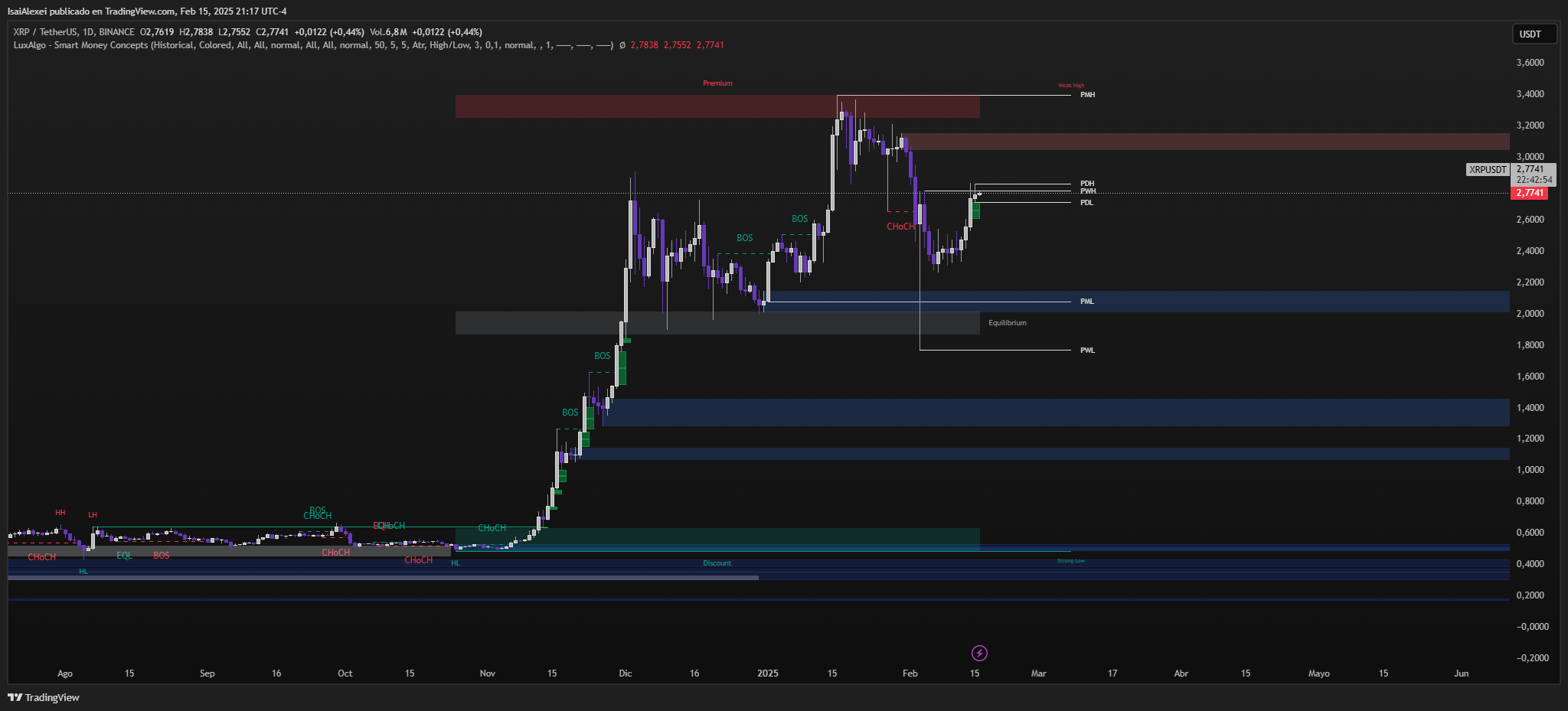

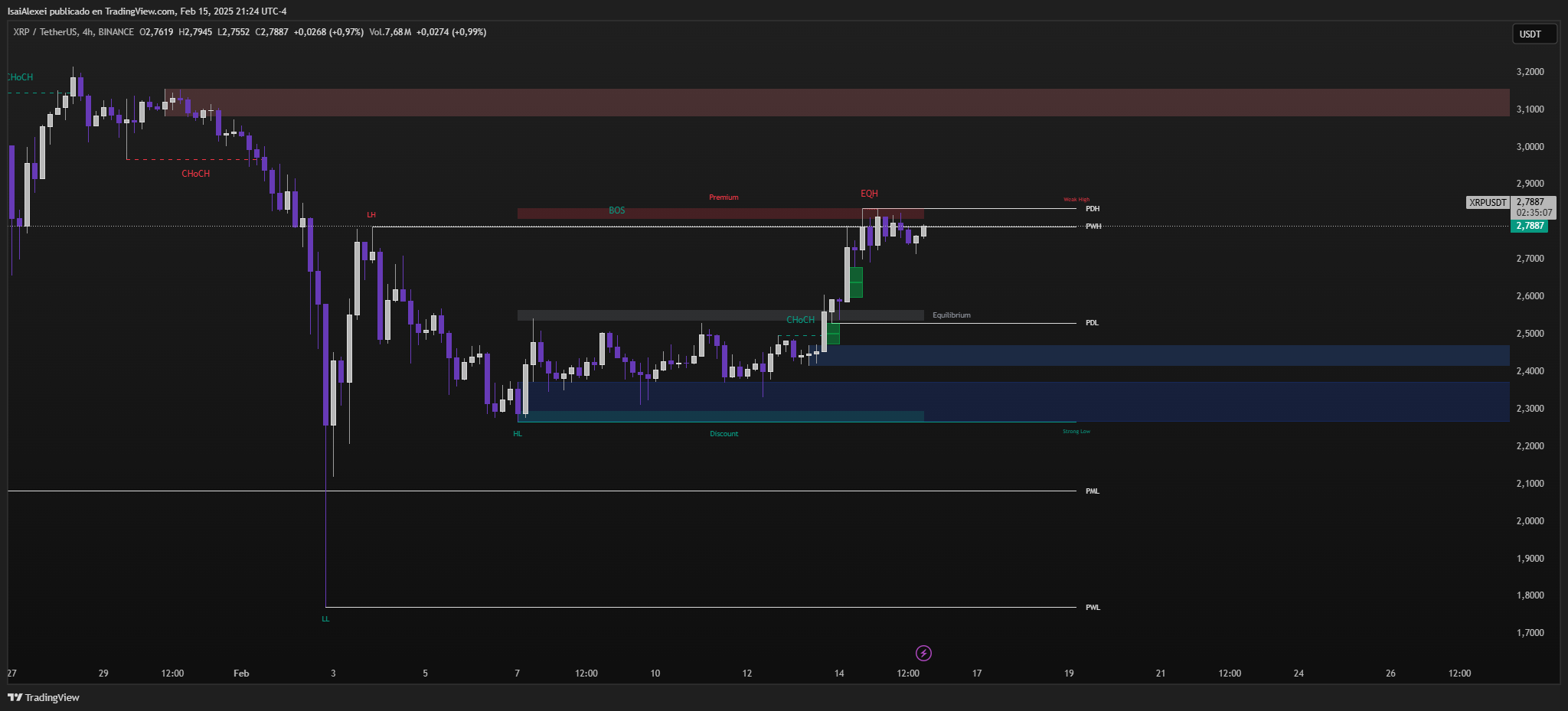

The current price of XRP (Ripple) is $2.77 USD, reflecting a 0.29% increase in the past 24 hours. Over the last week, XRP has surged 14.52%, showing strong bullish momentum. Over the past month, the token has gained 15.4%, and in the past year, XRP has skyrocketed 392.4%, making it one of the top-performing assets in the crypto market.

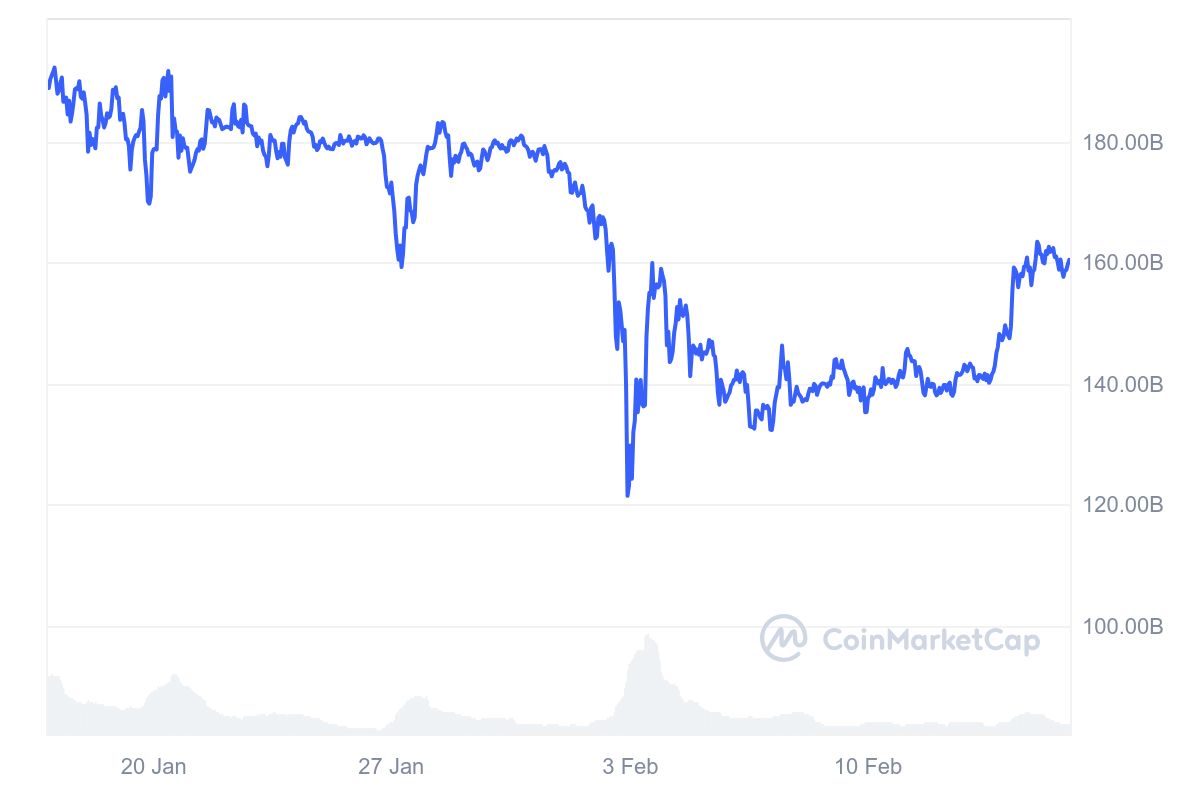

XRP’s market capitalization currently stands at $160.21 billion USD, ranking it as the third-largest cryptocurrency by market cap.

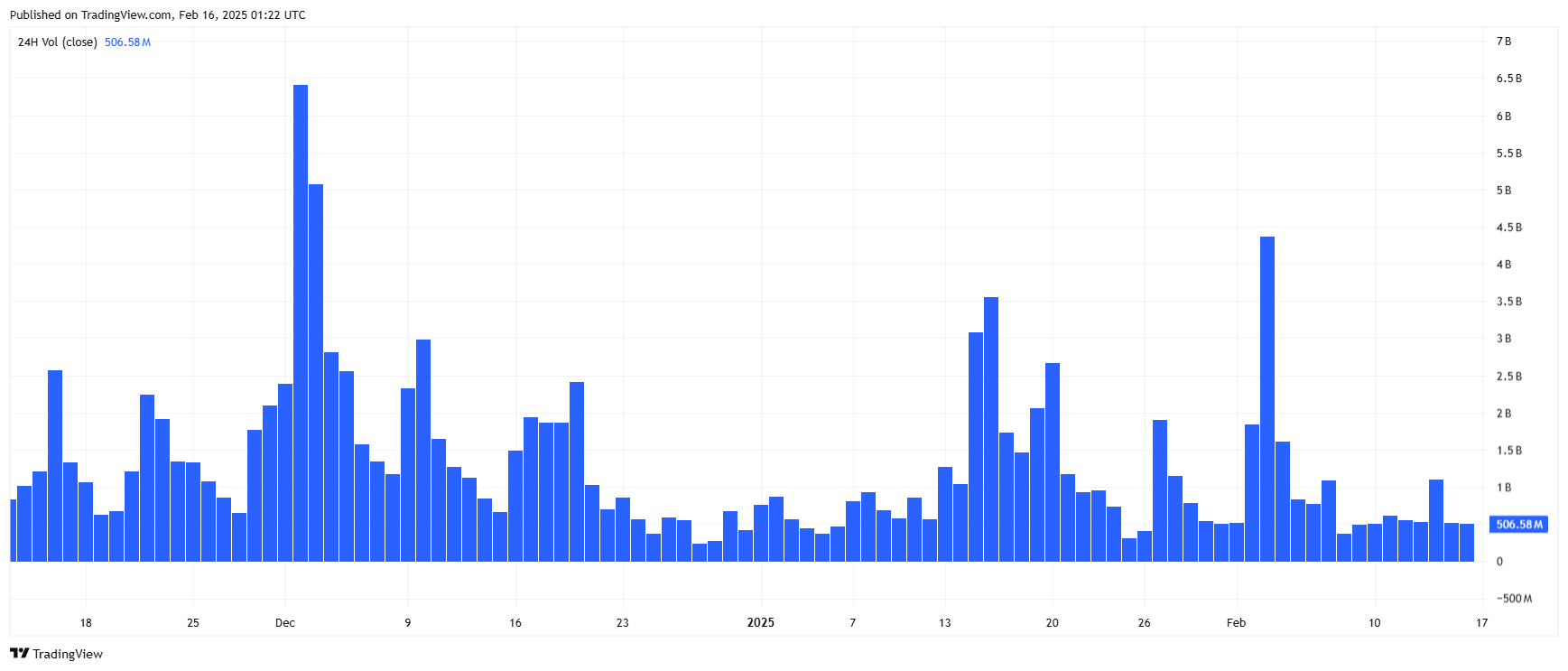

The 24-hour trading volume is $3.95 billion USD, indicating strong liquidity and investor interest. The circulating supply is 57.81 billion XRP, out of a total supply of 99.99 billion XRP, meaning a large portion of the supply is already in circulation.

From a technical perspective, XRP has been trading within a 24-hour range of $2.72 to $2.82 USD. The key support levels to watch are $2.60 and $2.50 USD, where buyers might step in to prevent further downside.

On the upside, resistance is found at $2.85 and $3.00 USD. If XRP successfully breaks above the $3.00 level, it could aim to retest its all-time high of $3.40 USD, recorded on January 7, 2018.

The post XRPL Community Debates Custodial Risks as DeFi Infrastructure Expands appeared first on ETHNews.