5 ways the new National Payment Stack would improve Nigeria’s payment solutions

PALM

PALM

BANK

BANK

READ

READ

WOULD

WOULD

At exactly 11:56 a.m. on Friday, November 7th, 2025, a significant chapter in Nigeria’s financial history began with the completion of the first live transaction on the National Payment Stack (NPS). This transaction, involving a transfer between PalmPay and Wema Bank, was processed in milliseconds with instant settlement – a major milestone for the Nigeria Inter-Bank Settlement System (NIBSS).

The National Payment Stack (NPS) is a secure, unified digital platform developed by NIBSS to simplify, accelerate, and democratise payments across Nigeria and beyond. It brings together financial institutions, fintechs, telcos, government MDAs, and consumers into a single ecosystem.

According to NIBSS, the NPS is built on the ISO 20022 global messaging standard. This aligns Nigeria’s financial system with international best practices and complies with the CBN’s directive mandating ISO 20022 by October 31, 2025, ensuring global compatibility and richer transaction data. This strategic shift fundamentally solves long-standing friction points in the Nigerian digital banking landscape.

However, the launch of the NPS is set to trigger a deep digital payment transformation across the entire Nigerian financial ecosystem. Here are five major ways this new infrastructure will impact payment solutions and the broader economy.

Read also: NIBSS completes first live transaction on National Payment Stack system

1. Deepen financial inclusion for all Nigerians

The NPS is designed to deepen financial inclusion by connecting the millions of unbanked and underbanked Nigerians. Its multi-rail architecture changes the payment environment by allowing direct connectivity and integration for mobile money operators and other payment service providers, not just banks.

This means that people in remote areas, or those relying solely on mobile money wallets, will enjoy the same speed, reliability, and interoperability as traditional bank customers. The NPS aims to ensure that the benefits of instant money transfers and access to other financial products reach every part of the country.

2. Improve Government tax collection and revenue tracking

The data capabilities of the NPS, built on the ISO 20022 standard, will improve social benefit disbursement, tax collection, and revenue tracking for government agencies (MDAs). Unlike the older system, NPS allows for richer transaction data, including purpose and unique references. This capability is vital for government efficiency and transparency.

As communicated by Taiwo Oyedele, the chairman of the Presidential Fiscal Policy and Tax Reform Committee, concerning the new tax laws taking effect in January 2026, the NPS will play a critical role. Its ability to enable real-time, transparent tracking of all government-related payments from taxes and levies to government-to-person transfers will significantly enhance the efficiency of the new tax regime.

This digital infrastructure supports the government’s push for a simpler and more effective tax administration by making it harder to hide income and easier to automate compliance.

3. Enable an Open Banking System for modern fintech integration

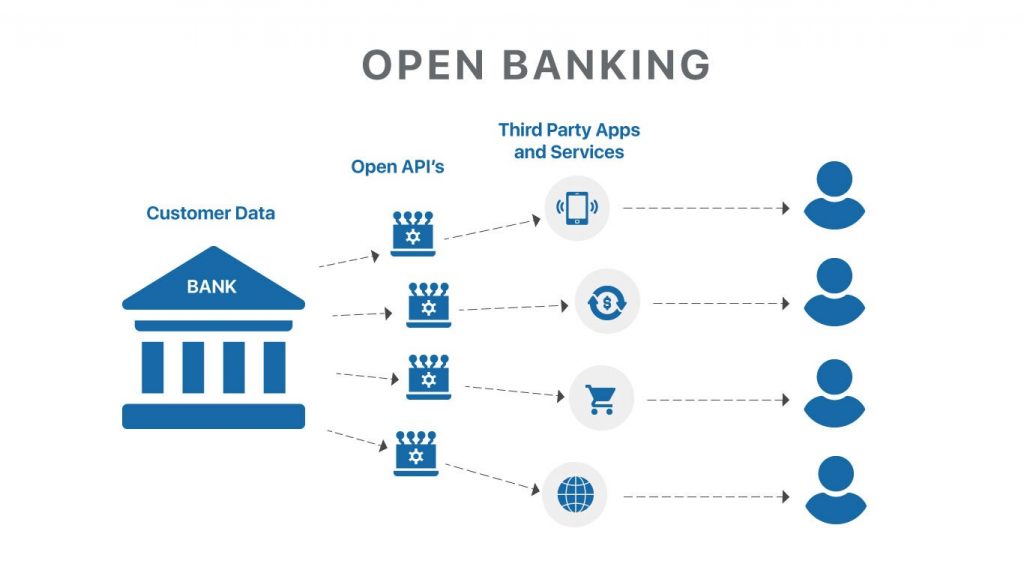

The NPS is APIs and Open Banking ready, supporting modern fintech integration. The CBN has been a driver in establishing a regulatory framework for Open Banking in Nigeria, an initiative which will accelerate the financial ecosystem by removing technical frictions and innovation.

This means the new NPS provides the standardised, secure channels that Open Banking relies on. This direct access lowers barriers to entry, fosters competition, and allows innovators to leverage APIs to build new, customer-centric services.

Read also: How CBN’s Open Banking system will impact Nigerian fintechs: All you need to know

4. Ensure secure, real-time payment with cross-border capability

The platform is designed to enable secure, real-time payments with built-in fraud detection mechanisms like Smart Risk Scoring and non-stop monitoring. Beyond domestic security, the NPS also supports both domestic and cross-border transactions, a crucial feature for Nigeria’s global presence.

For Nigerians in the diaspora, this means remittances and payments back home will be faster, safer, and potentially more cost-effective. By enabling multi-currency transactions on a single rail and built for cross-border compatibility, the NPS strengthens Nigeria’s position in the regional and global financial landscape.

5. Integrating digital identity for safe online participation and verification

A key feature of the NPS is its integrated digital identity capability, which enables safe and verified online participation. This means the system supports robust Know-Your-Customer (KYC) checks for individuals, primarily using the Bank Verification Number (BVN) system.

The integration of digital identity ensures that every participant in the payment ecosystem is uniquely identified and verified, significantly boosting trust and reducing fraudulent activities.

Read also: FG integrates NIN into INEC voter registration for identity verification