7 million Africans have built $2B credit with M-KOPA in 15 years- report

INSURANCE

INSURANCE

MIRROR

MIRROR

WOULD

WOULD

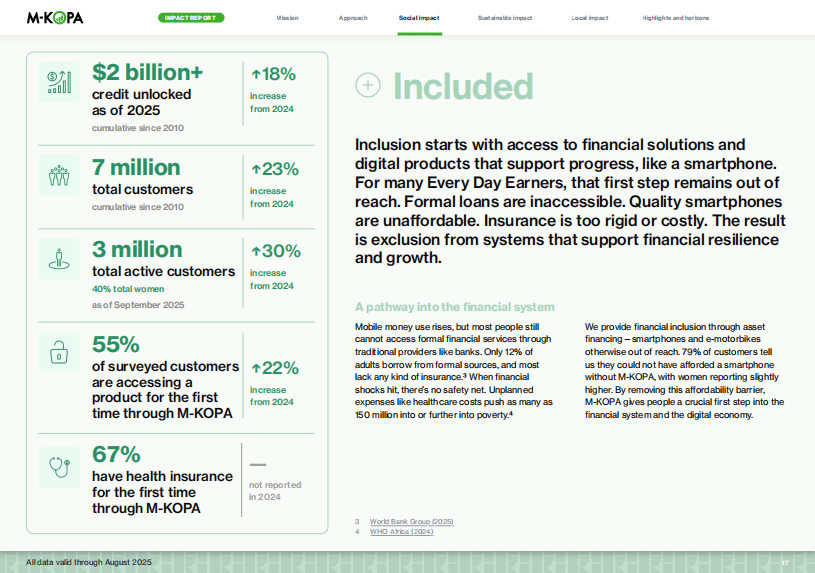

M-KOPA, a pan-African fintech, has now served over 7 million customers across five markets, unlocking more than $2 billion in credit since its founding in 2010, according to a report by the company.

What began 15 years ago with the sale of pay-as-you-go solar kits in Kenya has morphed into a fintech engine delivering affordable smartphones, loans, insurance, and even electric motorbikes to “Every Day Earners”, including the small traders, drivers, teachers, and artisans who keep Africa’s informal economy alive.

For many, the journey begins with something most in the West take for granted: a smartphone. In sub-Saharan Africa, 77% of adults don’t own one, and affordability remains the biggest barrier. An entry-level device can cost 99% of a low-income earner’s monthly income, according to GSMA.

M-KOPA’s financing model changes that. With a small deposit and flexible daily repayments, customers can walk away with a device they would otherwise never afford.

In 2025 alone, 1.3 million smartphones were sold, bringing the cumulative total to 6.4 million since 2020. Remarkably, 42% of these buyers were first-time smartphone owners. That translates to 2.5 million people accessing the internet and digital economy for the first time through M-KOPA.

For Lydia, a food kiosk owner in Kenya, that first step was transformative. Before M-KOPA, she earned about $5 a day selling porridge and relied on a $25 feature phone. Today, she owns a smartphone that connects her to customers and opens doors to data bundles, digital loans, and health insurance.

These tools helped her expand her small venture into a thriving kiosk, tripling her daily income and employing others in her community.

The real innovation lies not just in distributing phones, but in embedding them with financial services. M-KOPA’s model has turned a gadget into a platform for building credit histories and accessing services traditionally reserved for the formal economy.

- 38% of customers reported that their M-KOPA loan was their first-ever formal loan (43% for women).

- 67% said their M-KOPA health insurance was their first insurance policy.

- 55% of customers are accessing a product for the first time via M-KOPA.

These numbers are striking in a region where 88% of adults have never borrowed from a formal institution and 88% remain uninsured. For women, the barriers are even deeper.

The report shows that 81% of women could not afford a smartphone without M-KOPA, compared to 78% of men. Women now make up 40% of active customers and 45% of sales agents.

Take Suliyat, a rice seller in Nigeria. She had tried to save for a phone but could never quite reach the upfront cost. When she discovered she could pay just a $26 deposit for an M-KOPA device, she seized the opportunity. With the money she had saved, she reinvested in her rice business.

Her husband later applied for a digital loan, and she followed suit, using the extra funds to pay school fees and household expenses. Today, she uses her phone to market food on TikTok and coordinate sales staff. “My customers take me more seriously now,” she says.

M-KOPA’s impact on 4K customers

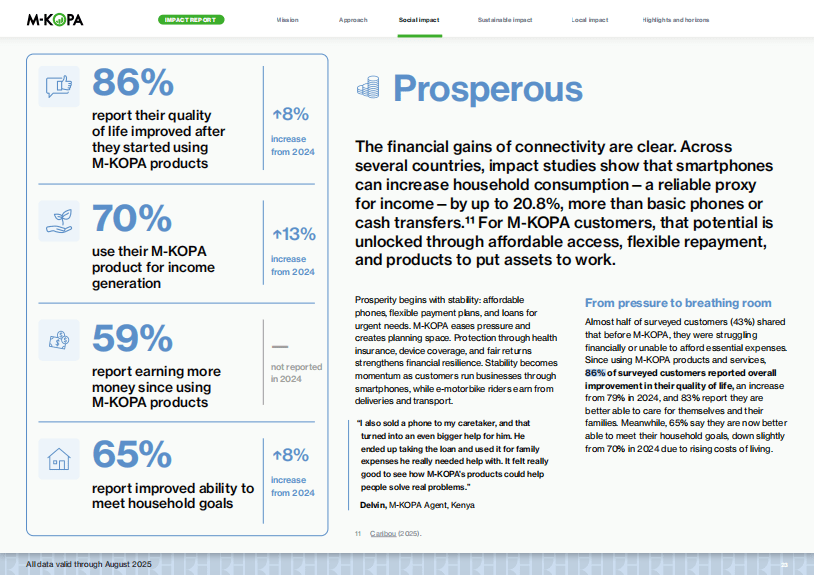

Beyond access, the impact is measurable. The 2025 survey of over 4,000 customers across five markets paints a clear picture:

- 86% say M-KOPA improved their quality of life (up from 79% in 2024).

- 70% use their product for income generation (up from 62% in 2024).

- 59% report they are now earning more.

- 65% say they are better able to meet household goals.

For many, that shift from struggling to stability is profound. Nearly half of customers said they were financially struggling before M-KOPA. Now, more than four in five report being better able to care for themselves and their families.

Behind these milestones are the people who power the network. M-KOPA works with 35,000 sales agents, many under 35 and often taking their first step into employment. For customers, these agents are the first point of contact with the financial system. For the agents themselves, M-KOPA has become a livelihood: 92% reported their income increased since joining.

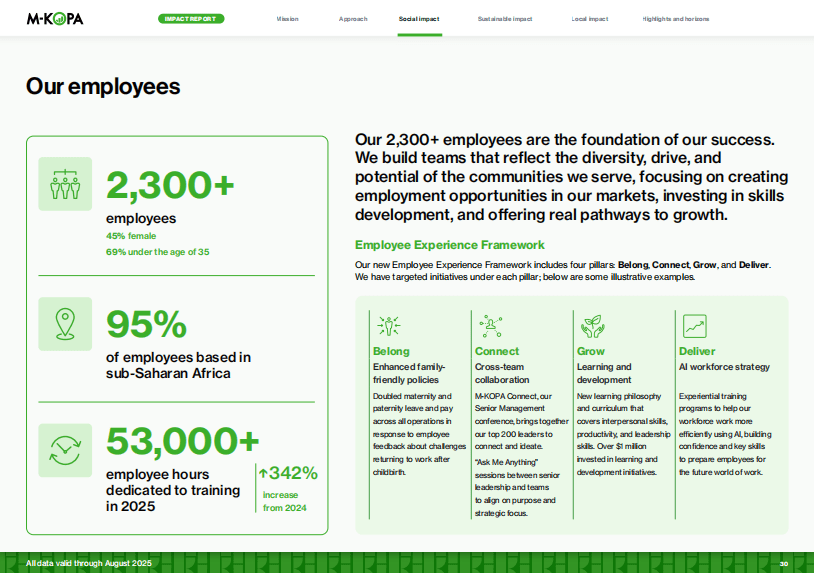

The company also employs 2,300 staff, nearly half of them women, with 53,000 hours of training delivered in 2025 alone. Its smartphone assembly plant in Nairobi has produced 2 million devices since 2023, adding jobs and cutting costs.

From device to dignity

At its core, M-KOPA is not just about selling phones or bikes. It is about rewriting what access looks like for the 62% of sub-Saharan Africans under 35, most of whom work informally, earn less than $5.50 a day, and have no payslips, collateral, or formal credit history.

M-KOPA has managed to turn exclusion into opportunity by designing financial products that mirror how people earn – flexible, daily, and without penalties. For some, that means paying school fees on time. For others, it means scaling a small business. For millions, it simply means the dignity of being connected.

As one customer put it in the report: “The unifying voice you hear is that paying for a phone daily improves life, brings progress, and opens a world you probably would not have experienced.”