African startups raised $162m in November, as funding slows to a halt in 2025

SXCH

SXCH

WORLD

WORLD

WHEN

WHEN

EVO

EVO

FORM

FORM

As the year slowly grinds to an end, venture funding into Africa has slowed down, as tech startups on the continent raised $162 million in November 2025. This is according to data from the African startup venture funding analytics company, Africa the Big Deal.

The $162 million, while not the smallest monthly raise of 2025, represents a 63.3 per cent decline from October 2025, when African startups raised $442 million. It also represents a 32.2 per cent decrease from the $252 million raised in October 2024, and a 39.2 per cent drop from the $267 million raised in November 2023.

This signals that in a period usually characterised by increased funding, the same period appears to be witnessing a decline this year.

Interestingly, 79 per cent of the total raised, about $128 million, came in the form of equity, while the rest came in the form of debt. Recall that of the $442 million raised in the previous month, $334 million, representing 76 per cent, came in the form of equity.

Before that, of the $140 million raised in September, $105 million, representing 75 per cent, came in the form of equity. This consistency in equity funding generally indicates a return of investor confidence in the space.

See also: Spiro and Moniepoint lead as African startups raised $442m in October

South African startups lead

A total of 32 startups that raised $100,000 or more were responsible for November’s tally. This is also a decline from October, when 53 startups raised $100,000 or more.

Of these 32 startups, 16 raised $1 million or more, while only six raised $10 million or more. Four of these are South African-based companies, making it the best-performing country of the month.

South African solar electricity company, SolarSaver, leads the pack, having raised $60 million in equity funding led by Inspired Evolution’s Evolution III Fund and supported by Dutch development bank FMO and Swedfund.

The company, which builds, owns, and operates rooftop and on-site energy systems, supplies electricity to clients through power-purchase and rent-to-own contracts. With the new funding, it intends to scale its small-scale solar and battery systems for businesses across Southern Africa, including its core markets of South Africa, Namibia, Botswana, and Zambia.

nextProtein, a Tunisian insect-based agritech startup, is next, having raised $21 million in a series B funding round.

The round was co-led by Swen Capital’s Blue Ocean Fund and British International Investment, with participation from existing investors like Mirova, RAISE Impact, Societe Generale, CIC Paris Innovation, and Banque Des Start-up by LCL.

nextProtein produces protein powders for livestock and fish, as well as fertilisers for plants. The new investment will enable the startup to significantly scale its operations, including the opening of its second state-of-the-art production facility in Tunisia and expand its production capacity.

Following is SolarX, a West Africa-focused solar energy startup which raised €15 million in November. SolarX provides energy solutions to clients in agro-processing, packaging, telecommunications, hospitality, cosmetics and other industries, reducing their energy costs and dependence on fossil fuels.

The round was led by AFRIGREEN Debt Impact Fund, and supported by E3 Capital, FMO, Proparco and Triple Jump. The facility, which includes a short-term tranche and a long-term tranche, will enable refinancing of existing assets as well as investments in new power plants in Côte d’Ivoire, Senegal, Mali and Burkina Faso.

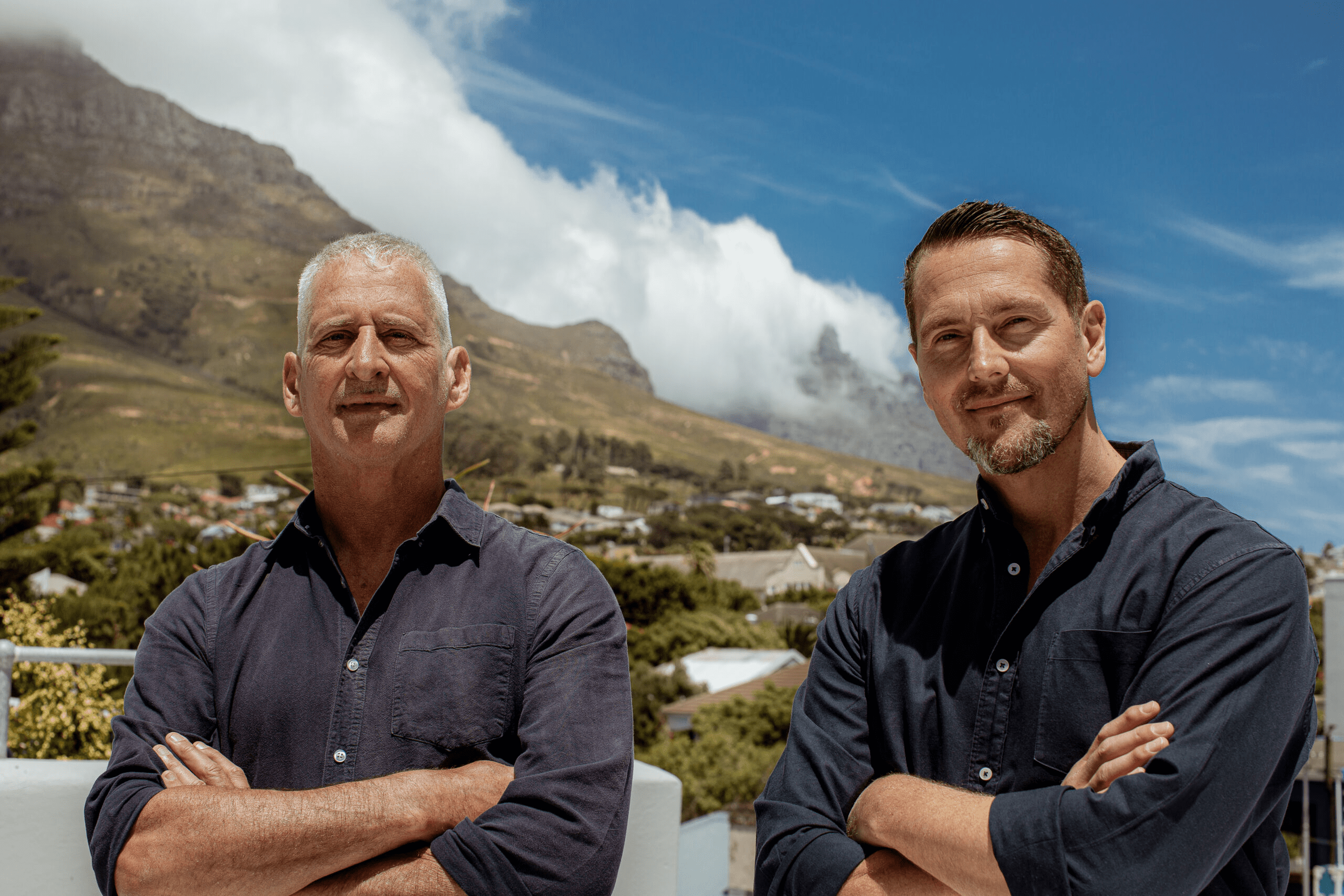

South African fintech, Omnisient, is the first of only two fintechs in the top 6, having raised $12.5 million in a Series A round in the month under review. Omnisient is an AI-powered data collaboration platform that helps banks and insurers draw new consumer insights from alternative data.

The round, co-led by TransUnion, will accelerate the company’s global expansion, including the U.S., where demand is surging for privacy-safe alternative data to score and onboard credit-invisible and thin-file consumers.

Lula, the other fintech in the lineup, is also based in South Africa and raised $10 million in November. The round was powered by the International Finance Corporation (IFC), a member of the World Bank Group.

With the new funding, the digital lending company will help unlock working capital for thousands of micro-, small- and medium-sized enterprises (MSMEs) in South Africa, with at least 80 per cent of the funding going to micro and small businesses which power the South African economy.

Finally on the list is SwiftVEE, a South African agric technology company that raised $10 million in a Series A round. The round was led by Cape Town-based VC, HAVAIC, and Exeo Capital, with support from Zire Africa and other angel investors.