Another crypto casualty: Bunni DEX shuts down days after Kadena collapse

FBTC

FBTC

KDA

KDA

DEX

DEX

WOULD

WOULD

BUNNI

BUNNI

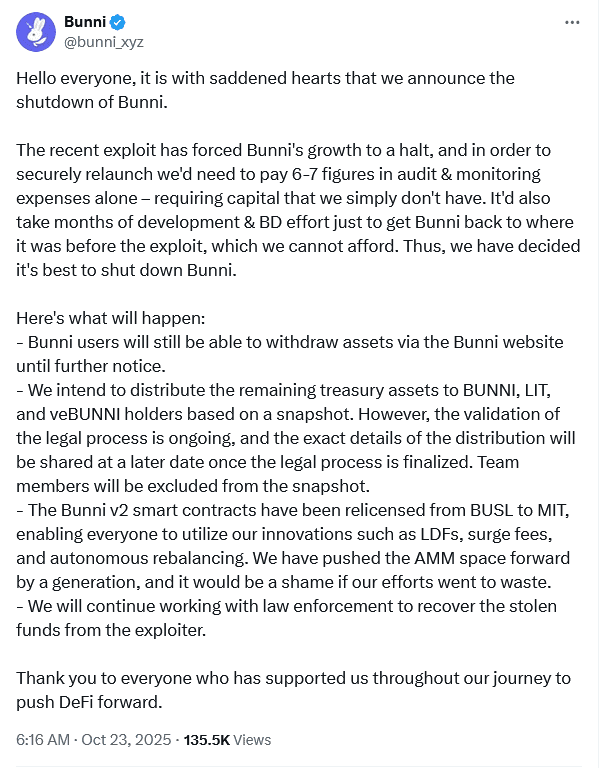

Just days after layer-1 blockchain Kadena announced it was winding down operations, decentralised exchange Bunni has become the latest casualty in the crypto winter. The DeFi platform confirmed that it is shutting down after suffering an $8.4 million exploit in September, an incident that wiped out its liquidity and left the team unable to continue.

The Bunni team revealed in a post on X on Thursday that the decision to close operations was based on one key factor: a lack of funds. The exploit not only drained the protocol’s liquidity pools but also eroded user confidence, leaving the team unable to sustain further development or pay for new security audits.

“We simply no longer have the financial capacity to rebuild, re-audit, and re-establish Bunni as a secure trading environment,” the developers said.

The announcement comes as the latest blow to the decentralised finance (DeFi) sector, which continues to reel from hacks, liquidity crunches, and dwindling investor confidence.

Inside the $8.4 million exploit

Bunni, built on Uniswap v4 hooks, gained early attention for its innovative approach to liquidity management and tokenised pool positions. But those same innovations may have opened the door to its downfall.

In early September, an attacker discovered a subtle rounding-error vulnerability within Bunni’s custom Liquidity Distribution Function (LDF). Exploiting this flaw, the hacker used flash loans and micro-withdrawals to trick the protocol into approving unauthorised fund withdrawals. Two pools, weETH/ETH on Unichain and USDC/USDT on Ethereum, were drained.

Bunni’s Total Value Locked (TVL) collapsed almost overnight, plummeting from tens of millions of dollars to nearly zero. The team offered a 10% white-hat bounty to the attacker in exchange for the safe return of funds. But like many DeFi exploits before it, that offer was ignored. The stolen assets were laundered through Tornado Cash, a privacy-focused Ethereum-based mixer known for its use in high-profile hacks.

The attack crippled the protocol’s ability to operate. Within days, liquidity providers had fled, token prices sank, and user trust evaporated.

No funds to relaunch

In its shutdown announcement, Bunni said that relaunching the exchange would require a complete security overhaul, including new smart contract audits, liquidity restoration, and a brand rebuild. The projected cost, the team noted, was “well into the six- to seven-figure range”, an expense the project could not sustain after the exploit.

The team also cited the erosion of user and investor confidence as another major challenge. After the attack, trading activity fell sharply, and liquidity providers began withdrawing what remained in the pools. Without capital or trust, Bunni faced a dead end.

Still, the team says it intends to handle the wind-down responsibly. Users will retain access to withdraw remaining assets, and a snapshot of token holders, including BUNNI, LIT, and veBUNNI, will be used to distribute any remaining treasury funds. Notably, team members will be excluded from the compensation.

In one final gesture, Bunni’s developers relicensed the project’s code under the MIT license, making its core smart contracts open source. This means developers in the broader ecosystem can freely use or modify Bunni’s technology, such as its liquidity management tools and rebalancing mechanisms, potentially giving Bunni’s ideas a second life in the wider DeFi ecosystem.

Another blow: Kadena’s shutdown

The shutdown comes just days after Kadena, once hailed as a scalable and enterprise-ready layer-1 blockchain, announced it would cease all business operations. Kadena’s leadership said the move was driven by financial strain and an inability to sustain the network’s infrastructure.

However, Kadena’s blockchain will continue to run in a limited capacity, powered by independent miners and community members. In contrast, Bunni’s closure represents a complete halt. Once its smart contracts are retired, the platform’s trading and liquidity functions will cease entirely.

These back-to-back collapses have amplified anxiety in the crypto ecosystem. They signal a new phase of contraction in the DeFi sector, where technical innovation alone is no longer enough to keep projects alive.

What Bunni’s fall says about DeFi

Bunni’s story is becoming increasingly familiar in the DeFi space. Even with audits and careful design, complex smart contracts remain vulnerable to hidden logic errors.

The exploit highlighted a deeper issue in DeFi: many projects operate with minimal reserves, relying on user liquidity and token valuations. When disaster strikes, be it a hack or a market crash, there’s little financial cushion to fall back on.

Read also: Tinubu’s crypto literacy push: Nigeria needs policy clarity before judicial training – Expert

Security analysts say Bunni’s case should serve as a warning. While the industry celebrates innovation, the push to launch quickly and integrate experimental features often outpaces the security measures meant to protect users.

Rebuilding trust is another uphill battle. Once a DeFi project suffers a major breach, it faces not just financial loss but reputational damage. In Bunni’s case, even a technically sound relaunch might not have restored user confidence.

The dual collapse of Kadena and Bunni in a single week underscores the fragility of today’s crypto ecosystem. It also raises uncomfortable questions about sustainability in decentralised projects that often depend on centralised teams, treasury funds, and user faith.

Bunni’s decision to open-source its code offers a silver lining. Its technology could live on through other projects, and its closure might prompt more careful engineering across the sector. But the broader takeaway is sobering: as the DeFi market matures, only projects with robust security, sustainable funding, and transparent governance are likely to survive.

The crypto industry may thrive on bold ideas, but as Bunni’s demise shows, innovation without endurance is not enough.