CBN’s Open Banking system hasn’t launched yet, here is why

BANK

BANK

CHAI

CHAI

MSHOT

MSHOT

APRIL

APRIL

READ

READ

The highly anticipated official launch of Open Banking in Nigeria has been indefinitely delayed, pushing back the expected roll-out date from August 2025. This postponement was confirmed by Chai Gang, Deputy Director for Payments Systems Policy at the Central Bank of Nigeria (CBN), during a panel discussion at Moonshot by TechCabal.

According to Chai, the regulatory framework is in place, but the system is not yet live. Rather than hasty implementation, the CBN has spent the past few months establishing a robust governance structure and instituting a diverse stakeholder working group.

This is a critical step that aims to ensure the security, stability, and broad acceptance of Open Banking across the entire financial ecosystem before it can transform how Nigerians access financial services.

“Open banking, from a CBN perspective, with the regulations and implementation, hasn’t gone live yet. But what we’ve been able to do over the past few months is put together a governance structure around its operations, and then also instituted a diverse stakeholder working group, which is looking at creating something that you’ve never lost. There are certain proportions and certain approaches that have been put in place,” Mr. Chai said.

Chai explained that the ongoing work is focused on establishing oversight and traceability. He noted that this effort directly addresses security and transparency concerns by allowing the CBN to trace who has access to customer information.

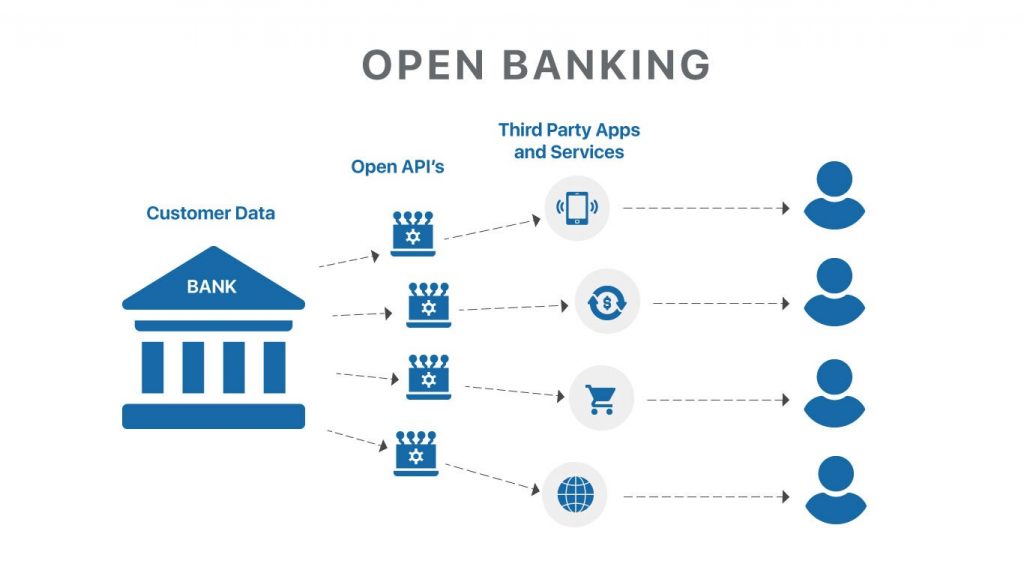

Furthermore, he highlighted that the working groups are actively developing a standardized enabling environment, which includes creating unified API standards. The goal is to build a single Application Programming Interface (API) template that all financial institutions will use.

This approach, he stressed, will make integration across different institutions easier and more seamless, effectively preventing a fragmented system where each institution uses its own unique API template.

“We have working groups who are working towards building that enabling environment for API standards as well. We are building a template where we will have a standardised template for the APIs, which will make integration easier instead of having different API templates in different institutions,” Chai said.

Read also: New CBN ATM Operations guidelines: Here are 10 key rules that you must know

CBN’s Open Banking trajectory

On April 29th, 2025, the Central Bank of Nigeria (CBN) announced that it will officially launch the open banking system in August 2025. This positioned Nigeria as the first African country to adopt this transformative financial framework.

However, the initial nationwide go-live date of August 1, 2025, did not materialise, but the financial industry remains optimistic. Industry leaders view the CBN’s cautious approach as a reflection of its core priorities of guaranteeing a safe system launch, protecting consumers, and maintaining industry stability.

According to the CBN, the journey over the past year has involved significant foundational work that now serves as the building blocks for Nigeria’s Open Banking framework. To secure this base, the CBN commissioned five dedicated implementation workstreams led by key financial industry members.

These streams focused on critical areas such as Governance & Regulation, Legal & Compliance, Technical & Infrastructure, Data Security, and Stakeholder Engagement.

“Each workstream has successfully produced essential documents and comprehensive frameworks designed to guide key operational functions, including data sharing, consent management protocols, and the technical onboarding process for participants,” the CBN said.

As of September 2025, these crucial deliverables have been completed and are currently under final review by the CBN. While the regulator has not set a new definitive date, the industry anticipates the next directive will lead to a phased go-live in early 2026.

This controlled phased launch is expected to translate the detailed groundwork from the workstreams into a functional reality, marking the critical transition from policy formation to full operational status.

Read also: 5 big changes PoS operators must know about CBN’s new agency banking rules