Complete step-by-step guide to applying for student loan on NELFUND portal

BANK

BANK

WHEN

WHEN

APRIL

APRIL

SPD

SPD

NOTE

NOTE

The Nigerian Education Loan Fund (NELFUND) has opened the student loan application portal for the 2025/2026 academic session. The process, scheduled to run from October 23, 2025, to January 31, 2026, marks the second session since the scheme was unveiled last year.

Director of Strategic Communications at NELFUND, Oseyemi Oluwatuyi, noted that institutions were reminded to update and upload verified records of both returning and newly admitted students on the NELFUND Student Verification Portal. This step is essential for students to successfully apply and benefit from the scheme.

Launched in April 2024, NELFUND marks a pivotal step towards ensuring sustainable higher education and functional skill development for Nigerian students.

According to information from the board, 282 institutions and over 850,000 students have successfully onboarded on the platform to date. The scheme has also recorded more than 795,000 successful student loan applications.

As of 26 September 2025, over N107 billion has been disbursed across 231 institutions, with N61 billion as institution fees and N46 billion as allowance.

This article will walk you through what you should know before applying and how to apply for a student loan yourself on the NELFUND portal.

Before you start applying

The student loan is open to Nigerians studying at any public tertiary institution in Nigeria. The loan is interest-free and includes monthly stipends for upkeep, which you can choose to opt into or opt out of.

Stipend is N20,000 per month and is only paid when your school’s academic session is active. This means that there will be no stipend during holidays.

There’s no need for any physical registration as all applications will be made online. While the tuition fee is paid directly to the institution, the monthly stipends are remitted directly to students’ provided bank account.

Documents needed

- JAMB registration number and admission letter

- National Identification Number (NIN)

- Bank Verification Number (BVN)

- A commercial bank account

Also Read: Funds recovered from cybercriminals used to finance student loans and other schemes – Shettima.

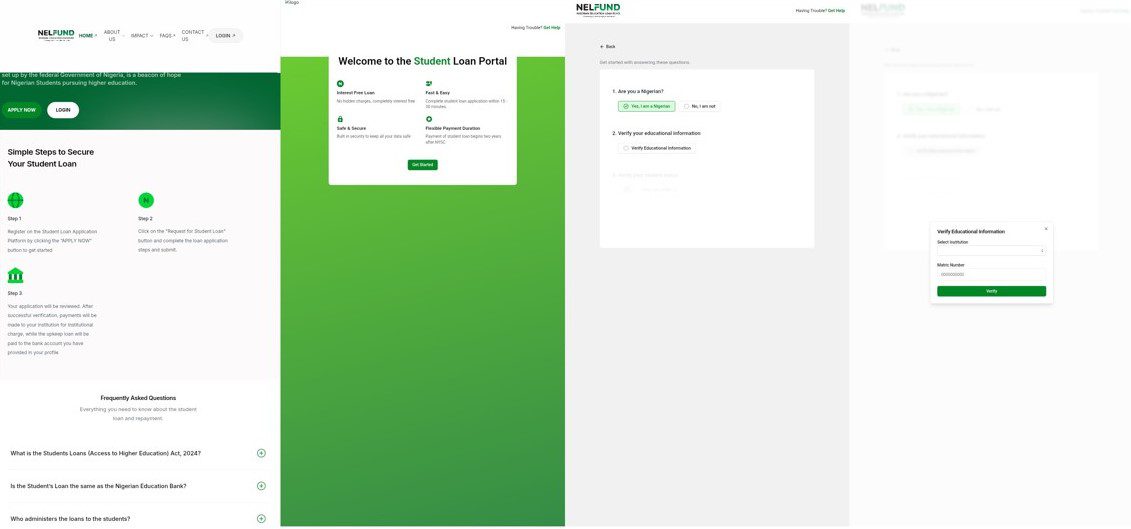

How to onboard on the NELFUND portal

To apply for a student loan, you must be onboarded on the platform. To onboard, you’ll need to pass the verification stage. The stage is to ensure you are a Nigerian, a student and if you qualify for the loan.

Step 1: Visit the official NELFUND website and click on “Apply Now”, then “Get Started”.

Step 2: Provide the verification details, such as the institution name and matric number, to confirm whether your institution has uploaded your details to the portal.

All public institutions are expected to upload students’ data on the NELFUND portal. If your record is not on the portal, contact the appropriate authority in your school.

Step 3: Authenticate with JAMB by clicking on “Verify with JAMB” and inputting your JAMB details as prompted. If your National Identification Number (NIN) isn’t registered with JAMB, provide your NIN for validation.

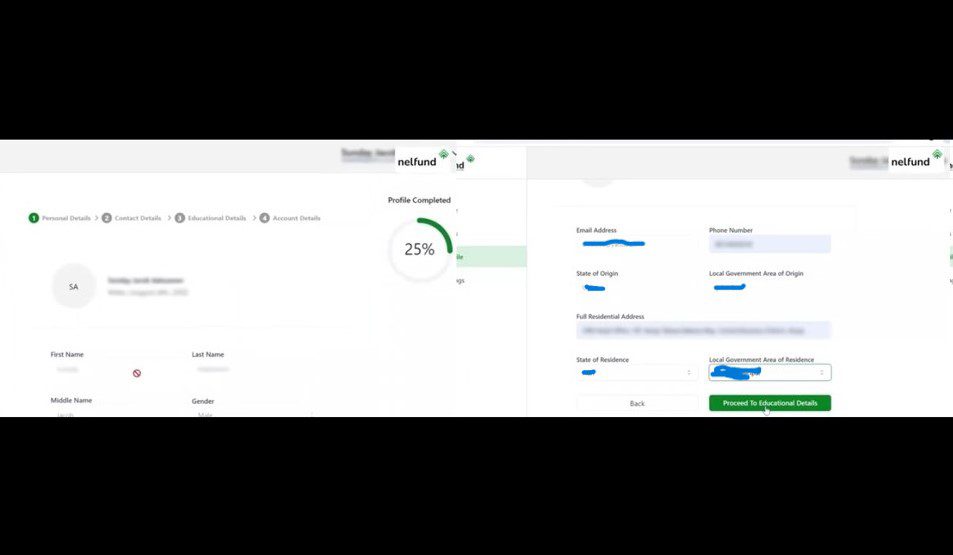

Step 4: Input your email address and set a secure password. Confirm your password and click “Create Account.”

Check your email for a link from NELFUND to verify your email. Click the link to activate your account.

Step 5: Once you’ve verified your email, update your contact details. Provide your current phone number, full residential address, state, and local government area of residence.

Click “Proceed to Educational Details.”

Step 7: Select your higher institution from the list. Enter your matriculation number accurately.

Click “Proceed to Account Details.”

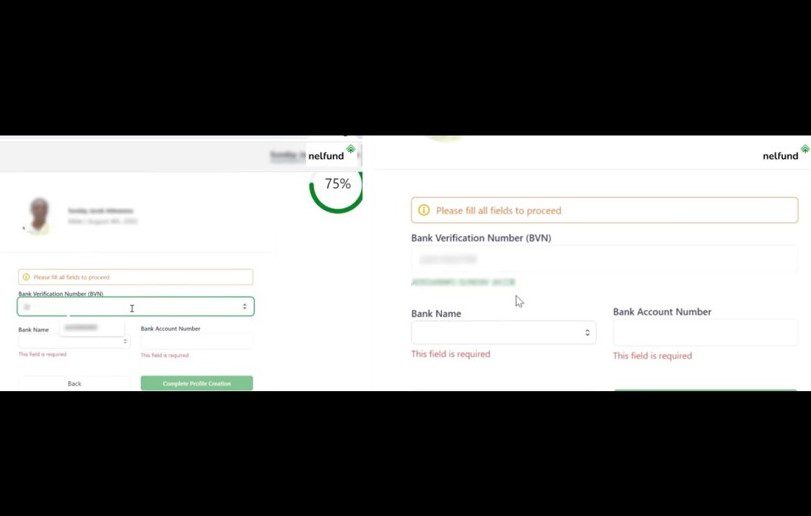

Step 8: Enter your Bank Verification Number (BVN). Select your bank from the dropdown menu and input your account number. Click “Save Changes” to complete your profile set-up.

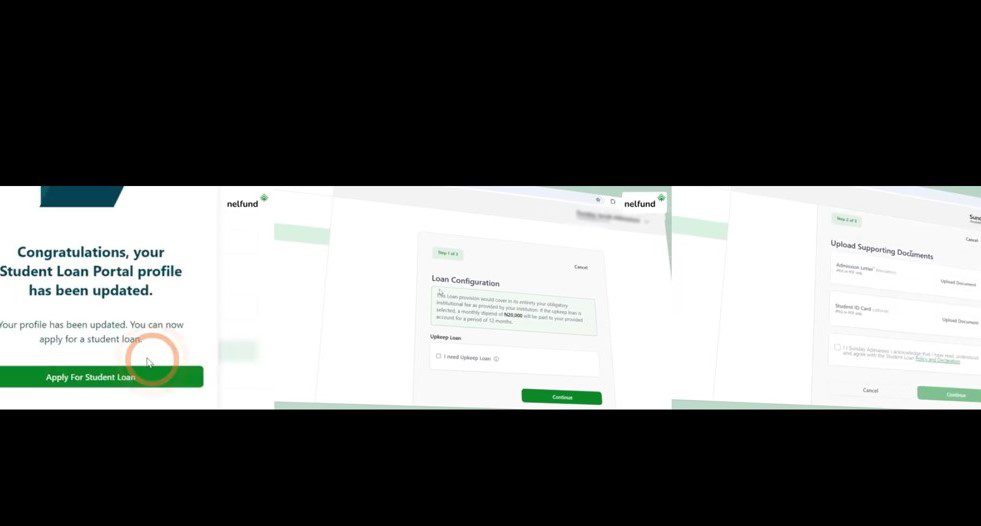

Applying for a student loan

After verification and setting up your profile, you can now apply for a loan.

Step 1: Apply for the student loan by clicking on the “Request for Student Loan” button located at the top right corner after logging in.

Step 2: Here’s where you specify your student loan requirements. If you require funds for personal upkeep, select the corresponding checkbox. If only institutional charges are needed, proceed without selecting the upkeep option. Click “Continue” to proceed.

Note that you cannot apply for upkeep without applying for a tuition fee loan. But you can apply for a tuition fee loan and decide not to apply for upkeep.

Step 3: Upload a scanned copy of your admission letter (mandatory). Optionally, you can upload your student ID and the institution’s invoice (a copy of your tuition fee from your student dashboard).

Acknowledge the policy and declaration by checking the appropriate box. Click “Continue.”

Step 4: Carefully read through the student loan overview. Agree to the terms and conditions and the Global Standing Instruction (GSI) Mandate by checking the respective boxes.

Then, click “Submit Application” to finalise your loan application process.

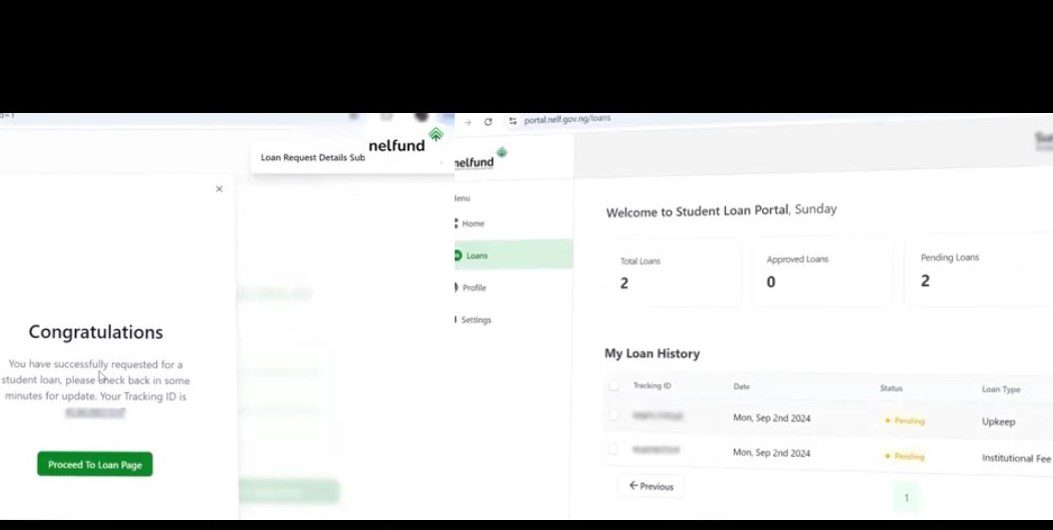

After submission, you’ll begin to monitor the status of the application on your dashboard.

To check application status, click on the “Loans” section to view the current status of your application. You will be notified if your application is successful. If your application is not approved, you can contact NELFUND through the email on their website.

Also Read: How to onboard and submit your final-year project on the NERD portal.

Why you’ll be denied access to a student loan

Applicants can be denied access to a loan if:

- Proven to have defaulted in respect of any previous loan granted by any licensed financial institution

- Found guilty of submitting fake/fraudulent documents and dismissed for exam malpractices by any school authority.

- Convicted of fraud and forgery, drug offences, cultism, felony, or any offences involving dishonesty.

Note: For existing users. If you want to be reconsidered for a loan in another session, you’ll need to log in to your dashboard and apply for the new session in line with the NELFUND’s calendar.

Repayment process

According to NELFUND, the loan is due for repayment 2 years after the completion of the NYSC.

10% of your salary will be deducted at source by the employer. Self-employed beneficiaries will be required to remit 10% of their monthly profit to the Fund.

Also, you are at liberty to seek to repay beyond the statutory 10% monthly repayment by your employers/by yourself if you are self-employed. Provided you don’t have a job by then, you will notify NELFUND by sworn court affidavit every 3 (three) months.

Meanwhile, loan forgiveness is only applicable in the event of death. The loan can also be written off for individuals with proven cases of severe or permanent disabilities.