Crypto investors lose $20 billion over Trump’s tariff war with China

ORDER

ORDER

FIRE

FIRE

BTC

BTC

WHEN

WHEN

HYPE

HYPE

Last Friday will go down as one of the darkest days in crypto history. Within hours, Bitcoin plunged from over $125,000, a new all-time high record set earlier in the week, to around $102,000, erasing weeks of steady gains.

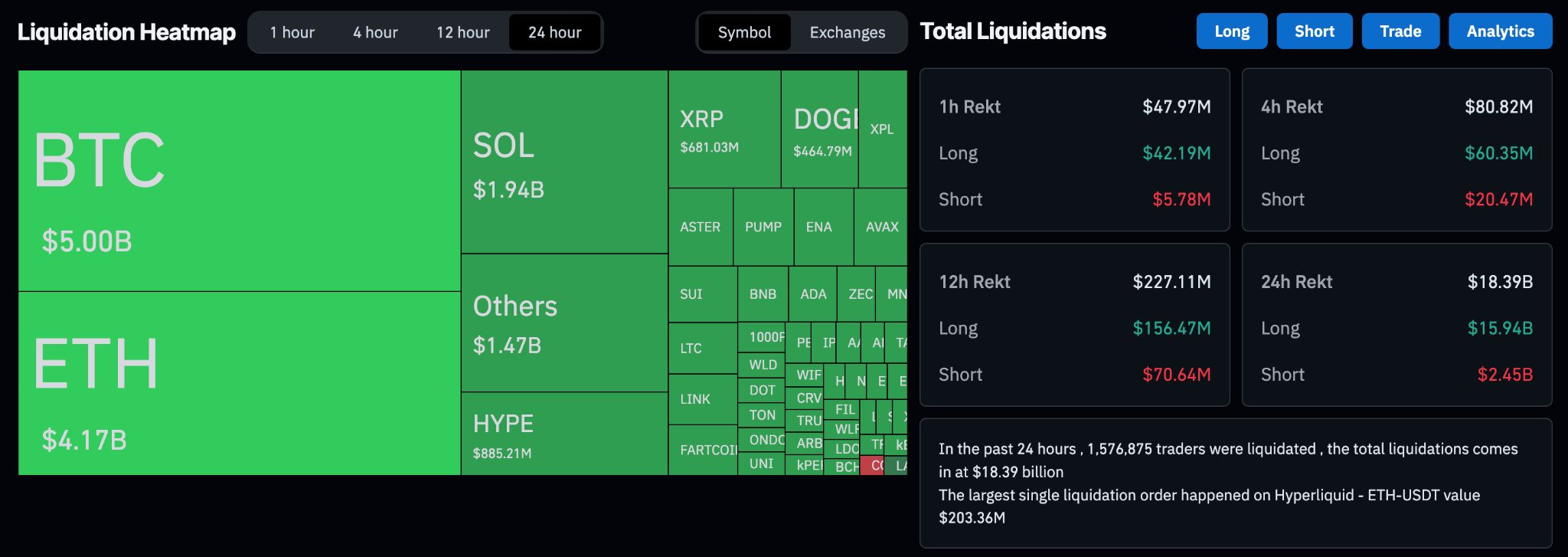

The market crash was catastrophic. Over $20 billion in leveraged positions were liquidated across global exchanges. Systems buckled under strain, liquidity vanished, and confidence was shaken to its core.

On the surface, the trigger seemed straightforward: Donald Trump’s surprise announcement of 100 per cent tariffs on Chinese tech exports. The decision reignited fears of a global trade war and sent investors fleeing from risk assets. Stocks, commodities, and crypto tumbled in tandem.

But as the dust settled, it became clear that the crash was about more than geopolitics. It was a stress test for an overheated market built on leverage, automation, and fragile infrastructure.

This wasn’t just a sell-off. It was a systemic wake-up call.

Walking you back on how the crash unfolded

Friday opened with tension. Global markets were already fragile, haunted by rising inflation, slowing growth, and hawkish monetary policy. Then came the tariff shock. Trump’s move blindsided traders and algorithms alike. Within minutes, Bitcoin slipped below key support levels around $112,000. That’s when he’ll break loose.

As prices dipped, billions in leveraged long positions started liquidating automatically. The domino effect was brutal. Data from multiple sources showed roughly $19–$20 billion in forced liquidations within 24 hours, the largest single-day wipeout in crypto’s history.

Liquidity thinned as panic spread. Order books froze, bids evaporated, and spreads widened dramatically. Binance reported temporary depegging of stable assets such as USDe from the Ethena protocol, triggering more forced liquidations from collateralised positions.

The pattern looked more like a sharp vertical crash fuelled by cascading liquidations in illiquid conditions. Traders described delays in order execution and frozen dashboards just as markets hit their lows. Some said their stop-losses failed to trigger, leaving them exposed.

By nightfall, the carnage had spread across the ecosystem. Altcoins cratered, with some losing 50–80 per cent in hours. Ethereum slid below $4,500. Solana tumbled under $150. Meme coins evaporated. The total crypto market cap shrank by over $250 billion in a single day.

Amid the chaos, long-term holders like Michael Saylor’s MicroStrategy held firm, a contrast that highlighted the gulf between conviction capital and speculative leverage.

Beyond Trump’s tariffs, the fault lines beneath

Trump’s tariff shock was the spark, but the fire had been building for months.

The first fault line was excess leverage. Throughout the third quarter, Bitcoin’s rally toward $125,000 drew a frenzy of leveraged bets. Retail and institutional traders alike piled into derivatives. Once the market turned, liquidation engines did the rest.

The second culprit was exchange fragility. Multiple platforms, including Bybit, Hyperliquid, and Binance, experienced slowdowns or halts at the height of volatility. Frustrated traders accused them of systemic failures, claiming trades couldn’t be executed or orders couldn’t be closed in time.

Crypto.com CEO Kris Marszalek has since called for a regulatory investigation into what happened. In a post on X, he urged authorities to probe whether exchanges had manipulated markets, delayed executions, or mispriced assets. He specifically named the platforms with the largest liquidation volumes:

- Hyperliquid – $10.3 billion

- Bybit – $4.65 billion

- Binance – $2.41 billion

- OKX, HTX, and Gate.io followed with smaller but significant losses.

Marszalek’s argument is simple: in a decentralised market, fairness and transparency must still apply.

The third fracture was liquidity fragmentation. As market makers pulled back during the drop, bid–ask spreads exploded. Thin liquidity amplified each downward tick. Small trades became price-moving events.

Fourth, behavioural herding magnified the panic. Algorithms tracking momentum signals joined retail traders fleeing losses. That feedback loop accelerated the crash beyond what fundamentals justified.

Finally, macro headwinds made everything worse. Rising U.S. yields, dollar strength, and global trade anxiety made investors less tolerant of risk. Crypto, the ultimate risk-on asset, bore the brunt.

The aftermath and the tentative recovery

By Saturday morning, Bitcoin began to stabilise. Buyers cautiously stepped in near $102,000, and the market has since clawed back to the $114,000-$115,000 range by Monday morning as of the time of writing this report.

Historically, October has been one of Bitcoin’s stronger months, birthing the famous “Uptober” pattern.

Some analysts noted that previous 5 per cent-plus drops in the month were often followed by seven-day rebounds of up to 20 per cent. If history repeats, the path back toward $124,000 isn’t impossible.

But sentiment remains fragile. Many traders are sitting on the sidelines, waiting for confirmation that the worst is over and that exchanges can be trusted.

Institutions are equally wary. The episode has reignited concerns over counterparty risk, particularly on offshore exchanges with limited transparency. U.S. regulators, emboldened by Marszalek’s call, may now move to demand clearer audit trails and trading safeguards.