Crypto millionaires hit a record 241,000 as Bitcoin wealth skyrockets in 2025

UTED

UTED

WORLD

WORLD

ETF

ETF

BTC

BTC

WOULD

WOULD

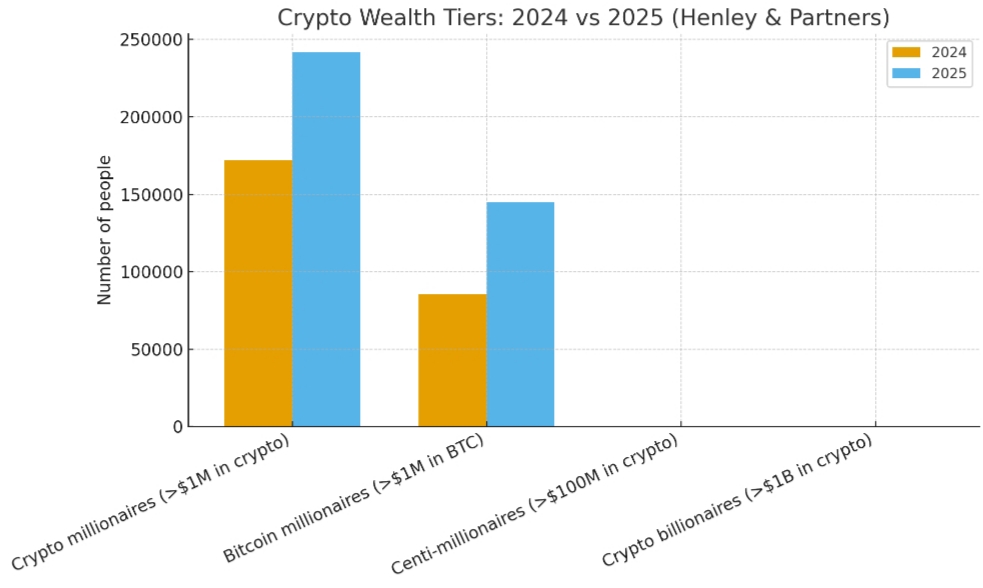

The global count of crypto millionaires surged to 241,700 by the end of June 2025. That represents a 40% year-on-year increase, driven largely by Bitcoin’s rally and a broader market valuation that topped $3.3 trillion in July, according to Henley & Partners’ Crypto Wealth Report 2025.

The gains are concentrated at the top. Henley report, which uses New World Wealth data and open-source blockchain records to map the new class of digital-asset wealth, reveals that there are 450 centi-millionaires, people holding more than $100 million in crypto, up 38% from a year earlier.

It also finds 36 crypto billionaires, a 29% rise from mid-2024. Those upper tiers are expanding fast as institutional flows and higher prices lift large, concentrated holdings.

Bitcoin is the single biggest driver. The number of Bitcoin millionaires jumped 70% year-on-year to 145,100, the report says. That surge mirrors a period of heavy inflows into spot Bitcoin exchange-traded funds and renewed institutional appetite for BTC as a macro hedge.

The market has broadened too. Henley estimates there will be about 590 million crypto users worldwide as of mid-2025. But the surge in millionaires is far steeper than the increase in users, signalling that most wealth gains are concentrated among existing holders or early adopters, rather than spread evenly across new entrants.

Banks, wealth managers, and migration advisers are taking note. Private banks are adapting services for digital-asset wealth. Residency and citizenship programmes are exploring ways to accept crypto as a source of funds. That shift is changing how the ultra-wealthy think about mobility and tax planning.

Where the new crypto wealth is clustering

Henley’s index and the Crypto Wealth Report highlight a core group of preferred destinations for crypto millionaires. Asia-Pacific and North America remain critical hubs because they host large pools of tech and institutional capital. But other jurisdictions are rising fast as digital assets-friendly policy and migration offers attract high-net-worth holders.

The report highlights jurisdictions such as Singapore, Hong Kong, the United States, Switzerland, and the UAE.

These jurisdictions score highly for a mix of public crypto adoption, institutional infrastructure, regulatory clarity, and tax and residence programme friendliness.

Other notable places attracting interest include Malta, the Cayman Islands, the Bahamas and Panama, all offering differing mixes of regulatory clarity, tax advantages and private-banking ecosystems.

Interest in “golden visas” and crypto-friendly investment migration has grown, even where actual crypto payments for such programmes remain limited by compliance hurdles. Younger crypto holders, especially Gen Z, are more likely to ask about migration options that match their borderless assets.

The result is a more mobile, digitally native wealthy class. They prize jurisdictions that combine clarity on crypto rules, low barriers to capital movement, and competitive tax regimes.

Governments are responding. Some are quietly expanding service offerings that cater specifically to crypto wealth.

The concentration of gains also raises risks. Market volatility can erase large paper gains quickly. Regulatory shocks remain a tail risk for those with big concentrated positions.

Observers say the next few quarters will be telling: either the market consolidates under clearer rules and deeper institutional custody, or it faces episodic threats from policy surprises.

Henley’s forecast for 2026

If the trends of 2024–2025 continue, Henley’s pattern suggests the number of crypto millionaires could rise further in 2026.

A simple, conservative extrapolation, assuming the market cap grows modestly and Bitcoin remains a leading store of value, points to another double-digit increase in millionaire counts next year. That would push the global tally toward the mid-300,000s if institutional ETF flows and macro conditions remain supportive.

This is not a prediction but an informed scenario based on 2024–25 growth patterns and current ETF and institutional momentum.

Key variables to monitor are ETF flows, policy clarity in the U.S. and EU, and any sudden de-risking by major institutional holders.

If regulators in major markets tighten sharply, or if macro stress squeezes risk assets broadly, gains could reverse quickly.

Conversely, continued institutional adoption, clearer custody solutions, and tax or residency incentives could accelerate wealth creation.

The Henley report frames the shift as more than price action. It sees a structural change in how wealthy individuals store and move value.