Egyptian fintech, Money Fellows now has over 8 million users and processed $1.4 billion

BANK

BANK

FOUNDER

FOUNDER

8

8

CEO

CEO

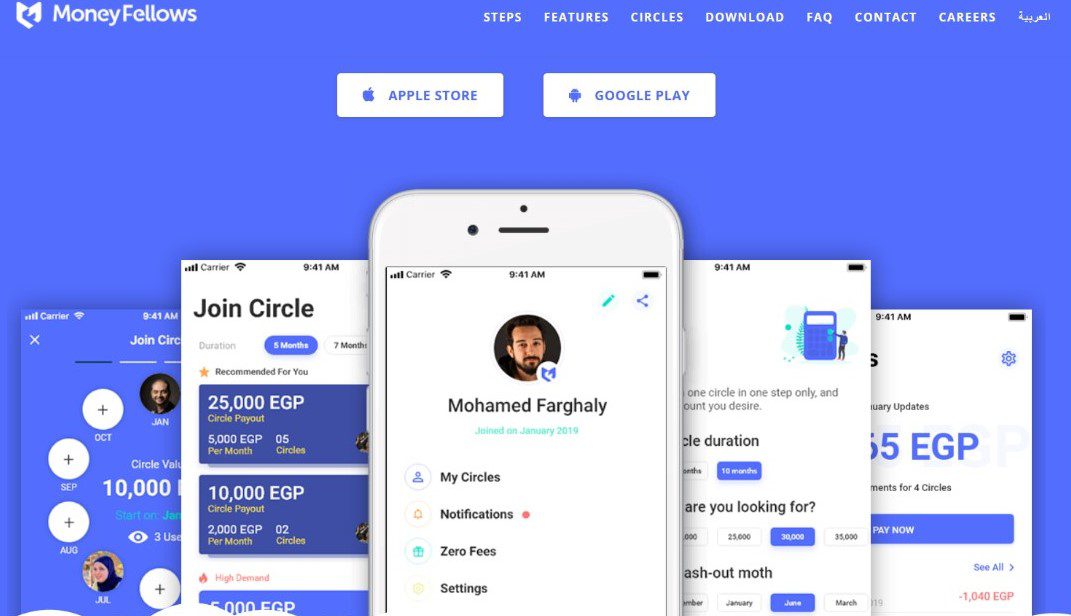

Money Fellows, Africa’s leading fintech digital platform, has announced that it has surpassed 8 million users on its platform, with total transaction value on the platform exceeding more than $1.5 billion.

In a statement seen by Technext, the Egypt-based fintech explained that the latest feat is a testament to its effort to digitalise the traditional money circle. The company is known for its unique model of onboarding rotational savings and making it safe and user-friendly for individuals.

Money Fellows has become a leading fintech company revolutionising traditional Rotating Savings and Credit Associations (RoSCA). Since it launched in 2017, the company has now onboarded more than 2 million rotating savings groups completed through its application.

Ahmed Wadi, Founder and CEO of Money Fellows, explained that the company believes technology can be a pivotal tool to empower communities and promote financial inclusion. And through this, he mentioned that Money Fellows has achieved profitability and enabled the expansion of its operations.

“Through our services, from digital savings groups to smart saving solutions and prepaid cards, we aim to provide simple, real-life solutions that help people save and access financing more flexibly and transparently,” he added.

In partnership with Banque Misr, its main banking partner, Money Fellows is the first Egyptian platform to offer an integrated experience that combines digital savings groups, smart saving solutions, and a prepaid card. And it’s processing this with its security-backed platform that ensures a safe financial experience.

Money Fellows has processed over $1.5 billion, backed by more than $60 million in funding from local and international investors. This reflects its strong market penetration and rapid growth within Egypt’s fintech ecosystem.

Founded in 2017, the startup has quickly established itself as a leader in the Fintech space. Money Fellows aims to digitise what’s commonly known as the Rotating Savings and Credit Association (RoSCA), a system where a group of people agree to contribute money for a specific period, thereby saving and borrowing together.

For instance, 10 people can come together and agree to pay $1,000 monthly for 10 months. At the end of each month, a member gets $10,000. It keeps rotating until everyone receives their payout.

Also Read: Egyptian fintech, Money Fellows raises $13M to enhance financial inclusion in Africa.

Money Fellows is driving financial inclusion with rotational savings

As the first of its kind, Money Fellows integrates rotational savings with a smart digital process. Its prepaid card facilitates deposits, withdrawals, and payments without service fees, offering additional benefits including cashback and discounts at major retailers.

In addition, the RoSCA has made the platform a key tool in driving financial inclusion and empowering users to conduct their daily financial transactions digitally with confidence and ease.

The RoSCA is also backed by the Central Bank of Egypt’s FinTech Regulatory Sandbox. In the policy, these services allow users to easily join savings circles and pay instalments. They receive payouts through multiple payment methods, including bank cards, e-wallets or via prepaid card.

According to CEO Ahmed Wadi, ROSCAs are a $700 billion opportunity globally, are quite popular in over 90 emerging and developing markets with several names: Esusu or ajo in Nigeria, Kameti or chit fund in India and Gameya in Egypt.

He added that the aim is to reimagine traditional financial systems into safe, organised digital solutions that offer a seamless experience. This helps users save and access financing to meet both short- and long-term aspirations, ultimately building a more aware and sustainable financial society.

“We continue to expand our services in line with Egypt’s national digital transformation and financial inclusion strategies. The success of Money Fellows is not just measured by numbers, but by the positive impact it creates in people’s lives, enabling millions to achieve their goals and improve their financial well-being,” he added.

The platform currently serves around 350,000 monthly active users. It has also issued over 50,000 prepaid cards and signed 328 B2B2C partnership agreements with leading companies and institutions. It also operates more than 40 distribution points across Egypt.

In May, Money Fellows raised $13 million in new funding. The round, which saw participation from Partech Africa and CommerzVentures, brings the total amount invested in the company to over $60 million since its inception.

The investment round, the company says, will enable it to enhance and upgrade its digital platform and collaborate with more than 350 local and regional partners.