Equity funding into African fintech startups declines by 88% in Q3

AI

AI

AMERICA

AMERICA

UTED

UTED

EQUITY

EQUITY

AMERICA

AMERICA

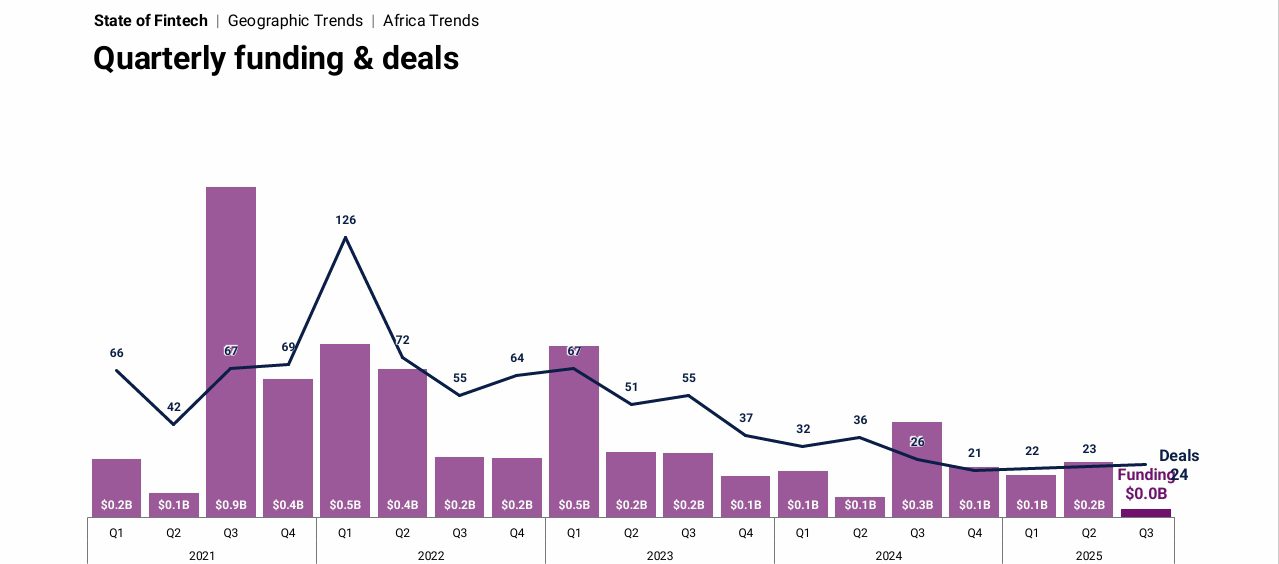

Equity funding into fintech startups suffered a significant decline in the third quarter of the year, as startups only raised $23 million in equity funding during the quarter. This is according to the global tech startup funding analytics company, CB Insights.

The $23 million equity funding pooled by African fintechs in Q3 represents a significant 88.5 per cent drop from over $200 million attracted in the previous quarter. It also represents a 77 per cent decrease from over $100 million recorded in the first quarter, essentially making Q3 by far the least performing quarter of the year.

24 fintechs were responsible for the lot, implying an average of less than $1 million per startup. This is interesting, as 23 fintechs polled over $200 million in the previous quarter, an average of $8.7 million per startup.

This is coming as fintech startups across the world raised a combined $10.9 billion in equity funding during the quarter. This was the same amount of investment attracted in the previous quarter, showing consistency.

However, it has been a good year for fintechs around the world, as the quarterly haul means they have now raised $32.6 billion in equity funding after three quarters in 2025. This puts them on course to exceed the $35.7 billion raised in the entire 2024.

AI-powered fintechs captured the highest share of total equity funding during the quarter, accounting for 23 per cent of the total quarterly haul. Indeed, five of the top 10 deals during the quarter went to AI-powered finance platforms like Ramp and AppZen.

This is positioning AI leaders to widen their competitive gap as AI-first and agentic solutions scale.

See also: African startups raised $140m in September to total $2.2bn in 2025

Africa trails in equity funding as early-stage funding drops 25%

Compared to other regions of the world, Africa is clearly the least favourite destination for equity funding, attracting what is by far the least total, representing 0.2 per cent of the total raised.

This was followed by the Oceania region, where $30 million was raised across 13 deals representing 0.36 per cent of the total.

Canada is next, raising over $200 million across 13 deals in the quarter, representing 1.83 per cent of the total. Next is the Latin America region, where fintech startups were able to attract over $800 million, representing 7.3 per cent of the total haul in the quarter.

Fintechs in Europe raised $1.4 billion across 142 deals during the quarter under review, representing 12.84 per cent of the total. The Asian region managed to outperform Europe in the second quarter of 2025, as 190 deals saw $1.8 billion in investments awarded to fintechs in the region. This represents 16.5 per cent of the total.

The United States of America, as always, accounted for most of the haul as fintechs in the country attracted $6.6 billion across 346 deals. This represents an astounding 60.55 per cent of the global total fintech equity funding.

Equity funding into early-stage fintechs in Africa has also continued to suffer a decline, as only 65 per cent of the total funding in the year so far has gone to early-stage startups. This represents a 25.2 per cent slip from the 87 per cent of total funding recorded in 2024.

Indeed, 2025 might yet be the first year in a while when up to 80 per cent of equity funding into the African fintech space did not go to early-stage startups. In 2023, 81 per cent of total funding went to early-stage startups. In 2022, it was 88 per cent and then 89 per cent the year before.

The trend is global, though, as early-stage deals fell to 66 per cent. This is the first dip below 70 per cent that has been witnessed since 2020, reflecting a strategic pivot by investors toward companies with established business models and clearer paths to scale.