Experts advise to buy and hold despite Bitcoin’s price crash to $105,000

GREED

GREED

BULLISH

BULLISH

BTC

BTC

WHEN

WHEN

POLY

POLY

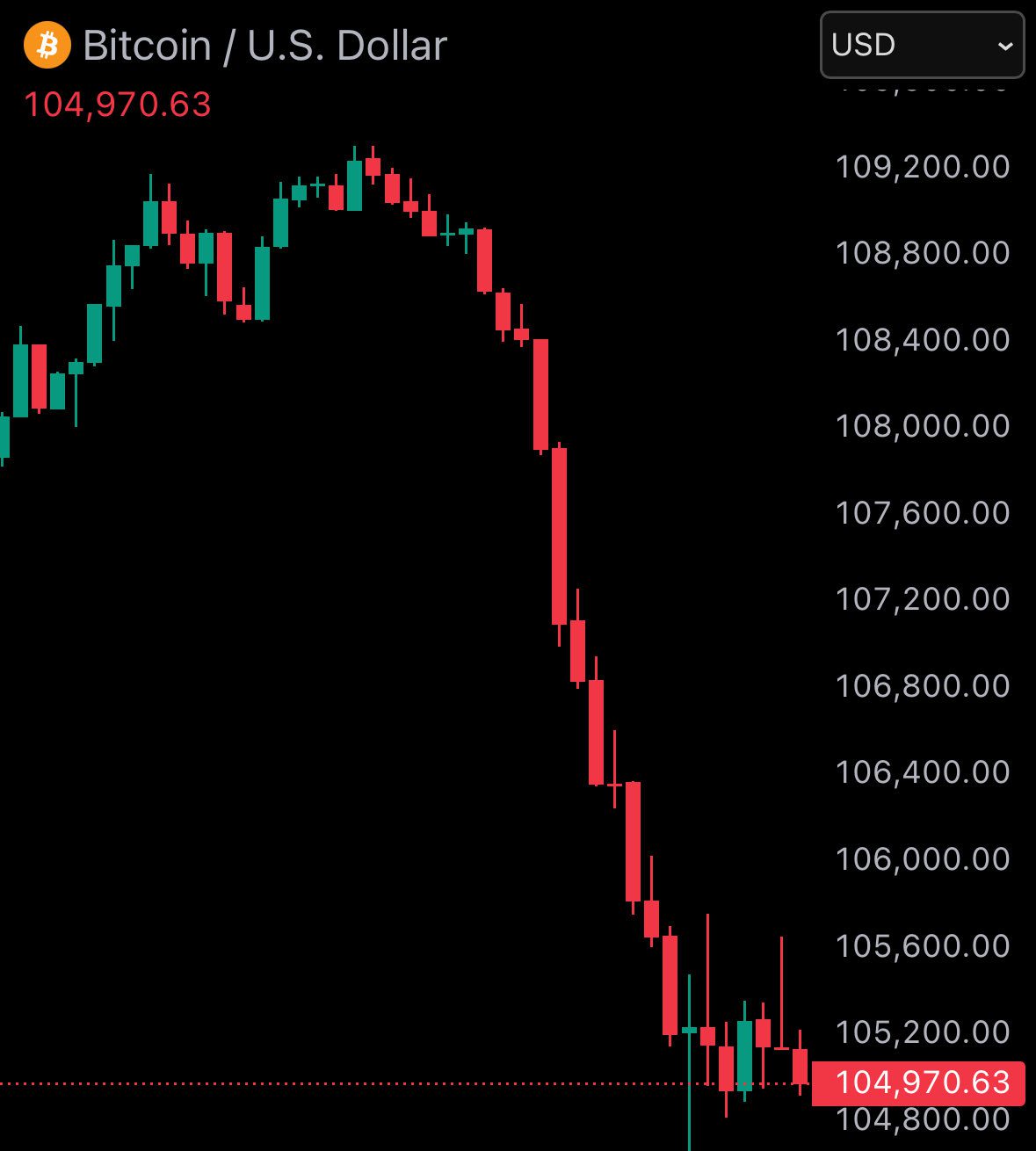

Bitcoin has been fighting through turbulence since last Friday’s dramatic slide. The crash rattled holders who liquidated about $20 billion across global exchanges and drained momentum.

As of this writing, BTC is hovering around $105,000, after going below the same mark earlier in the day. Broader markets remain volatile, macro pressures abound, and sentiment has turned sharply negative.

Hence, the Crypto Fear & Greed Index has tumbled from a greed reading of around 71 just days ago all the way down to 24, the lowest in about a year. That’s a brutal swing. Yet these extremes often mark tactical opportunities: when fear becomes pervasive, much of the margin-driven crowd is already gone.

Yet, while many traders are capitulating, some of the biggest capitals in crypto are accumulating. Beneath the panic, a compelling subplot is emerging: large holders are stepping in, treating the dip not as a danger but as a rare entry opportunity.

More importantly, analysts at Bitwise argue that current conditions favour accumulation, not retreat.

They see last week’s breakdown as largely driven by external factors, renewed US–China trade tensions, global risk aversion, and liquidations across leveraged positions, rather than a collapse in crypto fundamentals. In their view, many weak hands were flushed out, which may set the stage for new inflows.

That said, sentiment alone doesn’t make a bottom. We need corroboration. And that’s where the on-chain and whale activity starts to tell a richer story.

Two Bitcoin whales snatched 1,465 BTC

Over the last 24 hours, two whale wallets have bought an accumulated 1,465 BTC worth $162.4 million.

One wallet (bc1q0) withdrew 1,000 BTC (approximately $110.7 million) from Binance, while another (bc1qx) pulled 465 BTC (about $51.7 million) from FalconX. That amounts to 1,465 BTC ($162.4) in net accumulation.

These flows signal confidence. The fact that these coins left exchanges, likely going into cold or long-term storage, suggests they are not short-term trades.

On a broader scale, analysts report that exchange outflows among major holders exceed inflows. In other words, large wallets are taking coins off exchanges more than depositing them, a classic accumulation sign.

Meanwhile, on the “whale balance” front, short-term whales now control 44% of realised capitalisation, the highest level recorded. That indicates a growing dominance of newer large holders in the network’s capital base.

The sentiment odds and what the market thinks

Interestingly, prediction markets reflect this tension. Polymarket now places a 34% probability on Bitcoin ending October below $100,000, with under 10% odds for a close above $130,000.

That leaves 56% of implied probability resting somewhere between $100K and $130K, a wide band, but not a vote for a crash or runaway surge. In other words, many participants see a grinding range or cautious recovery as the base case this month.

These odds hint at a market that is unwilling to declare a bottom yet, but also unwilling to fully abandon risk. It’s a zone of indecision, an environment where nimble accumulation often reigns.

Meanwhile, Bitcoin is now trapped in a tension zone, and the next leg likely depends on a few catalysts.

- First: key price thresholds. A convincing break above $117,000–$118,000 could reassert bullish control; failure to do so might invite renewed selling pressure.

- Second: macro ripple effects. Any shock to risk assets, equities, bonds, or trade policy can cascade into crypto. If global sentiment stabilises, crypto may benefit disproportionately.

- Third: sustained institutional liquidity. Whale buys over hours are strong, but to shift conviction, flows must persist. If accumulation slows or reverses, the momentum could fade.

- Fourth: exchange dynamics and miner behaviour. Some analysts warn of miner sell pressure (miners liquidating to cover costs) near support zones. If miner outflows intensify, they could undercut whale strength.

If conditions align, we might see a two-stage rebound, a relief bounce, followed by structural reentry. The cautious path, though, is a drawn-out consolidation as sentiment and technicals stabilise.