Terra Classic(LUNC)

$0.00

+15.17%

Sahara AI(SAHARA)

+

Pi(PI)

$0.17

+1.50%

Internet Computer(ICP)

$2.48

+2.31%

Arbitrum(ARB)

$0.10

+2.63%

Venice Token(VVV)

+

Aethir(ATH)

$0.01

+23.93%

Mira(MIRA)

$1.86

+35.10%

ChainGPT(CGPT)

$0.46

-6.35%

Folks Finance(FOLKS)

$21.02

-15.96%

Decred(DCR)

$35.89

+15.07%

LayerZero(ZRO)

$1.63

+5.65%

Terra(LUNA)

$1.07

-3.92%

Heroes of Mavia(MAVIA)

$2.46

+16.32%

BUILDon(B)

$0.16

+22.11%

aixbt(AIXBT)

+

Flow(FLOW)

$1.55

-4.94%

Solayer(LAYER)

+

DAO Maker(DAO)

$0.42

+23.00%

币安人生(币安人生)

+

Terra Classic(LUNC)

$0.00

+15.17%

Sahara AI(SAHARA)

+

Pi(PI)

$0.17

+1.50%

Internet Computer(ICP)

$2.48

+2.31%

Arbitrum(ARB)

$0.10

+2.63%

Venice Token(VVV)

+

Aethir(ATH)

$0.01

+23.93%

Mira(MIRA)

$1.86

+35.10%

ChainGPT(CGPT)

$0.46

-6.35%

Folks Finance(FOLKS)

$21.02

-15.96%

Decred(DCR)

$35.89

+15.07%

LayerZero(ZRO)

$1.63

+5.65%

Terra(LUNA)

$1.07

-3.92%

Heroes of Mavia(MAVIA)

$2.46

+16.32%

BUILDon(B)

$0.16

+22.11%

aixbt(AIXBT)

+

Flow(FLOW)

$1.55

-4.94%

Solayer(LAYER)

+

DAO Maker(DAO)

$0.42

+23.00%

币安人生(币安人生)

+

Fed’s $125B ‘Stealth Easing’ And 67% Rate Cut Odds Hand Crypto A Window

By

Coin Edition

4 months ago

SHOW

SHOW

READ

READ

RSRV

RSRV

CIN

CIN

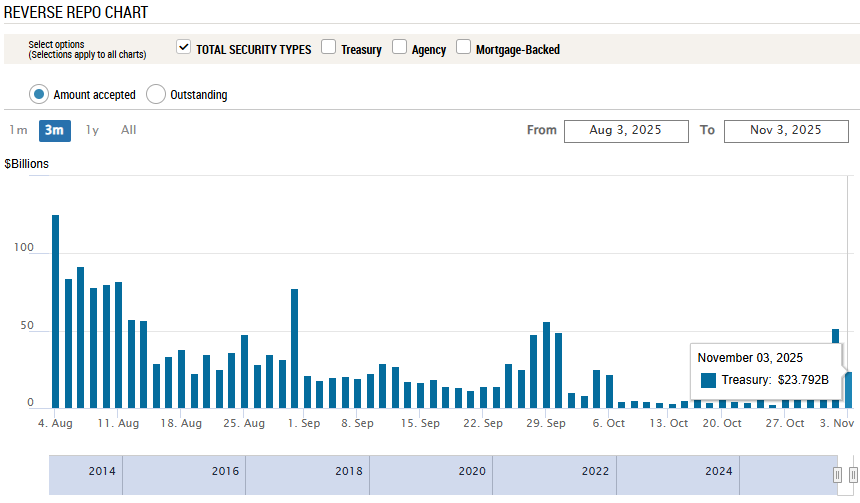

- The Fed injected $125 billion into the U.S. banking system over five days.

- This “stealth easing” contradicts the Fed’s hawkish tone, easing short-term funding stress.

- Markets have responded, with the CME FedWatch Tool now showing a 67.3% chance of a December rate cut.

The U.S. Federal Reserve has injected $125 billion into the banking system over the past five days, its biggest short-term liquidity move since early 2020. The largest single-day injection, $29.4 billion, came on October 31 through overnight repo agreements, according to official Fed data.

Repos allow banks to trade Treasuries for cash overnight, helping to ease short-term funding stress. The action follows a drop in bank reserves to $2.8 trillion, the lowest in over four years.

Powell Talks Tough, But Actions Show ‘Stealth Easing’

Analysts say these …

Read The Full Article Fed’s $125B ‘Stealth Easing’ And 67% Rate Cut Odds Hand Crypto A Window On Coin Edition.

Related News