Flutterwave reshuffles leadership team to strengthen risk, compliance, oversight

BANK

BANK

FOUNDER

FOUNDER

JP

JP

SEND

SEND

CEO

CEO

Fintech company, Flutterwave, has announced a sweeping reorganisation of its leadership team overseeing risk management, compliance, regulation, and legal affairs.

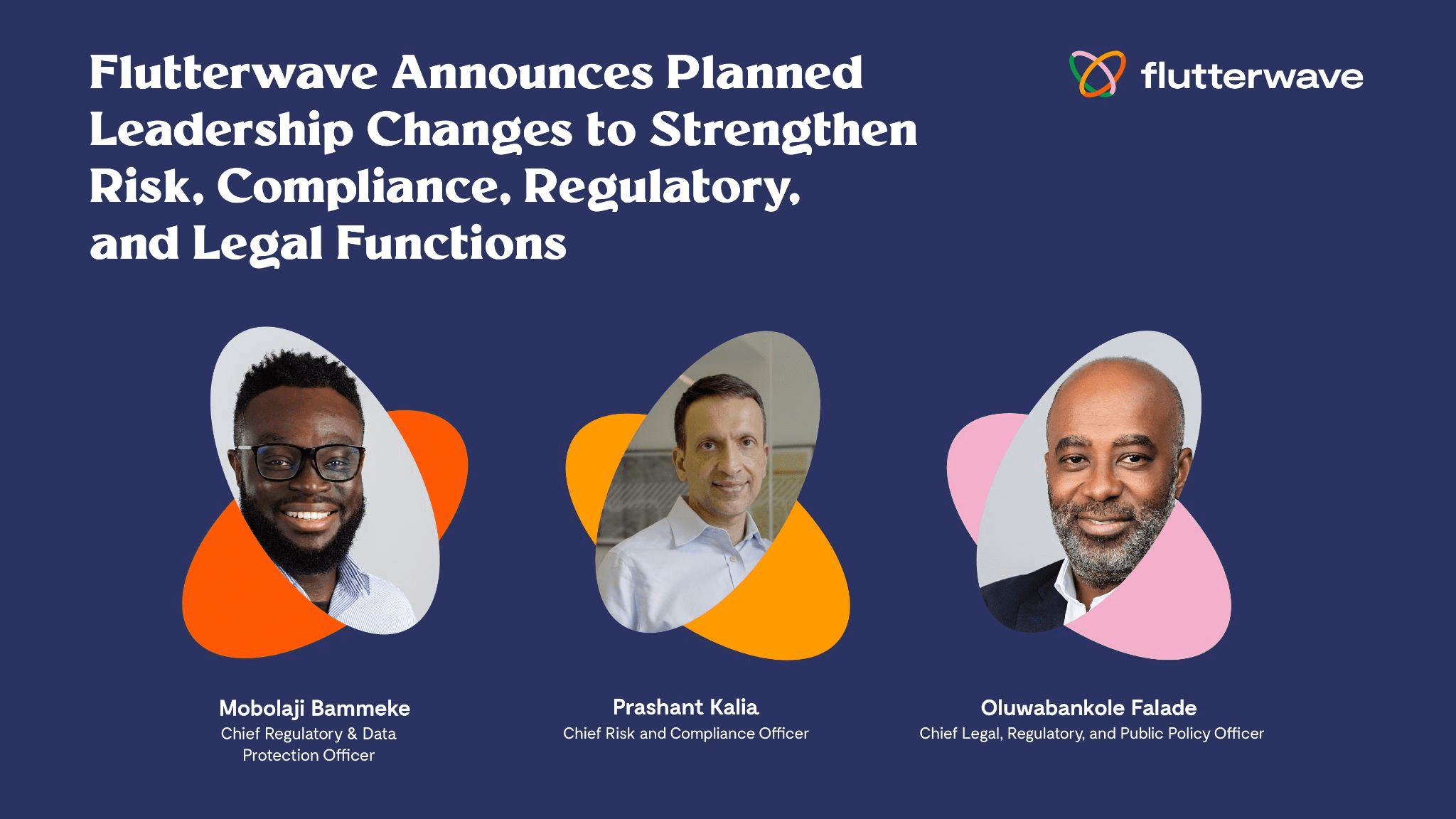

At the heart of the changes is the appointment of Prashant Kalia as Chief Risk and Compliance Officer. He is said to have over two decades of global experience and will now oversee Flutterwave’s global compliance posture.

The company, which powers payments for millions of Nigerians and global brands like Uber, PiggyVest, and Bamboo, says the changes are part of a planned succession strategy aimed at strengthening its governance as regulatory pressure on fintech entities intensifies in Nigeria and abroad.

Kalia’s appointment comes as regulators in Nigeria and across Africa adopt tougher stances on fintech oversight, forcing companies to strengthen transparency, fraud prevention, and data protection.

“Prashant’s deep expertise in risk and compliance will be invaluable as we continue to scale globally,” said Olugbenga “GB” Agboola, Founder and CEO of Flutterwave. “This is a planned succession, and we are confident the changes we are making today will sustain our high standards.”

Flutterwave’s announcement comes at a sensitive time for Nigeria’s fintech industry. Over the past two years, the Central Bank of Nigeria (CBN) has increased scrutiny of payment companies, introducing tighter licensing rules and stronger oversight of data handling, cross-border payments, and KYC requirements.

Nigerian fintech platforms have also faced challenges in maintaining banking partnerships as regulators push for stricter compliance measures.

For Flutterwave, which has faced its share of regulatory hurdles in Nigeria and Kenya, the leadership reshuffle signals an attempt to reset and reassure both regulators and users.

The company has processed over 890 million transactions worth over $34 billion, and any compliance missteps could ripple through Nigeria’s fast-growing digital payments ecosystem.

Prashant Kalia’s background in global firms could help Flutterwave align its risk and compliance frameworks with international best practices, a move that may give Nigerian regulators confidence in the company’s ability to operate within stricter rules.

Before joining Flutterwave, Kalia spent more than a decade at American Express, rising to Chief Credit Officer for Corporate Payment Services in Europe and Asia. He later held senior compliance roles at Amazon, Stripe, and Circle, before joining Flutterwave last year.

While Kalia takes charge of risk and compliance, familiar Nigerian leaders will continue to anchor Flutterwave’s regulatory and legal operations.

Mobolaji Bammeke, who has served as Chief Compliance Officer for the past five years, will transition into a new role as Chief Regulatory and Data Protection Officer. A former JP Morgan banker, Bammeke, will remain in charge of compliance in Nigeria but will also expand his focus to data protection across Flutterwave’s multiple markets.

Meanwhile, Oluwabankole (Bankole) Falade, who has been leading Flutterwave’s engagement with regulators and policymakers, will now combine that portfolio with legal oversight as Chief Legal, Regulatory, and Public Policy Officer. This integration, the company says, will provide “synergy and clarity” across functions that are central to Flutterwave’s growth.

“Bringing our legal, regulatory, and public policy functions together ensures greater alignment across these areas central to Flutterwave’s global growth,” said Falade. “Working with Mobolaji in this integration ensures we are better positioned to proactively engage with key stakeholders.”

The reshuffle will also see outgoing Chief Risk Officer, Amaresh Mohan, stay on as a strategic advisor to Kalia and CEO Agboola. Mohan is credited with helping Flutterwave build its risk function from the ground up, a role that has grown increasingly important as the company scales.

Flutterwave aims for local trust, global growth

For Nigerian users, the company’s internal changes may not immediately translate into new services or cheaper fees. But they could play a decisive role in ensuring the platform remains trusted by banks, regulators, and international partners.

In a market where fintech services are often disrupted by sudden policy shifts, such as recent limits on virtual cards and cross-border transfers, strong compliance and regulatory engagement can mean the difference between continuity and service shutdowns.

Flutterwave’s moves also highlight how Nigerian fintech platforms are evolving from scrappy startups to mature financial institutions expected to operate with the same rigour as traditional banks.

As Flutterwave continues to expand its infrastructure across 34 African countries, while offering remittances via its Send App, the message to regulators and users is that the company is preparing for a future where compliance and trust are as critical as innovation and speed.