From 18.02% to 16.05%: Can fintech companies ride Nigeria’s inflation wave?

AI

AI

INSURANCE

INSURANCE

BANK

BANK

IMAGINE

IMAGINE

GMIX

GMIX

Imagine walking into a market in Lagos or a village in Ekiti, and suddenly, the price of tomatoes or yams isn’t climbing as fast as it used to. That’s the story the inflation numbers in Nigeria are telling us today.

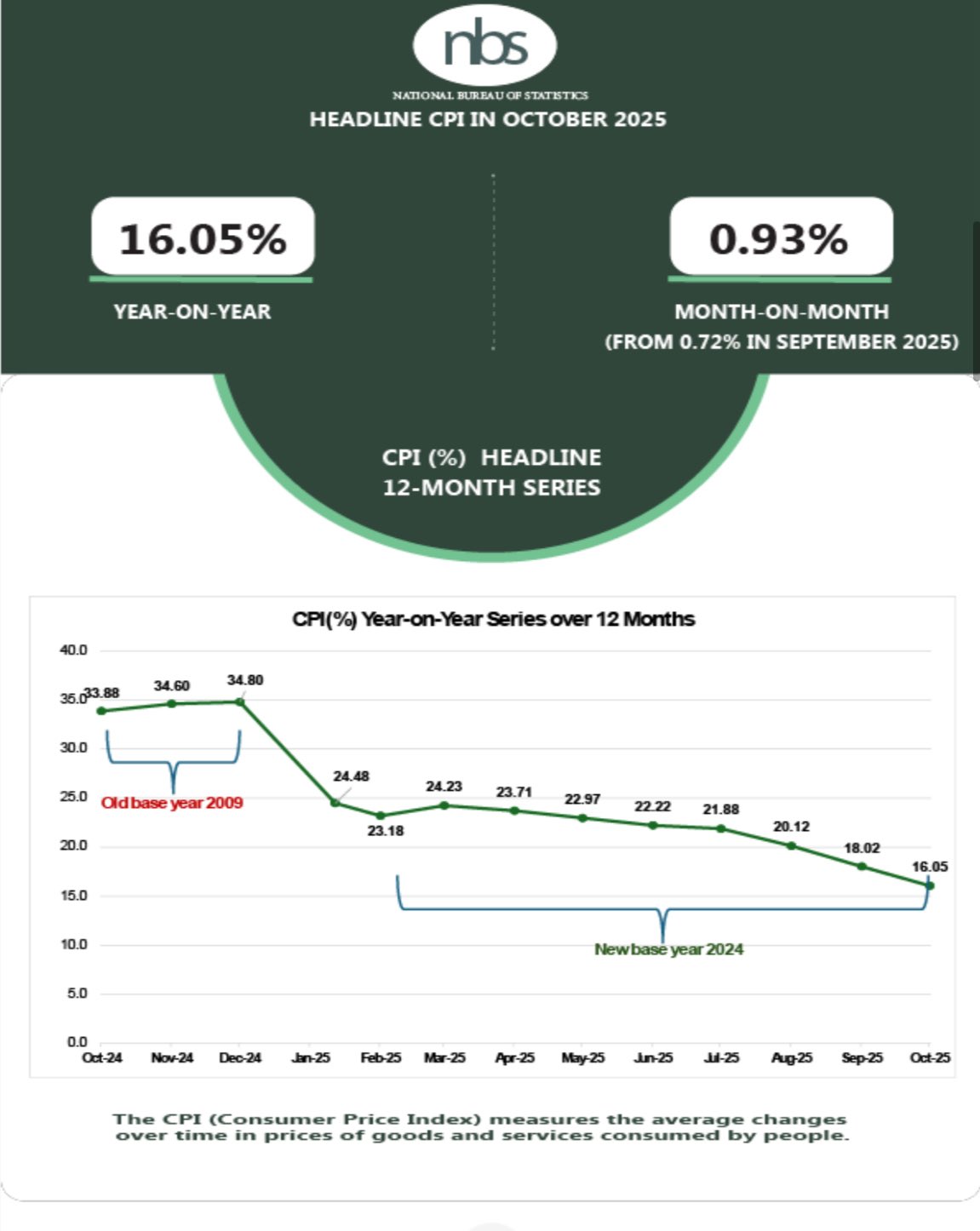

On November 17, 2025, the National Bureau of Statistics released a report showing inflation eased to 16.05% in October, down from 18.02% in September.

Food prices even dipped by 0.37% month-on-month, thanks to better harvests. For the average Nigerian, this might mean a little more cash in their pocket to spend or save. But what does this mean for the buzzing world of fintech companies in Nigeria?

Let’s break it down into a story that’s easy to follow and full of potential.

First, this drop in inflation could light a spark for fintech expansion. When prices aren’t soaring, people feel a bit more secure. They might start using mobile apps like OPay or Paga to send money to family or buy online.

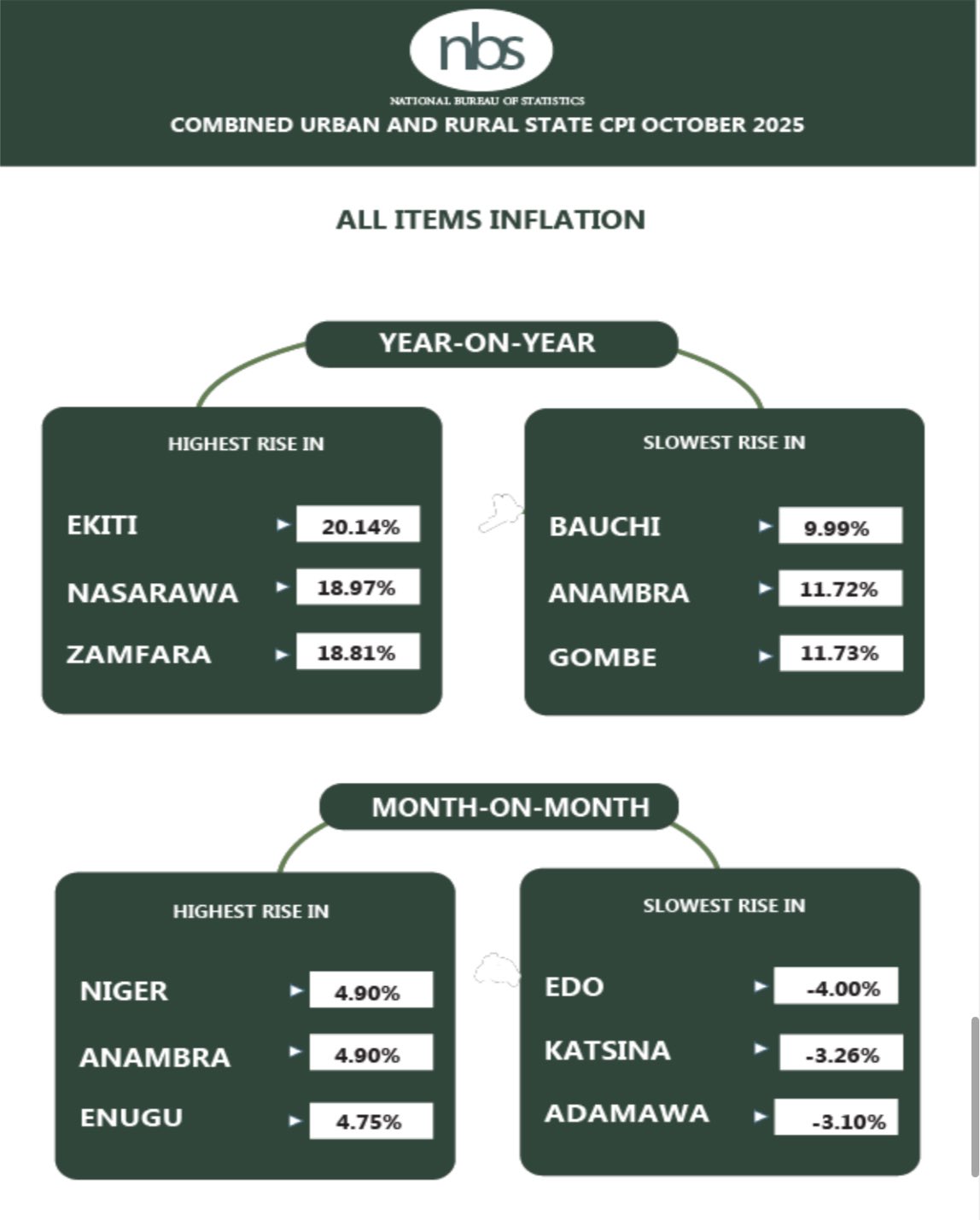

The NBS data shows urban inflation is at 15.65% and rural inflation at 15.86%, with differences in states like Ekiti at 20.14% and Bauchi at 9.09%. This means fintech entities can target areas where costs are still high, offering tools to help people manage money.

For example, a farmer in Ekiti could use a loan app to buy seeds, knowing food prices might stabilise. Companies like Flutterwave, which handle digital payments, could see more transactions as people spend that extra cash.

Even better, if the Central Bank of Nigeria (CBN) lowers its interest rates soon, borrowing money becomes cheaper. Fintech entities could then offer small loans to shop owners or traders at lower rates, helping businesses grow without breaking the bank.

But it’s not all smooth sailing. The core inflation rate, which excludes food and energy, sits at 18.69%. That tells us things like rent or transport are still pricey. For fintech entities, this means they need to get creative. They could roll out savings apps or insurance products to help people cope with these costs.

Take a young person in Lagos who spends half their income on transport. A fintech app that lets them save small amounts daily could be a game-changer. Plus, with inflation cooling, investors might feel bolder about putting money into Nigerian fintech companies.

Reports from earlier this year showed inflation hit 34.8% in December 2024, scaring off some funders. Now, with a downward trend, startups could get the cash they need to build new tools, like AI chatbots to assist customers or platforms for rural banking.

This shift could also open doors in unexpected places. The regional gaps in inflation mean fintech entities can zoom in on underserved spots.

Imagine a mom in Bauchi, where inflation is only 9.09%, using a mobile wallet to pay for her kids’ school fees. Or a trader in Ekiti, facing 20.14% inflation, getting a microloan to stock up before prices rise again.

Fintech entities that adapt to these local needs could win big. They might partner with local agents to bring services to villages or use simple USSD codes for people without smartphones. The key is flexibility, and this inflation easing gives them a chance to test new ideas.

Borrowing cost: Fintechs’ challenge in a shifting landscape

Now, let’s talk about the flip side.

This inflation drop sounds great, but it doesn’t guarantee success for fintech entities. One big question mark is the CBN. Right now, it hasn’t changed its main interest rate, even with inflation easing. That means borrowing costs are still high for fintech companies trying to grow.

If the bank waits until its next meeting on November 24-25, 2025, to act, companies might miss out on quick wins. A trader in Nasarawa, where inflation is 18.97%, might need a loan now, not later. Without cheaper credit, fintech entities could struggle to meet that demand, especially smaller startups already squeezed by 2024’s tough regulations.

Another hurdle is trust. On social media, people are calling the NBS numbers fake, saying they don’t match what they see at the market. If Nigerians don’t believe the inflation is really dropping, they might not rush to use fintech apps. A woman in Gombe, where inflation is 11.73%, might stick to cash if she thinks prices will jump again.

Fintech companies need to prove their value, maybe by offering clear savings goals or rewards for using digital payments. Building that trust takes time, especially when core inflation at 18.69% keeps some costs high.

Then there’s the regional puzzle. With inflation varying so much across states, fintech entities face a tricky balancing act.

In Edo, where month-on-month inflation is down to 0.4%, people might spend more freely, boosting payment apps. But in Niger, where it’s up at 4.8%, the same apps might see less action.

Fintech teams will need to study these patterns closely, adjusting their strategies to avoid losing money in high inflation zones. They might also face competition as bigger players jump in to grab the growing market.

So, what’s the takeaway?

This inflation ease is like a green light for fintech entities to innovate, from cheaper loans to tailored rural services. But they’ll need to navigate high interest rates, public doubt, and regional quirks.