FX Solutions in Africa: How Global Businesses Are Simplifying Cross-Border Settlements

BANK

BANK

CAN

CAN

WORLD

WORLD

8

8

USDC

USDC

Africa’s economic expansion has attracted a new wave of global and regional brands, yet for many, success on the continent is determined not by demand but by how efficiently they move money across borders. Every country operates its own currency and regulatory regime, creating a fragmented FX environment where settlement delays, conversion spreads, and liquidity shortages often eat into margins.

In 2023, Africa received $100 billion in remittances, nearly 6 percent of the continent’s GDP, alongside $48 billion in foreign direct investment. These figures reflect the sheer volume of cross-border capital moving in and out of African markets, and the urgent need for faster, more predictable settlement systems to keep pace.

For CFOs managing high-volume operations across countries like Kenya, Nigeria, Ghana, and South Africa, traditional banking infrastructure is struggling to keep up. Delayed settlements and inconsistent liquidity turn treasury management into a daily balancing act, making reliable FX solutions not just a finance function but a strategic necessity.

Why Traditional FX Channels No Longer Work at Scale

Conventional banking networks were never built for Africa’s multi-market realities. Most still depend on correspondent banking relationships, which introduce multiple intermediaries and extra compliance layers. As a result, a cross-border transaction that should take hours can stretch into several days, and cost as much as 8 percent in total conversion and transfer fees, according to World Bank data.

For global businesses processing hundreds or thousands of transactions daily, that inefficiency compounds fast. Liquidity mismatches between currencies also mean treasury teams often must route funds through the U.S. dollar, further increasing costs and exposure to FX volatility.

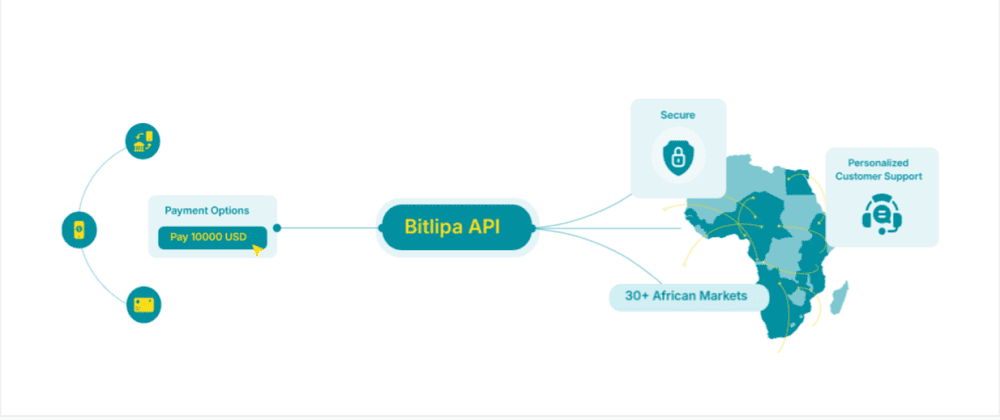

This is why a growing number of operators are turning to fintech-driven FX infrastructure that offers faster liquidity access and real-time settlement visibility. Providers such as Bitlipa, who specialize in multi-market FX and settlement APIs, are helping businesses simplify how they move and manage money across the continent, not by replacing banks, but by closing the gaps that slow them down.

The Shift Toward Smarter FX and Settlement Models

The last two years have marked a turning point for how businesses approach cross-border FX in Africa. Instead of relying solely on traditional banking rails, global companies are increasingly leveraging fintech-led settlement infrastructure that integrates local collection and global payout capabilities into one API.

One major catalyst behind this shift has been the rise of stablecoin-based settlement frameworks. Globally, stablecoins have grown to a circulating supply of $283 billion as of September 2025, a 128 percent increase since early 2024. In Sub-Saharan Africa, they now account for 43 percent of total crypto transaction volume, reflecting their growing role as practical FX tools rather than speculative assets.

For many African businesses and global platforms, stablecoins offer a faster, more predictable alternative to slow, USD-dependent conversions. A Nigerian trading firm can settle supplier payments in minutes using USDT; a Kenyan exporter can receive USDC and convert locally without waiting for wire transfers. The result is the same: instant liquidity and fewer FX bottlenecks.

How Bitlipa Simplifies Cross-Border FX for Multi-Market Businesses

This evolution in settlement design is where Bitlipa has positioned itself. The company offers API-driven FX and liquidity solutions for businesses operating across more than 15 African markets, enabling them to collect payments locally and settle in stablecoins or hard currencies like USD, instantly and transparently.

According to Anne Njoroge, the Business Development Strategist at Bitlipa, the company’s mission has always been to give high-volume and cross-border businesses the kind of liquidity access banks were too slow to provide.

“African businesses are scaling faster than the systems designed to serve them,” she explains. “Our role is to ensure liquidity and settlement reliability wherever those businesses operate, because growth shouldn’t stop at borders.”

Bitlipa’s approach bridges traditional finance and digital liquidity. By integrating local payment rails, it allows treasury and finance teams to manage cash flow across regions without maintaining separate banking relationships in every market.

For global operators handling thousands of transactions daily, this unified model translates into lower FX exposure, faster reconciliation, and real-time control over capital movement.

FX Reliability as a Competitive Advantage

As Africa deepens regional integration through initiatives like the African Continental Free Trade Area (AfCFTA) and new digital settlement platforms under COMESA, the demand for reliable FX infrastructure will only intensify.

For global businesses, FX reliability is becoming a competitive edge. It reduces risk, protects margins, and allows companies to reallocate working capital faster. And for fintechs and corporates alike, partnering with infrastructure providers that prioritize liquidity and transparency, rather than legacy intermediaries, will define who scales successfully across the continent.

Final Word

Africa’s growth is no longer limited by opportunity; it’s limited by liquidity. The businesses that adopt smarter FX systems now will be the ones that expand seamlessly across borders, maintain control over currency exposure, and build the financial agility needed for long-term success.

If your organization operates across multiple African markets and struggles with settlement delays or FX unpredictability, consult Bitlipa and explore how one API can simplify your cross-border FX and strengthen your liquidity position.

Contributing Author

Anne Njoroge

Business Development Strategist, Bitlipa