Gambler Risks $150M on Hyperliquid Shorts With $1.2M in Losses

XRP

XRP

X

X

GMIX

GMIX

WOULD

WOULD

HYPE

HYPE

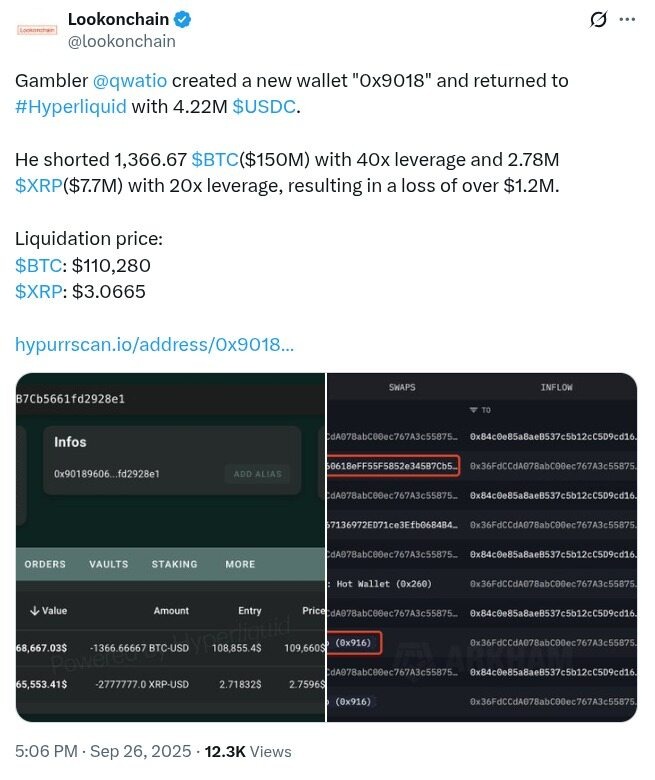

One of the most famous traders, Gambler, has just reappeared on Hyperliquid with hundreds of millions in short positions. With a new funding of $4.22M USDC, the action is an indication of a high-risk move that is already in the red. His wallet is now being followed by market watchers as liquidation levels are now dangerously close to the current prices.

According to Wallet information as highlighted by Lookonchain, Gambler initiated two giant leveraged shorts on Bitcoin and XRP. The BTC short is 1,366.67 BTC ($149.86M) at 40x leverage with an entry of $108,855.4. Meanwhile, the current short in XRP is 2.78M XRP ($7.66M) at 20x leverage, at an entry point of $2.7183. Both trades are losing with BTC and Ripple trading at above 109,600 and 2.76, respectively, resulting in an aggregate loss of more than $1.2M.\

SOURCE: X

Liquidation levels provide additional pressure, with Bitcoin key liquidation level being at $110,280 and XRP at $3.0665. Even small upward trends would have the effect of pushing these shorts out of business. The growing drawdowns can hardly be compensated for by the funding fees that have accrued approximately $3K in both trades. In this way, the trades point to how quickly being on the wrong side of high-leverage strategies is, particularly in markets that oppose bearish momentum.

Hyperliquid Attracts Aggressive Futures Traders

Hyperliquid's perpetual futures market has attracted attention for allowing such outsized bets, which appeals to aggressive investors. Nonetheless, bears have not been popular in the larger market context. The strength of BTC around all-time highs and XRP holding above areas of support remains burdensome to short positions.

Additionally, Hyperliquid is more attractive to traders who want greater liquidity in decentralized derivatives than other competitors, such as Bybit and Binance. However, this liquidity bears an increased risk should trades turn unsuccessful.

Liquidity Flows Highlight DeFi-CeFi Synergy

More so, the rise of Hyperliquid underlines the growing demand for decentralized trading systems. Wallet-to-exchange flows indicate the manner in which capital is recirculated by traders between centralized exchanges, such as Bybit, and decentralized exchanges, such as DeFi. It is this liquid flow that brings out the growing ecosystem of cross-platform trading.

Furthermore, Hyperliquid is in the spotlight of institutional traders, since the design best fits strategies of high-frequency traders, although it remains risk-heavy in comparison with spot markets.

Meanwhile, the destiny of trader Gambler's trades could depend on the volatility of Bitcoin and Ripple in the near future. When either of the two assets surges beyond liquidation levels, losses may increase exponentially, destroying the majority of the fresh infusion of wallets with $4.22M. A sudden turnaround of Bitcoin or Ripple token on the flip side would mean profitability again, justifying the risky decision.

In the case of Hyperliquid, it features the attractiveness of the platform to adventurous traders and the risks of excessive leverage.