Global PC shipments surge 8.1% in Q3 2025 as Windows 10 sunset sparks new sales

AI

AI

AMERICA

AMERICA

AMERICA

AMERICA

AMB

AMB

OS

OS

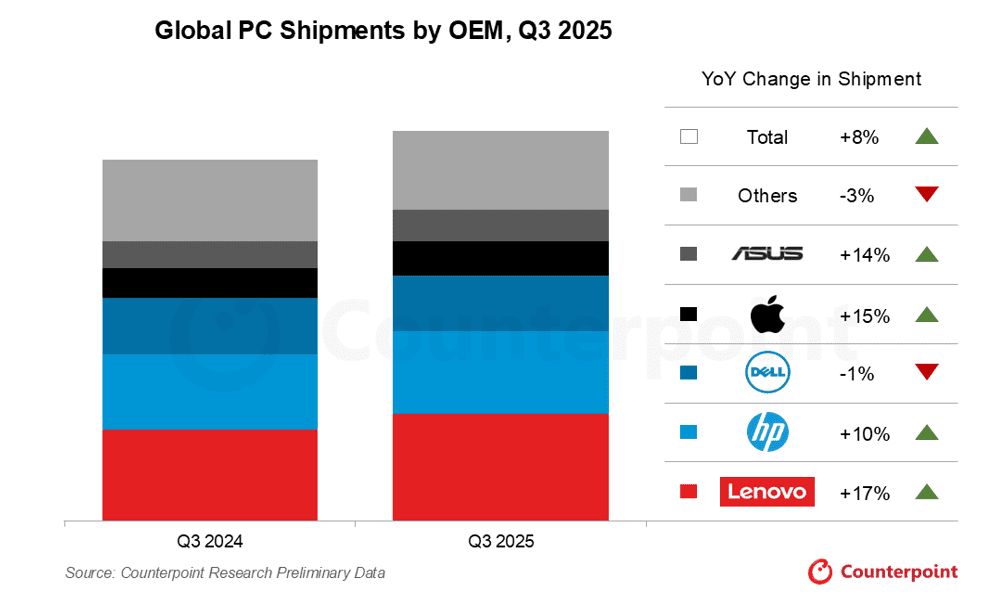

Global PC shipments surged 8.1% year-on-year in the third quarter of 2025, according to preliminary figures from Counterpoint Research. This marks one of the strongest rebounds the PC market has seen in recent years, fuelled by upgrade cycles, OS transitions, and strategic market shifts.

The growth was primarily driven by the looming end-of-support for Microsoft Windows 10 in October 2025. As enterprises and consumers prepare for the sunset of the decade-old operating system, replacement demand has surged across regions. Counterpoint estimates that roughly 40% of the current PC installed base still runs Windows 10, underscoring how deeply this software transition is influencing hardware sales.

At the same time, changing U.S. import tariff policies have prompted PC vendors to fine-tune inventory strategies, adding another layer of momentum to quarterly shipments. For the first time since 2021, the global PC market appears to have turned a corner, moving from stagnation to steady recovery.

Lenovo leads; HP and Apple gain ground

Lenovo once again maintained its lead as the world’s top PC maker, posting a remarkable 17.4% year-on-year increase in shipments for Q3 2025, the highest among the top six vendors. The company’s balanced focus across both commercial and consumer segments, coupled with efficient channel management, allowed it to capitalise early on the Windows 10 replacement wave.

HP followed closely, recording a 10.3% annual growth rate, driven by strong sales to businesses upgrading corporate fleets. HP’s deep relationships in the enterprise and education sectors helped it solidify its second-place position globally.

Dell, by contrast, faced a slightly more challenging quarter. Despite a 2.7% sequential (quarter-on-quarter) increase, its shipments dipped 0.9% year-on-year, reflecting more cautious enterprise spending in North America and Europe.

Analysts suggest that Dell’s high exposure to the commercial sector, where refresh cycles are more deliberate, may have tempered its overall growth.

Apple enjoyed a strong quarter as well, with Mac shipments up 14.9% year-on-year. The company benefited from robust demand for its latest MacBook lineup, featuring improved M-series processors and energy-efficient designs.

Counterpoint also noted growing enterprise adoption of Apple’s devices, a trend that’s been building steadily as businesses diversify beyond Windows-based systems.

Asus, meanwhile, recorded one of the most dramatic quarterly performances. Shipments surged 22.5% quarter-on-quarter and 14.1% year-on-year, driven largely by strong consumer notebook demand and competitive pricing. The company’s aggressive push into gaming and creator-orientated laptops paid off handsomely during the quarter.

Collectively, Lenovo, HP, Dell, Apple, and Asus now control nearly three-quarters of the global PC market, a clear sign that consolidation continues to favour the top-tier manufacturers. Smaller OEMs, unable to match the scale or supply chain agility of the big players, saw flat or declining shipments during the same period.

Windows 10 sunset sets the stage for the AI PC era

According to Counterpoint’s Senior Analyst Minsoo Kang, the current growth surge is not just a short-term boost. “While the current growth is primarily driven by OS migration, the industry is poised for an even more profound transformation with the rise of the AI PC,” Kang said. “However, this next wave of growth has not yet fully materialised in the Q3 2025 numbers.”

Indeed, the transition away from Windows 10 is doing more than reviving PC sales; it’s laying the financial and technical groundwork for the next major inflection point in personal computing: the rise of AI-powered PCs.

Associate Director David Naranjo highlighted that the ongoing refresh cycle is as much about future-proofing as it is about immediate upgrades. “The PC market’s rebound in 2025 is not just about replacing outdated systems,” Naranjo said. “It’s about preparing for what’s next. Many enterprises are choosing AI-capable PCs to future-proof their fleets, even if they do not yet need those capabilities immediately.”

Across the industry, PC makers have begun touting new models equipped with neural processing units (NPUs) and on-device AI acceleration. These systems can run AI assistants, large language models, and other generative AI workloads locally, without constant reliance on the cloud. Still, for now, these features remain more of a selling point for future-readiness than a primary purchase driver.

Buyers today remain focused on practical factors like OS compatibility, performance gains, and battery life. However, the trend toward AI-enabled hardware is clearly underway. Businesses are increasingly choosing PCs that can handle AI tasks, not because they need them today, but because they don’t want to be outdated tomorrow.

While AI PCs are already entering the market, analysts expect the real ramp-up to begin after 2026. That’s when the next generation of processors, purpose-built for AI workloads, will arrive in volume.

Qualcomm has already unveiled its Snapdragon X2 Elite PC processor, integrating advanced NPUs designed for sustained on-device AI inference.

Intel, meanwhile, is preparing its “Panther Lake” Core Ultra chips, featuring improved neural acceleration capabilities. NVIDIA, in partnership with MediaTek and other semiconductor firms, is also developing Arm-based CPU architectures with built-in GPU AI engines tailored for PC performance.

Counterpoint projects that mass shipments of these AI-centric chips will not hit full stride until late 2026, with broader consumer availability in 2027. As a result, the true AI PC boom is expected to take off in the second half of the decade.

By then, AI integration will likely redefine how users interact with their devices, shifting focus from pure performance metrics to intelligence at the edge.

Analysts predict that CES 2026 will showcase a wave of new AI PC models, marking the official dawn of a new computing era.

For now, though, 2025 stands as a pivotal bridge year, one defined by the replacement of ageing systems, the sunset of Windows 10, and the quiet groundwork being laid for the age of AI-enabled personal computing.

As Kang aptly summarised, “The current refresh cycle is about preparing for transformation. What comes next will be the most significant leap the PC industry has seen since the rise of the notebook.”