How Seyi Ebenezer’s Payaza turned debt into discipline and delivered ₦20.3B back to investors

AVA

AVA

READ

READ

FOUR

FOUR

CEO

CEO

WOULD

WOULD

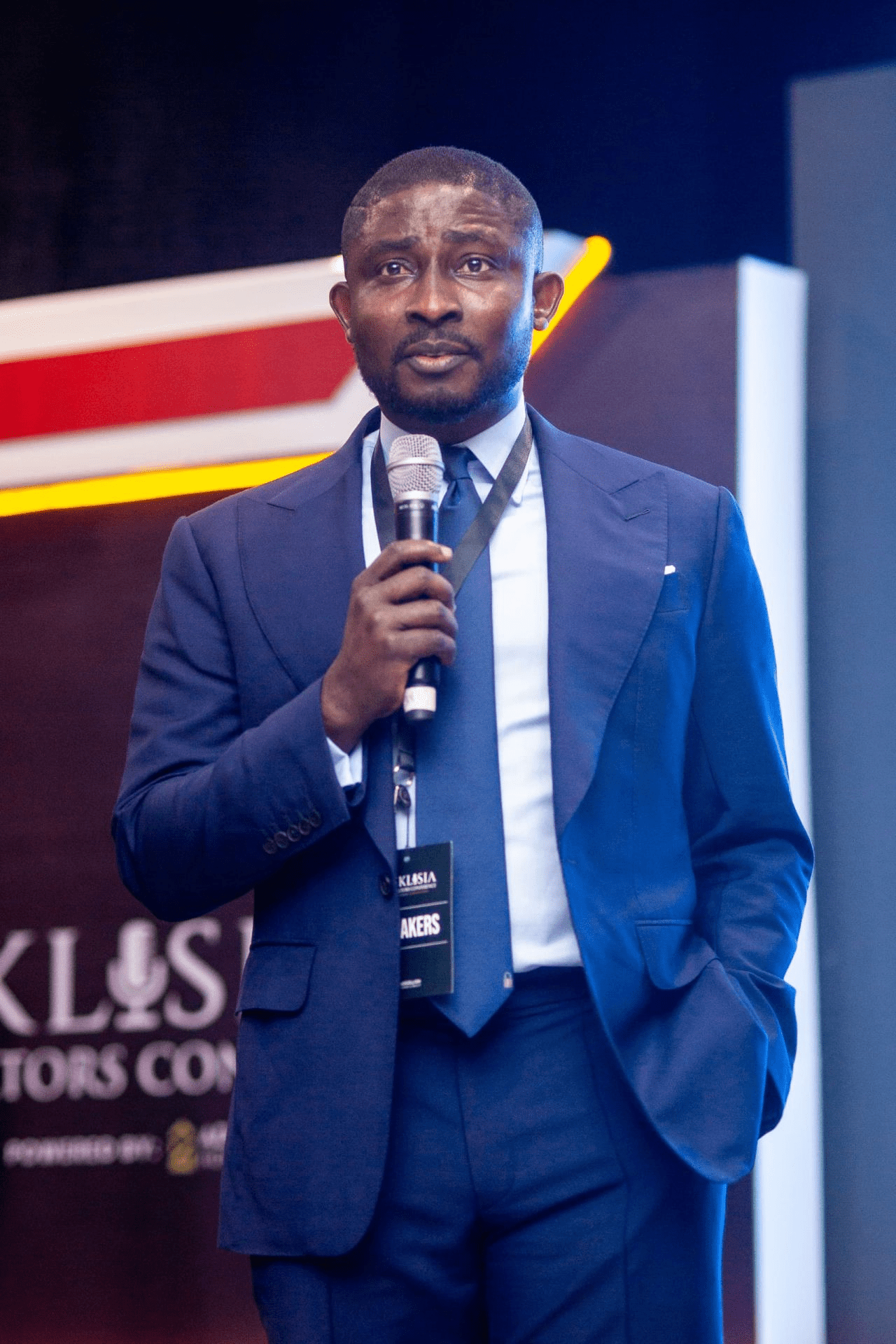

On September 24, Payaza founder and CEO Seyi Ebenezer took to LinkedIn with a note of pride: “A little over a month ago, we announced Series 3 & 4 of our ₦50B Commercial Paper Programme. Before that, Series 1 & 2 raised ₦20.3B, and I’m proud to share that we’ve now repaid it in full!”

It wasn’t just an update. It was a milestone, one that signalled Payaza’s evolution into a fintech with the discipline, governance, and credibility to raise, deploy, and repay billions in debt, like Nigeria’s largest corporates. And for Ebenezer, this moment was never about chance. It was about promise.

“When we launched the first series, my mind was on one word: promise,” he said in response to questions from Technext. “We were making a big promise to our investors, our team, and the market. It wasn’t just about raising capital; it was about demonstrating that a homegrown Nigerian fintech could leverage the local debt capital markets with the discipline and integrity of any blue-chip company.”

Did he imagine this day, posting proudly about ₦20.3 billion fully repaid? “Absolutely,” he said without hesitation. “It wasn’t a hope; it was the destination on our roadmap. The plan for repayment wasn’t an afterthought, it was built into the very first financial model. We stress-tested our cash flows against every imaginable scenario because repaying this debt, and doing so ahead of schedule, was the only acceptable outcome. It was our duty to prove the model works.”

Payaza’s model of walking away, winning trust

If repayment was the destination, then discipline was the path. And in Payaza’s journey, discipline often looked like restraint. Ebenezer recalled one tough call vividly. “About a year ago, during a period of significant market volatility, we had an opportunity to partner on a massive project. The potential revenue was incredibly tempting, and on the surface, it looked like a huge win.”

But Payaza’s governance framework required the deal to face rigorous review. The verdict was unacceptable levels of foreign exchange and settlement risk.

“The ‘strong process’ part was that we couldn’t ignore the data. The ‘discipline’ part was walking away. It was a tough call, and many would have taken the risk for the top-line growth. But that decision protected our cash flow and ensured our balance sheet remained resilient. It’s in those uncelebrated moments of saying ‘no’ that our commitment to good governance truly pays off.”

That governance-first approach is why Ebenezer believes Payaza has done what few fintech platforms have managed in Nigeria: gain investor trust in the debt markets. “We knew we couldn’t just walk in with a great story. We had to prove it with undeniable evidence,” he said.

Read also: Africa’s debt era: $1B loans reshape startup funding and shift power to East & Southern hubs

The evidence came in three parts. First, the past: audited financials that showed profitability and operational cash flow. Second, the present: an independent board, rigorous internal controls, and partnerships with firms like AVA Capital. Third, the future: a vision that every naira invested in Payaza would fuel Nigeria’s SME economy.

Investors could see the real-world impact of their capital – that every naira would enable thousands of small businesses to grow. They invested not just in Payaza, but in a predictable future for the entrepreneurs we serve.

Still, trust is not just built in boardrooms. Sometimes, it’s in the late nights that few ever see. Ebenezer recalls the week leading to the first repayment. “Our finance and operations teams were in the office until the early hours almost every day. Not because of a crisis, but because of ownership. They were triple-checking every analysis, reconciling every kobo, and coordinating with trustees, bankers, and regulators.”

One night, he joined them on a Google Meet call. “Instead of tired faces, I saw a team buzzing with energy, cheering as the final reconciliation report balanced perfectly. That’s the grit. It wasn’t a job for them; it was a mission. That image of their collective pride and dedication – that’s what makes me smile. They are the ones who truly delivered on our promise.”

Debt as fuel, SMEs as proof

Beyond the boardroom and spreadsheets, Ebenezer is clear on what the repayment milestone signals. “This milestone sends a clear message: debt is a powerful tool for mature businesses, but it must be handled with immense respect.”

Read also: Moove plans $1.2 billion debt funding to finance US expansion

For other founders, his advice is crisp:

Debt is for scaling, not discovery. You should only take on debt when you have a proven, predictable business model with positive unit economics. Debt is fuel for a well-built engine, not the spare parts you use to build it.

That engine is Payaza’s network of small and medium businesses, the heartbeat of its model. He points to the story of Madam Grace, a fabric seller in Onitsha, as proof of what repayment really represents.

“For years, she was a cash-only business. Growth was limited by what she could physically handle, and she was always a target for theft. When she started using a Payaza terminal, everything changed.

“Sales increased, and within six months, those digital transactions created a verifiable sales history. With that data, one of our lending partners gave her a small loan for inventory. She used it to import better fabrics, raised her margins, expanded her shop, and hired two young people.

“That’s what we mean when we say every transaction we enable helps a business scale. The transaction is just the beginning – it’s the gateway to credit, to insurance, to growth. Madam Grace’s story is why we exist.”

For Ebenezer, Payaza’s repayment is an entry in an accounting ledger and proof that Nigeria’s debt markets can power innovation, and that fintech entities can hold themselves to the same standards as corporates.

It signals a flight to quality, he said. The era of chasing growth at any cost is over. Investors are now prioritising resilient, well-governed companies with strong fundamentals and clear profitability. Our success proves that sustainable businesses can find the capital they need to grow right here in Nigeria.

That success now sets the stage for the future. Series 3 and 4 of the ₦50 billion programme, announced in August, are already in motion. This time, Payaza isn’t just chasing scale.

“Our next moves are about strategic depth, not just expansion. We will strengthen our core infrastructure, deepen penetration in key sectors, and develop more value-added services to empower our merchants. We’ve built the trust; now we’re going to build the future on top of it.”

Yet through it all, Ebenezer insists numbers alone don’t explain Payaza’s journey. At the heart of it is faith. He had written on LinkedIn: “How we are here today is not BODMAS; it’s God’s math.”

“BODMAS represents the predictable, logical order of operations you can control on an Excel spreadsheet. But building a business in Nigeria is filled with variables you can’t model. God’s math is my way of acknowledging those elements beyond our control: favour, timing, resilience, and grace.

Read also: Senegal-based Wave raises $137m in debt to expand financial affordability

“My faith is the foundation of my leadership. It gives me a moral compass, and it provides a quiet confidence that if we do our part with excellence and integrity, the outcome is in better hands than just our own.”

It is why, for him, repaying ₦20.3 billion is not just a financial milestone. It is the fulfillment of a promise – to investors, to a team, and to the thousands of small businesses whose futures are tied to Payaza’s resilience.