How to calculate your income tax as a Nigerian freelancer and remote worker

BANK

BANK

WHEN

WHEN

READ

READ

BRTR

BRTR

ALLOWANCE

ALLOWANCE

The days when freelance earnings could bypass the Nigerian tax system are over. By January 2026, remote workers, freelancers, online influencers, and even sex workers are expected to generate revenue for the Nigerian government.

This is because the new Nigeria Tax Act (NTA) explicitly clarifies that the worldwide incomes of residents are taxable. The nation’s vast and dynamic pool of digital professionals is now a major focus for revenue mobilisation.

For the vast majority of digital professionals and remote workers, the key obligation is the Personal Income Tax (PIT), also known as Pay As You Earn (PAYE). This is levied by the State Internal Revenue Service (SIRS) in the individual’s state of residence and applies to the total annual income earned from all sources, whether local or foreign.

Note: if your Payoneer, Wise, or Barter account is linked to your Nigerian BVN or bank, your foreign inflows are already visible to the Nigerian authorities.

However, this guide provides the essential breakdown for every remote earner, freelancer and digital e-commerce entrepreneur on how to correctly calculate their liability, make payments, and navigate the compliance landscape.

Read also: How to get a Nigerian Tax ID before Jan. 2026 deadline for bank account holders

How to calculate Personal Income Tax (PIT): a step-by-step guide

Step 1: Determine Your Gross Annual Income (GAI)

The first and most crucial step is to determine your annual gross income in Naira. All foreign income (e.g., USD) must be converted using the official Central Bank of Nigeria (CBN) exchange rate applicable at the time the income was received.

Sum up all income earned from your freelance/remote work, both local and foreign, for the financial year.

Step 2: Determine Your Taxable Income

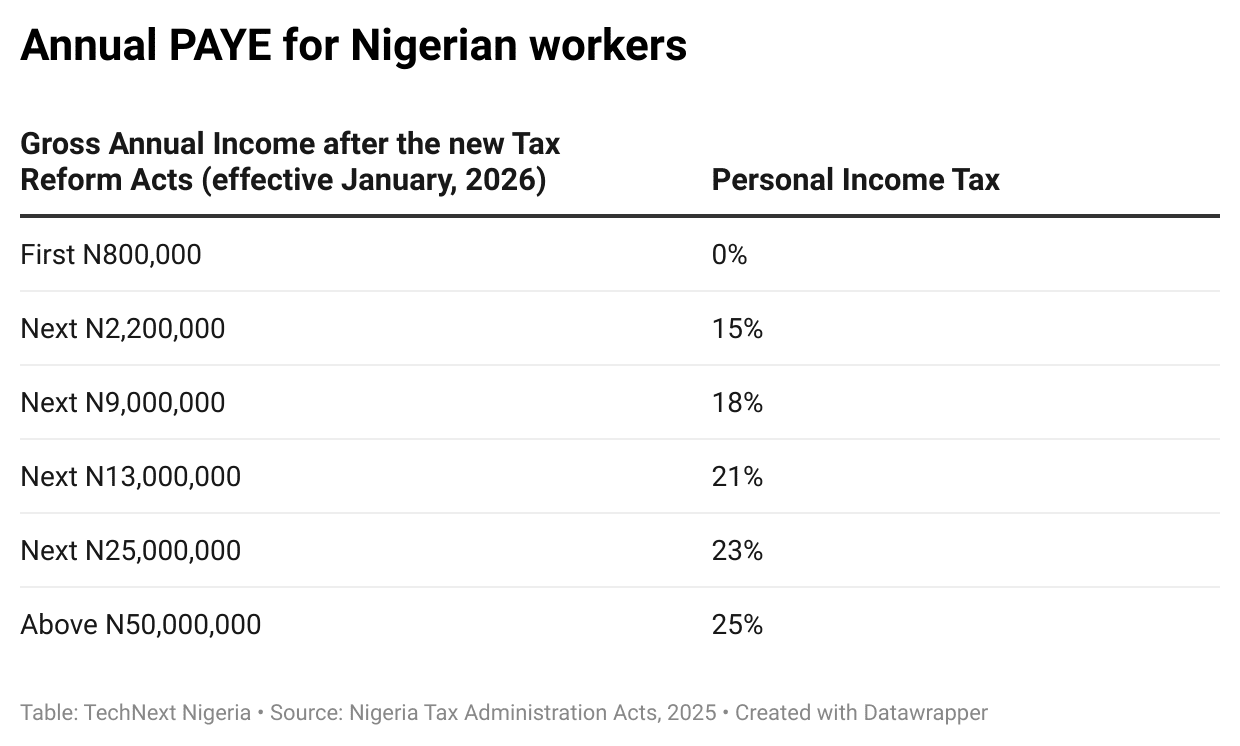

Under the new law, the first N800,000 of your GAI is tax-exempt.

You can legally reduce your taxable income by deducting expenses incurred for the purpose of earning that income, such as internet/Data subscriptions for work, software licenses, the cost of equipment essential for your work, and professional training/courses relevant to your skill.

Also note that the new law replaces the old Consolidated Relief Allowance (CRA) with a Rent Relief, calculated as the lower of N500,000 or 20% of your annual rent paid. Therefore, you’re eligible for a 20% relief if 20% of your annual rent is not more than N500,00.

Step 3: Apply the Progressive Tax Rates

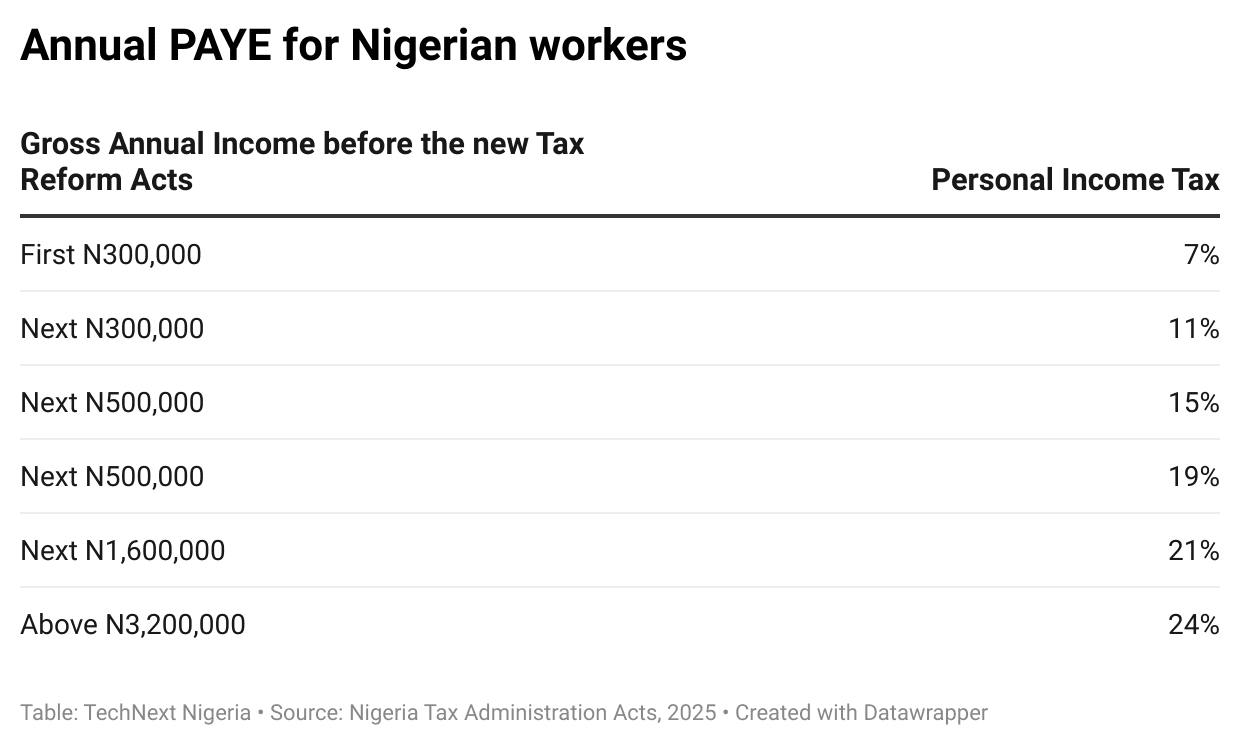

The tax is calculated in bands. You apply the corresponding rate to the portion of your Taxable Income that falls within each band.

Step 4: Calculate Total PAYE

The Presidential Reforms Committee launched a personal income tax calculator that simulates the rates that you must pay. This will allow you to compare and understand the potential impact on your income.

Access the calculator here.

For example (Hypothetical Taxable Income of N3,500,000):

- First N800,000: N800,000×0%=N0

- Next N2,200,000 (N3,000,000−N800,000): N2,200,000×15%=N330,000

- Remaining N500,000 (N3,500,000−N3,000,000): N500,000×18%=N90,000

- Total PIT Payable: N0+N330,000+N90,000=N420,000

Filing Requirement: As a remote worker/freelancer, you are considered Self-employed. You must file a Self-assessment income tax return with your relevant State Internal Revenue Service (SIRS) by March 31st of the following year.

Why pay PIT in 2026?

The necessity of paying Personal Income Tax (PIT), also known as PAYE, is that it is the primary engine of government function and a clear legal mandate. PAYEs are an essential revenue source for the government.

Failing to pay these taxes or engaging in tax evasion is a serious criminal offence that can lead to heavy financial penalties, often involving a fine of 10% or more on the unpaid amount.

For remote workers earning income from foreign companies, the recent tax reforms address the fear of double taxation. The law ensures fairness by ensuring that employment income will only be taxed in Nigeria if the individual is a resident or works in the country and isn’t paying elsewhere.

This means you won’t be taxed twice on the same income.

Paying is both a civic obligation that supports national development and a critical step in avoiding severe legal and financial consequences, while the clarified laws protect you from unfair deductions.

Overview of the 2025 Tax Reform Acts

Nigeria’s tax laws underwent a major overhaul in June 2025 with the enactment of four key reforms, which will largely take effect from January 1, 2026.

These new laws were designed to simplify administration, broaden the compliance base and improve government revenue collection. They also consolidated existing statutes for easy compliance by individuals and businesses.

The four new laws enacted are:

- The Nigeria Tax Act (NTA) consolidates existing laws into one statute.

- The Nigeria Tax Administration Act (NTAA) 2025 which creates a unified framework for tax administration.

- The Nigeria Revenue Service (Establishment) Act (NRSA): establishes a new national revenue body to replace the FIRS.

- The Joint Revenue Board (Establishment) Act (JRBA), which enhances coordination between revenue authorities and establishes dispute resolution mechanisms like the Office of the Ombudsman.

Actionable steps for freelancers and remote workers

To thrive under the new regime, freelancers and remote workers should:

- Stay informed: Monitor updates from the Nigeria Revenue Service, online news platforms like TechNext Nigeria, and subscribe to our newsletter for more updates.

- Register with state authorities: Obtain a Tax Identification Number and comply with state-specific requirements.

- Maintain detailed records: Use tools like QuickBooks or Expensify to track income, expenses, and deductions, ensuring audit readiness.

- Engage professionals: Consult experts to navigate complex laws and maximise deductions, as recommended by industry sources.

- Plan for liabilities: Set aside a portion of earnings in a dedicated savings account to cover payments.