MultiChoice’s new owner Canal+ to develop super app to unify DStv, Netflix, and more

MAJOR

MAJOR

D2D

D2D

AMB

AMB

GMIX

GMIX

CEO

CEO

MultiChoice’s new owner, Canal+, is developing a “super app” to consolidate DStv and Canal+ content. The app may also integrate access to popular third-party streaming services like Netflix, Apple TV+, HBO Max, and Paramount+.

Canal+ finalised its MultiChoice acquisition following a restructuring that satisfied South African regulatory requirements.

Canal+’s R125 ($7) per share cash offer was accepted by over 90% of MultiChoice shareholders, increasing Canal+’s stake from 46% to 94.36% and granting it near-total control. Canal+ will now utilise section 124(1) of the Companies Act to “squeeze out” the remaining shares.

The merged company boasts over 40 million subscribers across 70 countries, with a substantial presence in Africa, including 40 countries on the continent, making it one of the largest entertainment audiences there.

One app, all content

According to Canal+ CEO Maxime Saada, one of the company’s first moves will be to simplify how customers access its content.

“We want to make it as convenient and pleasant as possible for our subscribers to access all this great content from companies all over the world, as well as local sports and general entertainment,” Saada said.

He added that the long-term goal is to make all this content available through a single platform, a super app that combines all Canal+ and DStv services.

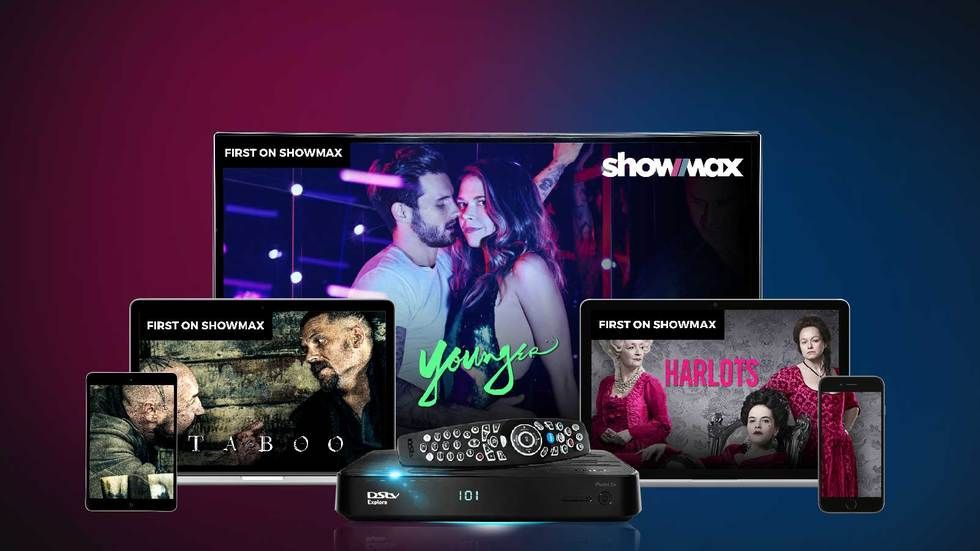

Canal+ and MultiChoice currently operate separate streaming platforms: Canal+ in French-speaking markets and MultiChoice with DStv Stream and Showmax in Africa. Canal+ is considering merging these services into a unified product under a single brand.

Canal+ could integrate its in-house content with external services, leveraging existing partnerships with major streaming providers like Apple TV+, HBO Max, Netflix, and Paramount+. This approach would allow customers in some regions to subscribe to multiple services through Canal+ with bundled discounts.

A unified app could simplify content discovery and management, streamline subscriptions, and create a central hub for African and international entertainment.

It’s unclear whether the super app will be branded as DStv, Canal+, or under a new name. While Canal+ doesn’t operate in South Africa, it competes with DStv in other African markets.

The future of Showmax

A key question is the future of Showmax, MultiChoice’s streaming service relaunched in 2024 in partnership with NBCUniversal, with MultiChoice holding a 70% stake and NBCUniversal owning 30%.

The relaunch, backed by a R4 billion ($231.36 million) investment from MultiChoice, featured a new platform based on Peacock’s streaming technology, enhanced video quality, and expanded content, resulting in improved user experience and increased subscriptions.

Since the relaunch, Showmax has become Africa’s third most-used streaming platform, behind Netflix and Amazon Prime Video, according to entertainment data firm Fabric.

Despite its success, Canal+ will review the Showmax joint venture, with Saada stating the company needs to fully understand the partnership before deciding its future.

“We know what’s public about Showmax, but not the details of the transaction, the economics, the investments,” Saada said. “We expect to make a decision in the next few weeks or months.”

Read also: Major milestones of Canal+’s $3.17bn Multichoice acquisition deal

This means that Showmax’s place in Canal+’s long-term streaming strategy is not yet certain. While Saada earlier said there were no plans to drop the Showmax brand, the ongoing review could lead to changes in how it operates or how its content is distributed.

If Canal+ decides to move away from Showmax, some of its content could be folded into the planned super app. Most of the local programming already airs on DStv channels, so integration would not be difficult.

How Canal+ could change Africa’s streaming market

The creation of a Canal+/DStv super app could mark one of the biggest shifts in Africa’s pay-TV and streaming space.

For millions of African viewers, this could mean easier, centralised access to local and international entertainment, streaming everything from Premier League matches to Netflix dramas on a single platform instead of juggling multiple apps and subscriptions.

The merger strengthens Canal+’s position against Netflix and Amazon’s expansion in Africa by creating a unified platform. This offers subscribers greater convenience, choice, and locally relevant content, improving retention.

The integration raises concerns regarding pricing, data sharing, and the visibility of local content. Showmax’s significant investment in African original productions, for example, prompts questions about the future of such projects under the Canal+ partnership.