Nigeria leads as stablecoins hit a record $283bn supply globally

TOKEN

TOKEN

2024

2024

2024

2024

TOKEN

TOKEN

USDC

USDC

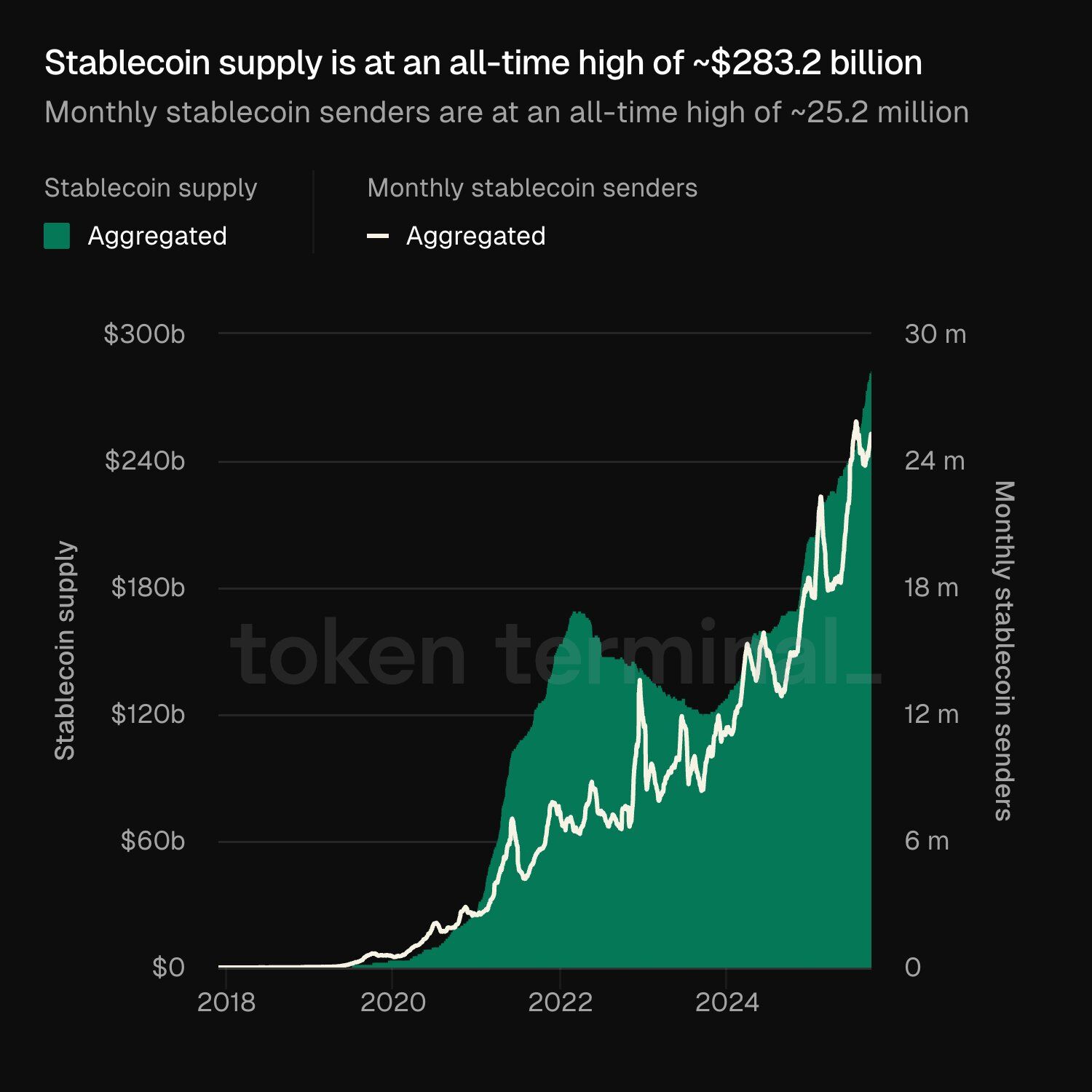

The stablecoin market has just broken several records at once. According to new data from Token Terminal, the total supply of stablecoins has reached an unprecedented $283.2 billion, while the number of monthly senders climbed to 25.2 million.

At the same time, startups building stablecoin projects have already raised over $621 million in 2025, a funding surge nearly seven times higher than last year’s total. But beyond the raw numbers, one story stands out: Africa, and Nigeria in particular, has become a major engine powering this unprecedented growth.

For years, stablecoins were dismissed as mere trading tools for crypto traders. Today, they are fuelling remittances, powering cross-border commerce, and everyday transactions across the Global South.

In Africa, where currency volatility, forex scarcity and high remittance fees have long frustrated consumers, stablecoins are filling gaps that banks and mobile money often can’t.

Yellow Card, in its recent report, noted that stablecoins account for 43% of crypto transaction volume in Sub-Saharan Africa, with Nigeria leading the continent’s largest stablecoin market with nearly $22 billion in transactions between July 2023 and June 2024.

Nigeria, Africa’s stablecoin trailblazer

For three years, Nigeria has consistently ranked among the world’s top adopters of digital assets.

With the naira under pressure and inflation eroding savings, millions of Nigerians are turning to dollar-backed tokens like USDT and USDC for stability and utility. Local fintechs are integrating stablecoins into wallets, payroll solutions, and even point-of-sale systems, making them a lifeline for small businesses and freelancers earning internationally.

According to Chainalysis’ latest Geography of Cryptocurrency report, the country received $92.1 billion in on-chain value between July 2024 and June 2025, nearly half of Sub-Saharan Africa’s total of about $205 billion.

This usage is reflected in global metrics: the record 25.2 million monthly senders is partly driven by African corridors, where remittances and cross-border trade rely heavily on stablecoin rails.

In Lagos, Nairobi, and Accra, crypto-savvy merchants now treat USDT payments as routine as cash or bank transfers.

Similarly, the funding boom also has African fingerprints. Startups across the continent are drawing investor attention for their ability to scale stablecoin-powered services quickly in markets hungry for alternatives to legacy banking.

Nigerian startups, often backed by global VCs, are experimenting with stablecoin remittances, decentralised lending, and payment APIs that plug directly into African e-commerce.

Also read: “Nigeria’s crypto adoption isn’t fading,”- Emmanuel Onuoha of Web3 Nigeria on latest ranking

While Hong Kong’s OSL Group made headlines with a $300 million raise in July, African innovators are quietly securing their own rounds, underscoring the global race to build on stablecoin infrastructure.

On the regulatory front, it’s pertinent to mention that the U.S. GENIUS Act has set a precedent for regulatory clarity, but its ripple effects are being felt in Nigeria and across Africa.

With clearer rules abroad, international partners are more confident in integrating stablecoins into African payment flows. Meanwhile, African regulators like Nigeria’s SEC, among others, are weighing their own frameworks to balance innovation with consumer protection.

Analysts remain divided. Coinbase researchers forecast a $1.2 trillion market cap by 2028, while J.P. Morgan tempers expectations at $500 billion.

Goldman Sachs calls 2025 the “Summer of Stablecoins”, highlighting their role not in dismantling banks but in modernising global financial plumbing.

Also read: Nigeria fuels Sub-Saharan Africa’s $205bn crypto surge despite slip in global ranking

For Africa, the picture is already clear: stablecoins are not abstract financial experiments; they are tangible tools solving daily problems. In Nigeria, they are helping households preserve value, businesses scale, and workers get paid across borders.

With record supply, record usage, and record funding, stablecoins are rewriting the rules of digital finance. And from Lagos to Nairobi, Africa isn’t just along for the ride but is helping drive the surge.