Nigeria’s power generation plants operated at 38% capacity in September

FCTR

FCTR

WHEN

WHEN

X

X

X

X

PLANT

PLANT

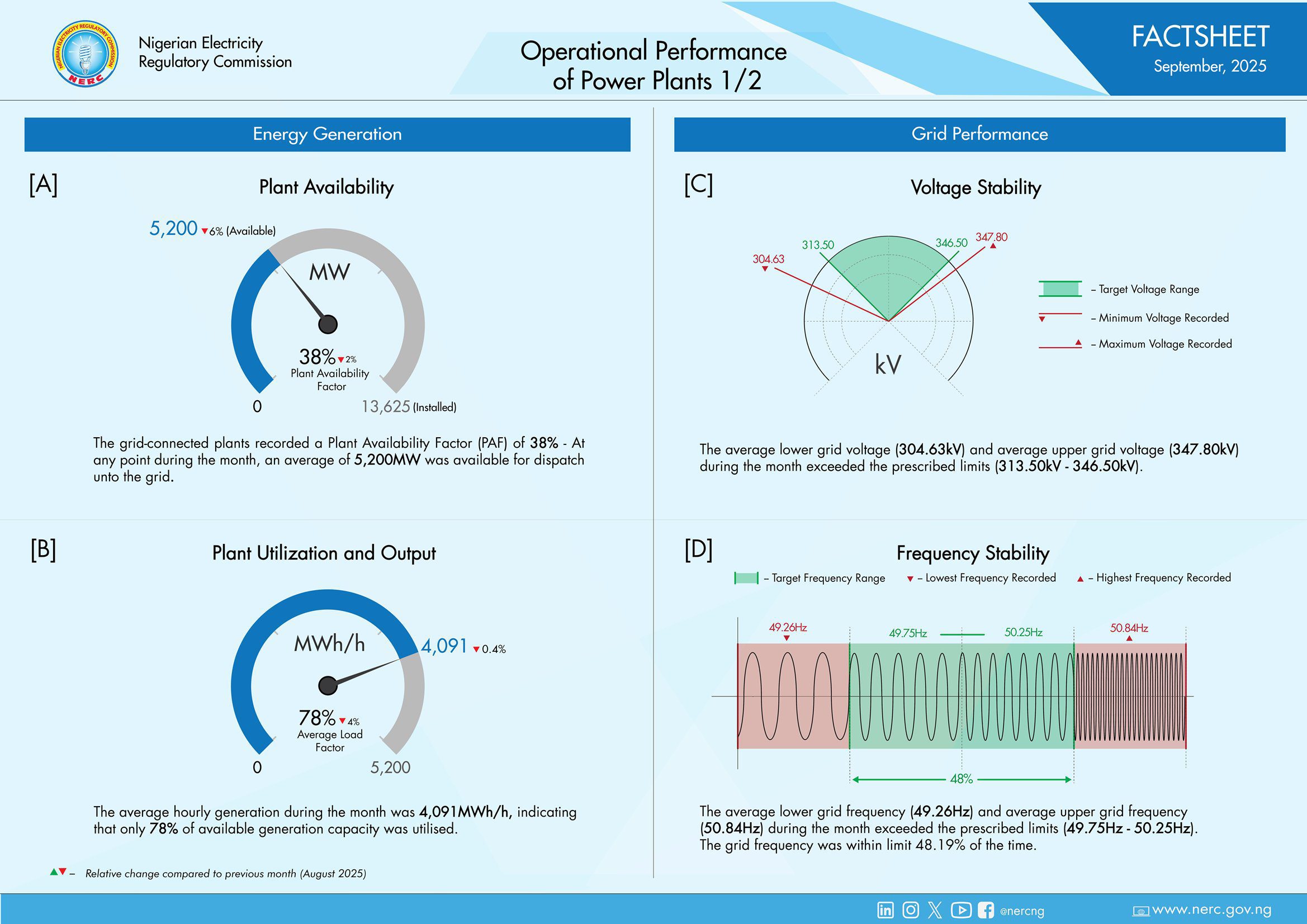

The national grid continues to face its familiar struggle with reliability and efficiency. The September 2025 Operational Performance Factsheet shared by the Nigerian Electricity Regulatory Commission on its official handle on X has revealed that grid-connected power generation plants operated at an average Plant Availability Factor (PAF) of just 38%. Meaning, less than half of the country’s installed capacity was actually available for dispatch.

From an installed capacity of 13,625 megawatts (MW), only about 5,200 MW could be generated on average in September, a figure that underscores the gap between Nigeria’s potential and its actual power delivery.

Still, when power was available, it was used efficiently. The report shows an Average Load Factor of 78%, indicating that most of the available power generation capacity was actively dispatched and consumed. In simpler terms, Nigerians are ready to use electricity; the problem lies in making it available in the first place.

Zungeru, Egbin, Kainji, and Jebba keep the grid afloat

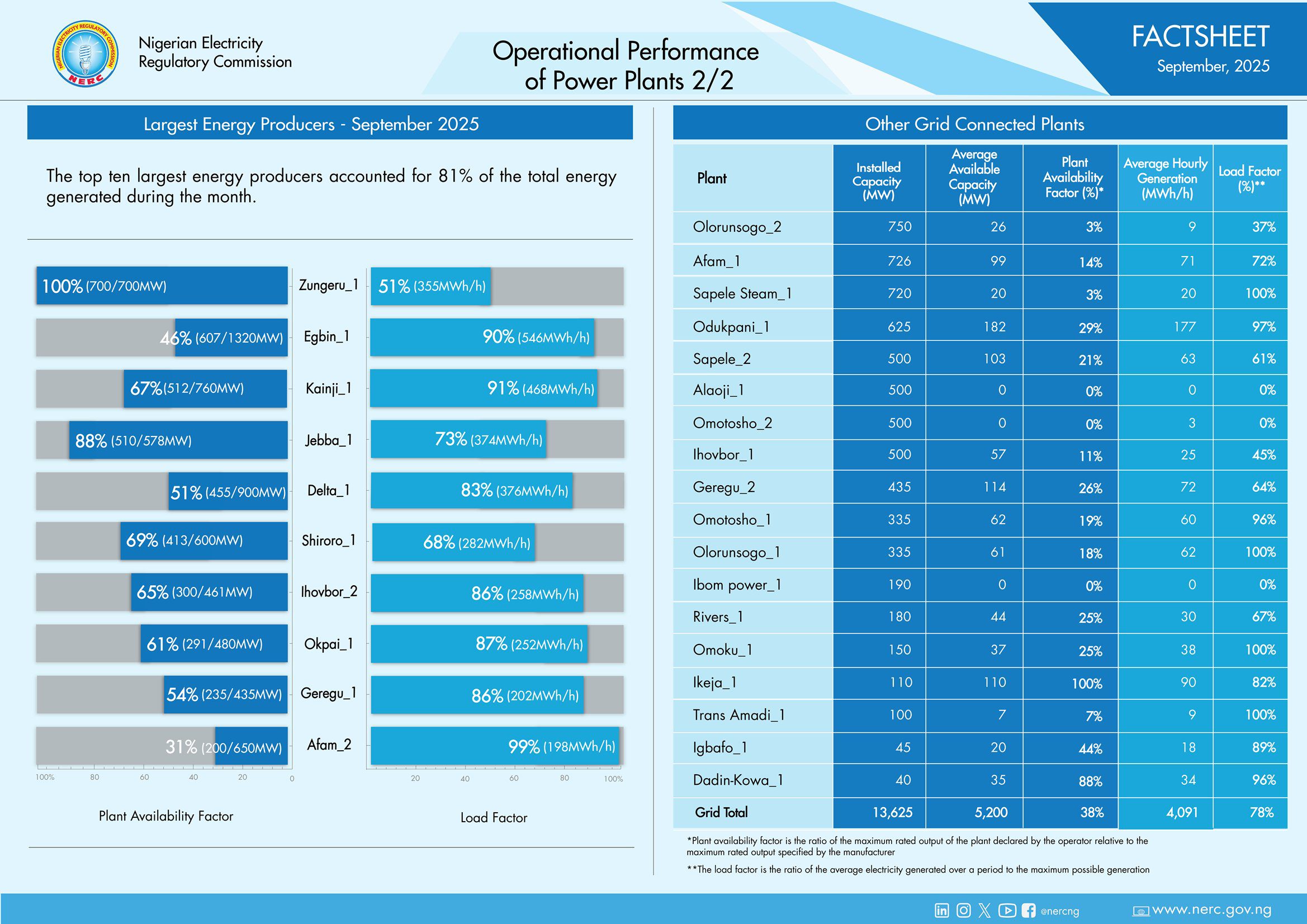

While the overall generation numbers remain disappointing, four power plants stood out for their strong performance: Zungeru, Egbin, Kainji, and Jebba.

Zungeru Hydropower Plant, one of the newest additions to Nigeria’s energy mix, continues to show promise. Since its launch, it has provided a stable source of hydropower that helps balance out the frequent gas supply issues affecting thermal plants.

Egbin Power Station, Nigeria’s largest thermal plant, also maintained steady output despite challenges with gas shortages and ageing infrastructure. The consistent performance from Egbin, alongside the hydropower contributions from Kainji and Jebba, provided much-needed stability to the national grid in September.

Together, these four plants carried much of the power generation burden, highlighting how dependent Nigeria’s power system has become on a handful of reliable facilities.

Also read: Eko Disco: All you need to know about the birth of Excel Electricity Distribution in Lagos

Meanwhile, the 38% availability factor paints a troubling picture. Nigeria’s 13,625 MW of installed capacity exists largely on paper, with much of it sitting idle due to a mix of gas supply disruptions, poor maintenance, equipment failures, and transmission limitations.

Despite government promises and ongoing reforms, the country still generates far less than what it needs to meet daily demand. For a population of over 200 million, an average available power generation of 5,200 MW is barely enough to power a handful of large cities, let alone drive industrial growth.

Energy analysts say Nigeria requires at least 20,000 MW of stable, available power to support sustainable economic development. Yet, the sector remains trapped in a cycle of underinvestment and systemic inefficiencies.

Load factor high, but consumers still in the dark

Interestingly, the 78% load factor is a bright spot in the report. It shows that when power generation capacity is available, the Transmission Company of Nigeria (TCN) and the distribution companies (DisCos) are effectively dispatching and utilising it.

In other words, the grid is using what it has, but there simply isn’t enough to go around. Many consumers continue to experience load-shedding, blackouts, and voltage fluctuations. Businesses rely on diesel or solar alternatives, further driving up operational costs in an already tough economic climate.

This “efficiency in scarcity” highlights how Nigeria’s grid is operating near its limits. It’s not wasteful, it’s starved.

Ultimately, with the September numbers now public, calls for comprehensive power sector reform are getting louder. Stakeholders are pushing for urgent action to improve gas supply reliability, plant maintenance, and sector liquidity.

There’s also growing support for diversifying the energy mix. Hydropower plants like Zungeru, Kainji, and Jebba have proven to be more resilient and cost-effective. Energy experts are also urging the government to expand investment in renewables, mini-grids, and embedded generation, which could take pressure off the national grid while improving rural electrification.

The September 2025 factsheet is both revealing and frustrating. It shows a country with enough installed capacity to push it to energy sufficiency, yet one that continues to underperform due to systemic failures.

Still, the performance of leading plants like Zungeru and Egbin offers a glimmer of hope. They show that where investment, management, and maintenance align, Nigeria’s power plants can deliver consistent output.

For now, the story of Nigeria’s electricity grid remains a tale of contrast, of potential and paralysis, of efficiency amid scarcity, and of an energy sector still trying to bridge the gap between darkness and development.