Paxos accidentally mints $300 trillion in PayPal stablecoins, more than double world’s GDP

ETH

ETH

STABLE

STABLE

DOLLAR

DOLLAR

USDP

USDP

WHEN

WHEN

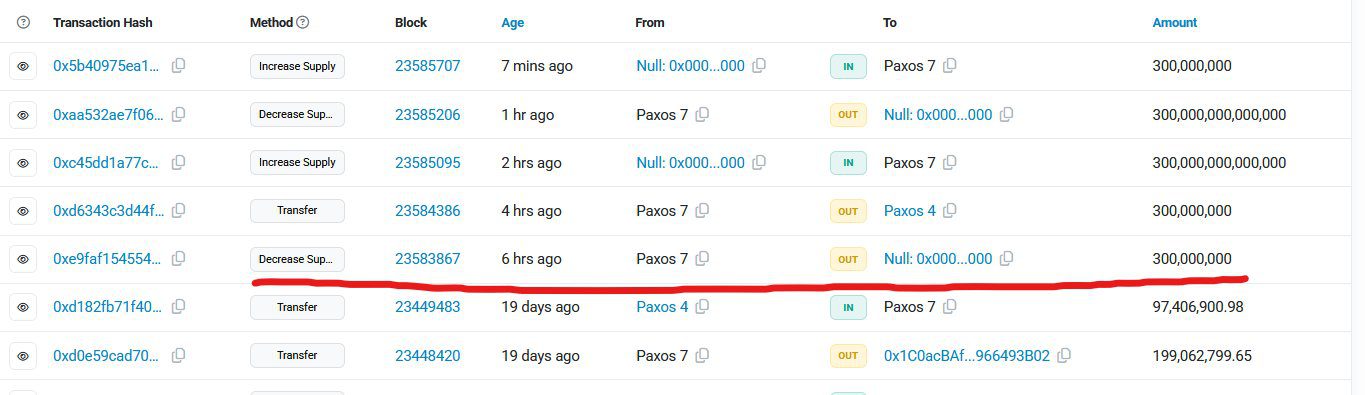

Stablecoin issuer Paxos mistakenly created 300 trillion tokens of PayPal’s PYUSD on the Ethereum blockchain on Wednesday. The amount dwarfs the global economy. It represents a sum larger than twice the world’s annual GDP. Paxos says the mint was an “internal technical error” and that the tokens were quickly destroyed.

According to on-chain data, the tokens were created in a single Ethereum transaction before being swiftly sent to a burn address, effectively erased from circulation. Paxos later said the event was an “internal technical error” that occurred during a routine transfer and insisted that no customer funds were affected.

The company, in a post on X, explained, “At 3:12 PM EST, Paxos mistakenly minted excess PYUSD as part of an internal transfer. Paxos immediately identified the error and burnt the excess PYUSD.”

“This was an internal technical error. There is no security breach. Customer funds are safe. We have addressed the root cause,” the company added.

The sheer size of the mistake made it one of the most eye-popping blockchain blunders in recent memory and quickly drew attention across social media. Blockchain watchers spotted the mint almost instantly, and screenshots of the 300 trillion figure spread like wildfire. Paxos, which also issues the Pax Dollar (USDP), scrambled to clarify that the incident was “an internal ledger error” and had been fully resolved within minutes.

Paxos’ minting error that broke the internet but not the system

The absurdity of the numbers is what made this story blow up. At $1 per PYUSD, the accidental mint would have produced $300 trillion worth of stablecoins, dwarfing the entire world economy, which hovers around $120 trillion by IMF estimates.

Within about half an hour, the company burnt the tokens and issued a statement calling it an internal systems issue, not a hack.

Despite the dramatic figures, the market impact was surprisingly mild. On-chain data shows PYUSD briefly wobbled off its $1 peg by about 0.5%, but trading soon normalised. DeFi protocols like Aave temporarily froze PYUSD transactions out of caution, highlighting how interconnected the crypto ecosystem has become and how fast it reacts to anomalies.

For PayPal, which launched PYUSD last year as its flagship entry into crypto payments, the incident is an awkward moment. The company has marketed PYUSD as a transparent, regulated stablecoin, one backed 1:1 by U.S. dollar reserves and issued by a New York-regulated trust company.

This glitch doesn’t challenge that backing directly, but it raises questions about operational controls and auditing at Paxos, the firm trusted to keep things steady.

Blockchain transparency and the cost of human error

One ironic twist in this story is that the same transparency that exposed the blunder also proved the fix worked. Every mint and burn event on Ethereum is public. So when Paxos minted 300 trillion tokens, everyone saw it. And when they burnt them, everyone saw that too.

This dual visibility, both a spotlight and a safety net, underscores the fragile balance of trust in modern finance. Even in a system built on a code, humans still press the buttons. And occasionally, those buttons mint a few hundred trillion dollars by mistake.

Crypto analyst Adam Cochran called it “a fat-finger moment of historic scale,” noting that it’s not the first time token issuers have made errors during internal tests. But given Paxos’ role as PayPal’s official blockchain partner, the stakes are much higher.

The error, Cochran said, “shows that centralised control over minting, even in a transparent system, can still go wrong, and that’s something regulators will care about.”

Regulators are already watching Paxos closely. Earlier this year, the company faced pressure from the U.S. Securities and Exchange Commission over its Binance-branded stablecoin, BUSD. Now, with the PayPal partnership under scrutiny, this glitch adds fuel to the debate about whether even regulated stablecoins are truly risk-free.

For everyday users, nothing was lost. No wallets were drained. No market collapsed. But the reputational hit is real. Trust, the most valuable currency in finance, doesn’t burn as easily as tokens do.

Paxos insists it has since fixed the root cause of the glitch and strengthened its safeguards. But as stablecoins become increasingly central to digital payments and DeFi ecosystems, even the appearance of instability can rattle confidence.

The irony is hard to miss. In trying to move money more efficiently through code, Paxos reminded the world that human oversight still matters, maybe more than ever.

If nothing else, this episode will go down as a bizarre footnote in the history of digital finance: the day someone accidentally created $300 trillion out of thin air, realised it within minutes, and deleted it just as fast.

It’s a story only crypto could produce, and one the industry won’t be in a hurry to forget.