Ripple CEO hails billion-dollar XRP win

CNR

CNR

BRAD

BRAD

XRPETF

XRPETF

XRP

XRP

CEO

CEO

Ripple CEO Brad Garlinghouse recently highlighted how U.S. spot exchange-traded funds (ETFs) tied to XRP have become the fastest offering to hit $1 billion in assets under management (AUM) since Ethereum (ETH) ETFs.

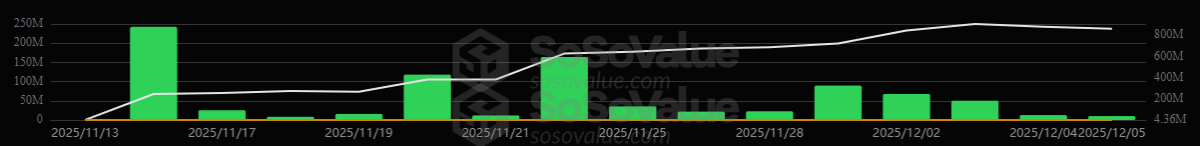

As per the on-chain analytics platform SoSoValue, spot XRP ETFs have recorded the cumulative total net inflow of $897.35 million as of Dec. 5.

- Canary XRP ETF (Nasdaq: XRPC): $363.85 million

- Grayscale XRP Trust ETF (NYSE: GXRP): $211.85 million

- Bitwise XRP ETF(NYSE: XRP): $187.14 million

- Franklin XRP ETF (NYSE: XRPZ): $134.50 million

Garlinghouse said there is a "pent up" demand for crypto regulated crypto products. The Vanguard Group's plan to allow crypto exposure via its products, digital assets are now accessible to millions of people, he highlighted.

The CEO also underlined that longevity, stability and community are all underrated themes that matter to this new set of “offchain” crypto holders.

Canary Capital CEO Steven McClurg said his fund identified the strong institutional demand for XRP.

He also asked his followers to watch out for RLUSD, Ripple's stablecoin, whose growth he said is closely related to that of XRP.

We are very humbled to be a part of this. I spent the majority of my career managing institutional money, and Canary identified the strong institutional demand for XRP.

— Steven McClurg (@stevenmcclurg) December 8, 2025

Watch RLUSD blow past other stable coins under the guidance of Brad and the Ripple team.

The growth of the two… https://t.co/8wlZ5Kx6UL

Spot Bitcoin (BTC) ETFs, launched in January 2024, have accumulated $57.62 billion in cumulative total net inflow. With $62.52 billion, BlackRock (NYSE: BLK) led the pack.

For spot Ether ETFs, launched in July 2024, the figure stood at $12.88 billion. BlackRock, with $13.09 million, again led the charge.

More News:

- Ripple CEO makes bold new Bitcoin prediction

- Ripple CEO issues harsh warning on online scams this Christmas

- Ripple CEO says ‘turkey trot’ for XRP ETFs starts now

Crypto market fails to recover

The total crypto market cap stood at $3.08 trillion at the time of writing, down 0.8% in the last 24 hours.

BTC was trading at $90,303.14 at press time, down 1.2%. ETH was exchanging hands at $3,123.77, down 0.5%.

Though XRP attempted to recover, it failed despite best efforts. It was trading at $2.08, down 0.5% in a day.

Related: How Ripple's XRP defied the odds to dominate the crypto market with a 300% surge