Solana hits record $126B market cap as Bitcoin reclaims $116K in major crypto rally

SHIFT

SHIFT

SOL

SOL

BTC

BTC

BNB

BNB

CIN

CIN

Solana (SOL) has cemented its position as one of the most rapidly rising cryptocurrencies in 2025, surpassing Binance Coin (BNB) to become the fifth-largest digital asset by market capitalisation. Its market cap surged above $126 billion, marking a new record high. This comes as Bitcoin reclaimed $116,000, reinforcing the overall bullish sentiment in the crypto market.

Solana’s rally has been fuelled by a combination of investor enthusiasm, on-chain growth, and increased institutional interest. Over the last week, Solana has gained traction as transaction volumes and developer activity on the network have increased. Investors are channelling funds to high-growth Layer-1 blockchains, and Solana has emerged as the biggest beneficiary of this trend.

In addition to market speculation, real adoption is helping Solana grow. The blockchain has seen an increase in demand for decentralised finance (DeFi) projects and non-fungible token (NFT) platforms, which benefit from its high throughput and low transaction costs.

Analysts say that consistent inflows into Solana-related investment products are also driving demand. In recent weeks, digital asset funds tracking SOL have experienced consistent inflows, indicating that institutional investors are betting big on Solana.

Shift from BNB to SOL

For years, Binance Coin ranked fifth in the crypto rankings, thanks to the dominance of Binance’s exchange ecosystem. However, Solana’s meteoric rise has upended that order. The shift reflects a shift in investor preference for ecosystems that promise scalability and greater decentralisation.

Also read: Nigeria fuels Sub-Saharan Africa’s $205bn crypto surge despite slip in global ranking

BNB continues to be a significant player, punching above its weight and recently setting a new all-time high, but Solana’s ecosystem has grown faster in relative terms.

Its growing transaction throughput, vibrant developer base, and expanding DeFi ecosystem provide a competitive advantage. This momentum has now translated into market capitalisation dominance, with SOL surpassing BNB in a symbolic but significant move for the cryptocurrency industry.

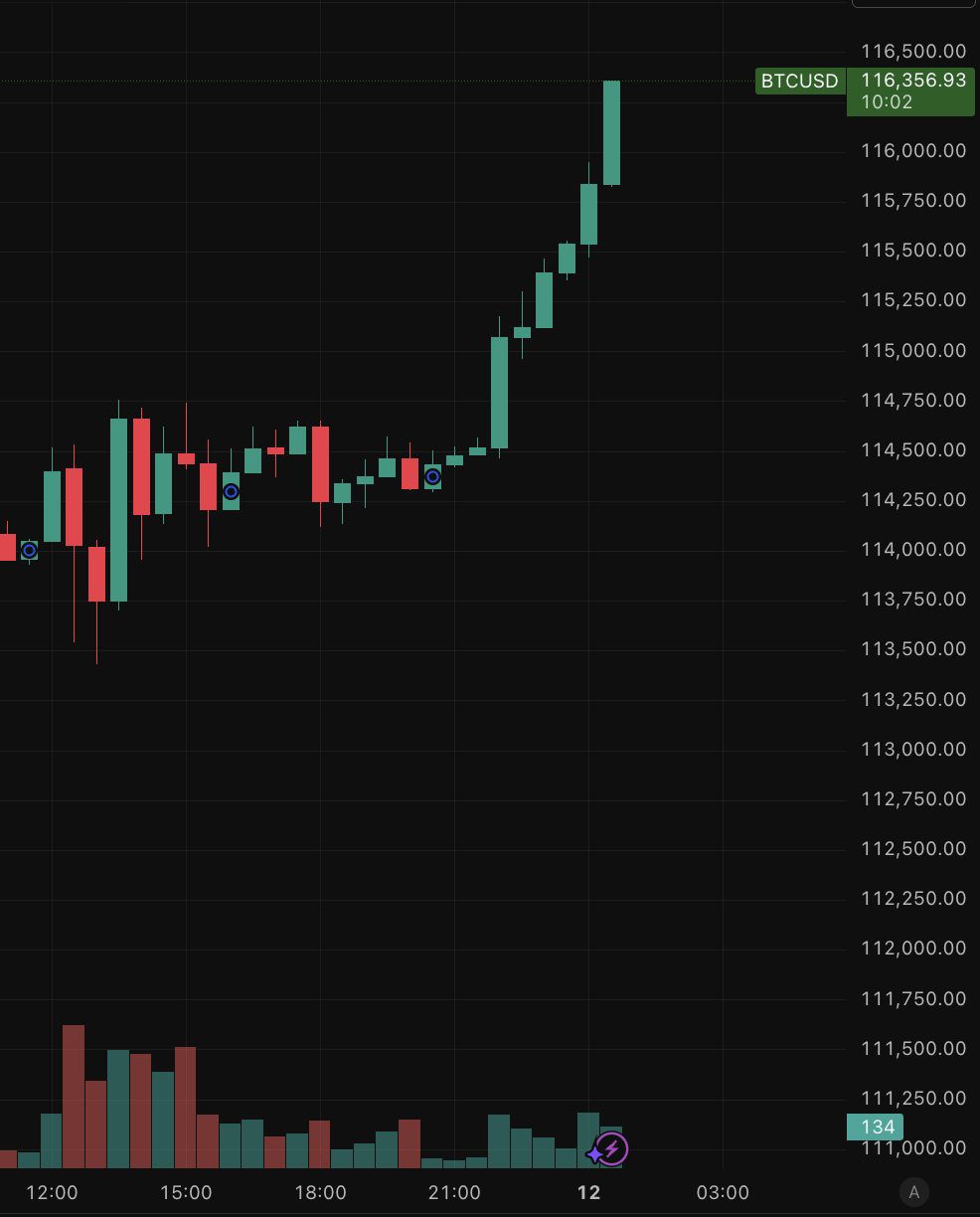

Bitcoin claims $116,000

While Solana was making headlines, Bitcoin made a strong comeback, crossing back above the $116,000 level. This move comes at a critical juncture for the world’s largest cryptocurrency, which has been on a rollercoaster of historic highs, corrections, and consolidation over the last few months.

Several factors have fuelled Bitcoin’s rally. Signals from the US Federal Reserve’s rate cuts may be considered to have revived optimism in risk asset markets.

Historically, lower interest rates have made non-yielding assets such as Bitcoin more appealing to investors. Exchange-traded funds (ETFs) have also fuelled institutional demand, with inflows reflecting rising confidence in Bitcoin as a store of value.

On-chain data shows Bitcoin consolidating within a significant trading range of $110,000 to $116,000. Buyers have consistently stepped in during dips, establishing a solid support base. If Bitcoin maintains its position above this level, analysts believe the next leg of the bull run could be on the way.

A broader market revival

The rise in both Solana and Bitcoin indicates a broader revival in the crypto market. Altcoins have been one key beneficiary of increased investor confidence in the market. Ethereum, XRP, and other major digital assets have all seen recent gains.

According to market observers, capital rotation is a factor here. As Bitcoin’s price stabilises at higher levels, investors typically begin to invest in alternative assets with greater growth potential.

Solana, with its strong technical fundamentals and expanding ecosystem, has been one of the most significant beneficiaries of this rotation.

Despite the bullish sentiment, risks persist. Profit-taking among short-term investors is already evident, and sharp corrections are possible if momentum weakens.

The global macroeconomic climate continues to exert influence on the market. Inflation data, central bank decisions, and regulatory actions will all play a role in shaping the trajectory of digital assets in the months ahead.

Maintaining Solana’s momentum will require more than speculative buying. The network must continue to be stable, with high developer activity and strong user adoption across DeFi, gaming, and NFT projects. Any setbacks may dampen investor enthusiasm.

Solana’s leap past BNB into fifth place by market cap, combined with Bitcoin’s return to $116,000, reflects a renewed wave of optimism in the crypto market. These developments demonstrate both growing confidence in Solana’s ecosystem and Bitcoin’s enduring strength as the market leader.

If these assets can maintain their current levels, the crypto bull market could enter a new phase.