SpaceX, ByteDance, OpenAI lead the world’s most valuable startup in 2025

AI

AI

UTED

UTED

F

F

MUSK

MUSK

MUSK

MUSK

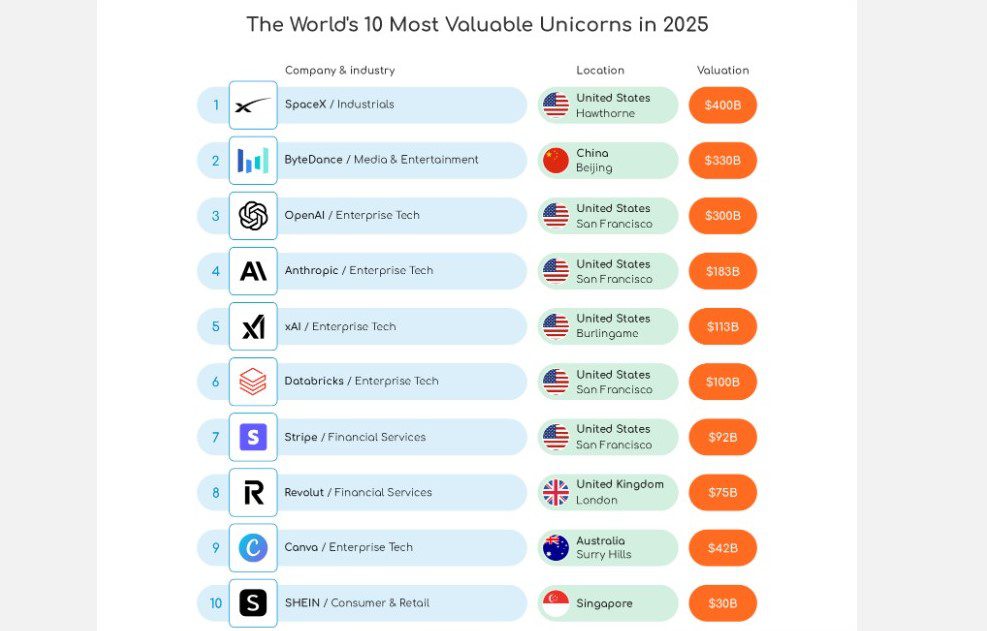

Starlink’s SpaceX, TikTok’s ByteDance and ChatGPT’s OpenAI have emerged among the top 10 most valuable private companies/startups in 2025. This is according to a report by BestBrokers, which compiled findings from CB Insights and data from PitchBook.

The September 2025 report analysed the list of unicorns (private startups with at least $1 billion valuation) as of early July 2025. According to BestBrokers, findings revealed that the most valuable startups are those using innovations and scalable technology to solve everyday issues.

“The most valuable private companies today are also the ones most capable of converting breakthrough technology into steady revenue,” it said in the report.

SpaceX, Elon Musk’s rocket and satellite company, emerged as the most valuable company with a $400 billion valuation. From $350 billion in December 2024, the company reached $400 billion through an insider share sale.

The company has continued to grow rapidly, with projected significant revenue for 2025 and the expansion of Starlink worldwide. It recently acquired a wireless spectrum license from EchoStar to expand Starlink’s satellite network and direct-to-cell 5G services.

Behind SpaceX is TikTok’s ByteDance with $330 billion. Despite facing regulatory challenges in the United States, the Chinese company has remained a global leader in media and entertainment, with other holdings including Douyin, Capcut, and Lemon8.

Sam Altman’s OpenAI is the third-most valuable private company at a $300 billion valuation. A top contribution to this mark is the $40 billion funding round raised in April 2025. The funding is the largest private tech funding in history, led by SoftBank and co-funded by many other investors.

The ChatGPT owner is set to restructure into a for-profit entity, a move that has birthed a court case with co-founder Elon Musk. A successful transition will likely see an IPO that targets a $500 billion valuation.

Coming fourth with a $183 billion valuation is Anthropic. The AI research lab hit that valuation early this month when it raised $13 billion in a Series F funding round led by ICONIQ Capital. The U.S.-based company, backed by a number of investors, is the brain behind Claude, a next-generation AI assistant.

Another Elon Musk company, xAI, completes the top 5 at $113 billion. The acquisition of Twitter (now X) saw the merger of the AI startup with the social media platform. A $300 million employee share sale, plus raising $5 billion from investors, boosted its valuation to $113 billion.

Other private companies in the top ten are:

- Databricks – $100 billion

- Stripe – $92 billion

- Revolut – $75 billion

- Canva – $42 billion

- SHEIN – $30 billion

In total, the world’s 10 most valuable startups have a combined worth of $1.665 trillion.

Also Read: Paystack, Trendybeatz, Google top most visited websites by Nigerians in August 2025.

On a location basis, 60% of the companies are based in the United States. This further reinforces the U.S. as a powerhouse in technology and AI advancement across the world, all thanks to its well-established venture capitalist system and legal protection for investors.

China, the United Kingdom, Singapore and Australia hold 1 company each in the top 10 ranking.

Startups and the new focus on AI and Tech

Artificial intelligence and technology have continued to be a global driving force, with many of the world’s 10 most valuable private companies being AI-focused companies. This focus on artificial intelligence is behind their significant rise and interest from investors.

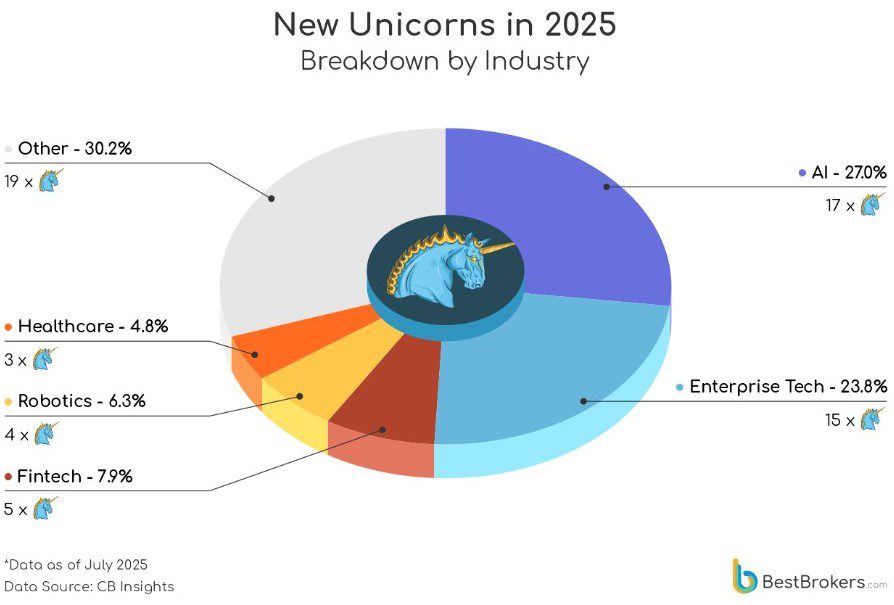

According to the report, venture capitalists are increasingly focusing on companies that focus on AI and fintech. This has seen most capital flow into the coffers of companies that demonstrate the adoption of tech ideas into sustainable, large-scale businesses.

“In 2025, venture investors are far more cautious, backing fewer companies and focusing their capital on sectors such as AI, fintech, and enterprise tech, where demand and monetisation are proven,” it said.

Furthermore, out of all 63 private companies that reached unicorn status so far in 2025, 17 are AI companies, representing 27% of the total. Enterprise tech followed closely with 15 startups and 23.8% market share.

Others are:

- Fintechs: 5 (7.9%)

- Robotics: 4 (6.3%)

- Healthcare: 3 (4.8%)

- Others: 19 (30.2%)

Furthermore, artificial intelligence is significantly pushing startups in their valuation.

The report revealed that more companies have climbed to ‘ultra-unicorns’ status (worth $5 billion or more) in 2025. Not only that, there are now more startups valued at over $100 billion (hectocorns) than ever before.

Notably, the development reveals the continued rise of AI and its integration into every phase of technology. Startups are also leveraging AI-powered models to boost productivity and returns.