UniLag says no new increase in fees, only NELFund integration

INSURANCE

INSURANCE

xPort

xPort

PORTAL

PORTAL

PORTAL

PORTAL

WHEN

WHEN

The University of Lagos (UNILAG) has denied reports that it increased tuition or other mandatory charges for undergraduate students. The school stated that the recent adjustments visible on students’ portals are not a new fee hike, but rather part of a directive from the Nigeria Education Loan Fund (NELFund) to consolidate all payable charges into a single system.

The clarification followed concerns raised by students earlier this week after noticing what appeared to be upward changes on their portals. Many feared another fee increment, especially given the current cost-of-living pressures facing students and their families.

UniLag’s Communication Unit Head, Adejoke Alaga-Ibraheem, clarified that the updated fees are a restructuring, not an increase. She stated that these figures represent the combined faculty and departmental dues, now paid as a single payment, as directed by NELFund.

What actually changed on the portal

Payment advice slips from returning students showed adjusted charges and new categories under the consolidated system, despite no major tuition increase.

For example, departmental and faculty dues, which were previously around ₦2,000, are now listed as ₦15,000 on the student portal. Similarly, the UniLag Tertiary Institutions Social Health Insurance Programme (TISHIP) rose from ₦5,000 to ₦7,500.

New line items also appeared, including:

- Entrepreneurship fee – ₦5,000

- Portal maintenance – ₦15,000

- Student insurance policy – ₦1,250

- Student support services – ₦1,250

- Professional services – ₦7,500

- General Studies (GST) – ₦5,000

These figures sparked confusion as students questioned how there could be no fee increase when new categories were clearly visible.

The university maintains that these fees, previously collected informally by departments or faculties, are not new. UniLag states that formalising them through the official system will increase transparency and ensure proper accounting within the NELFund process.

Why the NELFund directive matters

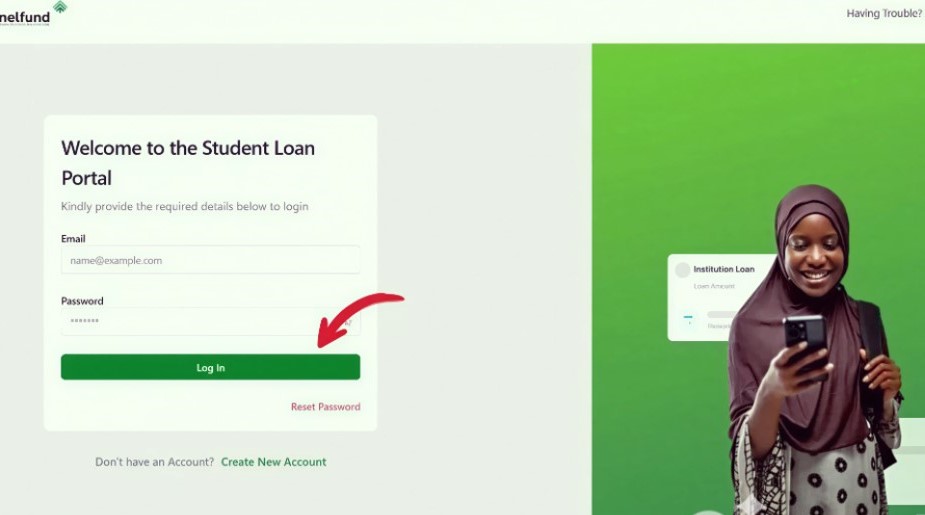

NELFund, which provides interest-free loans to Nigerian students, has instructed higher institutions to consolidate all payments onto a single platform. This aims to simplify the loan application process by enabling students to present a single, comprehensive bill encompassing all legitimate dues.

Previously, many schools, including UniLag, had students pay some charges directly to their faculties or associations, which were not reflected on the central portal. This fragmented system often created difficulties for students seeking loans or refunds since not all payments could be verified under the central university system.

UniLag said the restructuring is, therefore, in line with NELFund’s requirement for full transparency. By integrating all legitimate payments, it hopes to help students access funding that covers the total cost of schooling.

“What we have done is in the best interest of the students so that when they apply for NELFund, they get funding that covers every bill they pay in school through a central system, which will also eliminate all other forms of payment outside the official portal”. Alaga-Ibraheem explained.,

Despite the university’s clarification, some students remain skeptical. Many believe that the integration process has indirectly resulted in higher costs, especially for returning students who did not pay these combined fees during the previous session.

For example, the jump from ₦2,000 to ₦15,000 in faculty and departmental dues has raised concerns about affordability. Others worry about timing, as the adjustment coincides with rising living expenses and the approaching registration deadlines.

Read also: OpenAI partners UNILAG to launch Africa’s first OpenAI academy

However, school officials maintain that the restructuring was not meant to burden students but to simplify payment and make it easier to qualify for educational loans.

What happens next

The clarification comes as more Nigerian universities begin implementing NELFund’s integration model. This move signals a nationwide shift toward centralized payment systems, which could reshape how student finances are handled.

For students, it means every charge, tuition, health insurance, departmental fees, and student services, will now be processed through one transparent portal. This would prevent double payments and unauthorized levies, but it also raises new questions about affordability and accountability.

The Ministry of Education and NELFund are expected to issue more detailed guidelines on how universities should structure their fees under the new framework. Meanwhile, UniLag says it will continue engaging students to explain the changes and ensure the process runs smoothly.