Wall Street sells Bitcoin ahead of Fed's key decision

DJT

DJT

ETF

ETF

BTC

BTC

DON

DON

TRUMP2024

TRUMP2024

Crypto markets are edging up but still look fragile. The global crypto market cap sits around $3.18 trillion, up about 0.9% on the day, with Bitcoin near $90,500 and Ethereum around $3,130.

Gains remain modest compared with traditional stocks. Bitfinex analysts recently warned that BTC is showing “relative weakness” versus U.S. equities as spot demand softens and investors grow more sensitive to macro shocks.

Related: JPMorgan’s Jamie Dimon sends harsh response to debanking allegations

Bitcoin ETF outflows flash warning into FOMC week

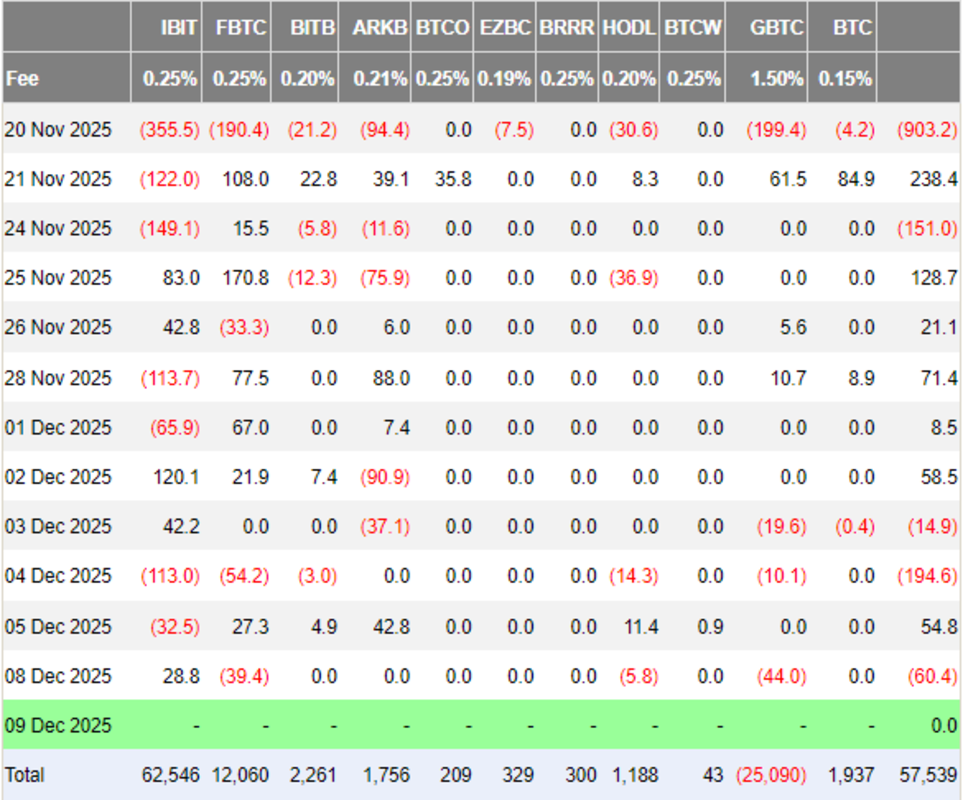

Flows into U.S. spot Bitcoin ETFs have cooled ahead of this week’s Federal Reserve decision.

Data compiled by Farside Investors shows several sizeable net outflow days over the past three weeks, including $903 million on Nov. 20, roughly $195 million on Dec. 4 and another $60 million on Dec. 8.

Whether it's BlackRock’s IBIT, Fidelity’s FBTC, or Grayscale’s GBTC, none escaped the heat.

This recent selling has reinforced the “fragile setup” Bitfinex highlighted, with traders using strength to reduce exposure rather than add risk.

Why a December Fed rate cut matters for Bitcoin

Attention now turns to the Fed’s Dec. 10 meeting, where futures markets imply roughly a 90% chance of a 0.25% rate cut.

A cut of this size would generally lower borrowing costs across the economy—including mortgages, credit cards and business loans—helping ease overall financial conditions.

Cheaper credit typically supports risk assets, as investors and businesses find it less costly to deploy capital.

More News:

- Analyst warns XRP is forming a death cross

- Ethereum edges higher as Wall Street returns on fresh inflows and corporate buying

- Trump’s national security strategy skips Bitcoin and blockchain

Lower rates can also encourage companies to hire and invest more freely, improving the job market over time. The trade-off is that savers holding cash or short-term deposits would likely see reduced yields, as interest paid on those products tends to fall when policy rates decline.

Politics are adding extra pressure. Multiple social media reports, citing Reuters, quoted U.S. President Donald Trump as saying that “immediate rate cuts” are a requirement for the next Fed chair, underscoring the White House’s push for dovish monetary policy.

Analyst maps ‘final sweep’ scenario toward $78K-$82K

Crypto trader Michaël van de Poppe, CIO and founder at MN Trading, sees Fed's Wednesday decision as a potential turning point.

In a post, he called $92,000 the “crucial level” for Bitcoin, warning of a “relatively harsh rejection” there and a hawkish press conference from Fed Chair Jerome Powell potentially triggering a classic “sell-the-news” move.

Van de Poppe outlined a scenario where BTC sweeps the lows one final time in 2025, dropping toward $78,000–$82,000 before sharply reversing higher.

His accompanying chart shows an alternative path in which a clean breakout above $92,000 could open the way toward resistance just above $100,000, but only if buyers step back in with conviction.

For now, Bitcoin sits in the middle of that range, with ETF flows, Fed policy and macro nerves all converging around one decision this week.

Related: Bernstein reveals new Bitcoin target amid market pullback