Why Bitcoin Treasuries Are Trading at a Discount

MTPLF

MTPLF

BTC

BTC

ETF

ETF

WHEN

WHEN

NRVE

NRVE

TL;DR:

- Net capital inflows into Bitcoin totaled $661B since January 2024, with US spot ETFs acquiring approximately 5.2% of that flow, while FASB fair value accounting (effective 2025) eliminated impairment-only treatment that distorted corporate Bitcoin holdings on balance sheets.

- Strategy owns 650K BTC (3% of total supply) as of December 2025, built through convertible debt with 0%-2.25% coupons and equity issuance at premiums to NAV.

- KindlyMD merged with Nakamoto Holdings in August 2025, raised $763M, purchased 5.7K BTC, then crashed 54% in September when execution failures destroyed investor confidence.

- Most treasury companies now trade below NAV (Strategy mNAV: 0.856), compressed by Fed rates at 3.75%-4%, direct ETF competition, and governance concerns.

- December 2025 Fed rate cut (80% odds) and M&A consolidation may stabilize discounts, but buybacks risk converting treasuries from net buyers to net sellers.

Corporate treasurers have spent a century optimizing the same trade-off: safety against yield. Cash earns nothing but stays liquid. Bonds pay coupons but lock duration. Equities promise growth but invite volatility. The result has been a predictable allocation pattern across industries. Working capital sits in money markets. Strategic reserves rotate between short-term Treasuries and investment-grade credit. Boards approve these choices without debate because the alternatives have always looked worse.

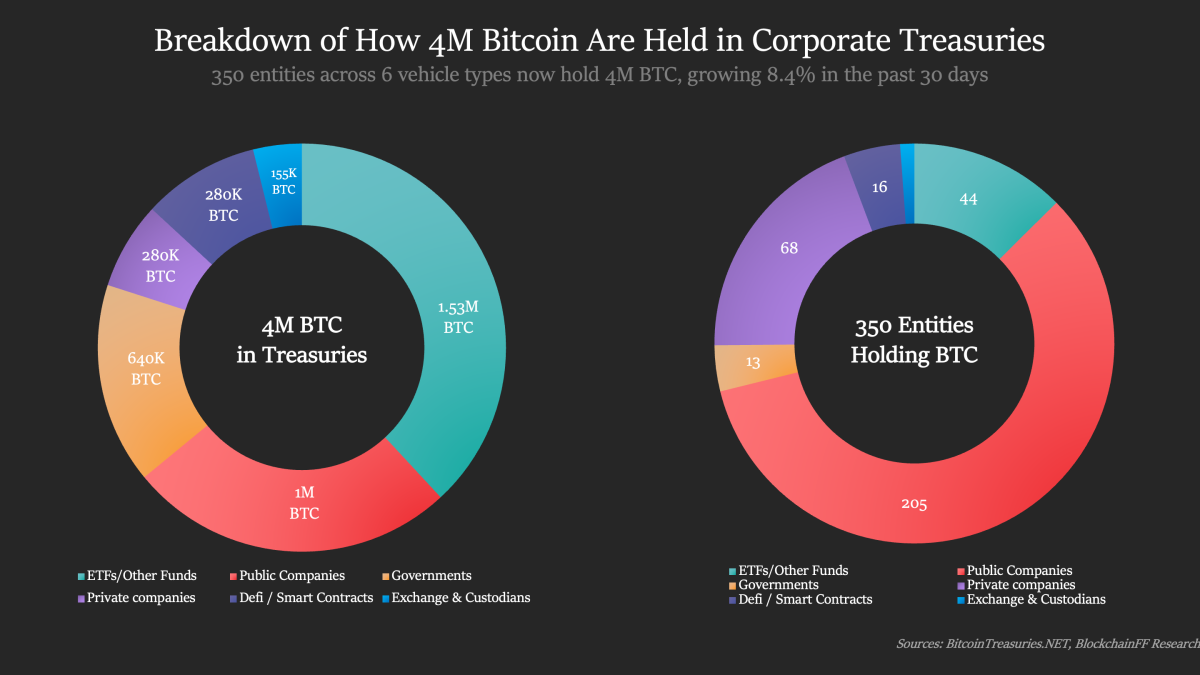

That consensus is fracturing. A new class of public companies has emerged with a different mandate: raise equity or debt in traditional capital markets, then deploy the proceeds into Bitcoin or other digital assets. The structure looks straightforward on paper. The market response has been anything but. Bitcoin treasury companies now hold billions in collective market capitalization. Their shareholders are not buying operating businesses in the traditional sense. They are buying levered exposure to an asset class that most institutional portfolios still exclude.

For eighteen months, the model worked. Share prices traded at premiums to the Bitcoin these companies held. That premium justified further equity raises, which funded more Bitcoin purchases, which lifted valuations again. The flywheel spun faster as spot Bitcoin ETFs launched and accounting rules shifted. Then the discount arrived. By late 2025, many of these vehicles trade below the value of the assets on their balance sheets. The reflexive bid has reversed into reflexive pressure. The question is whether this is a temporary dislocation or a structural reprice.

The Institutional Bridge That Changed Everything

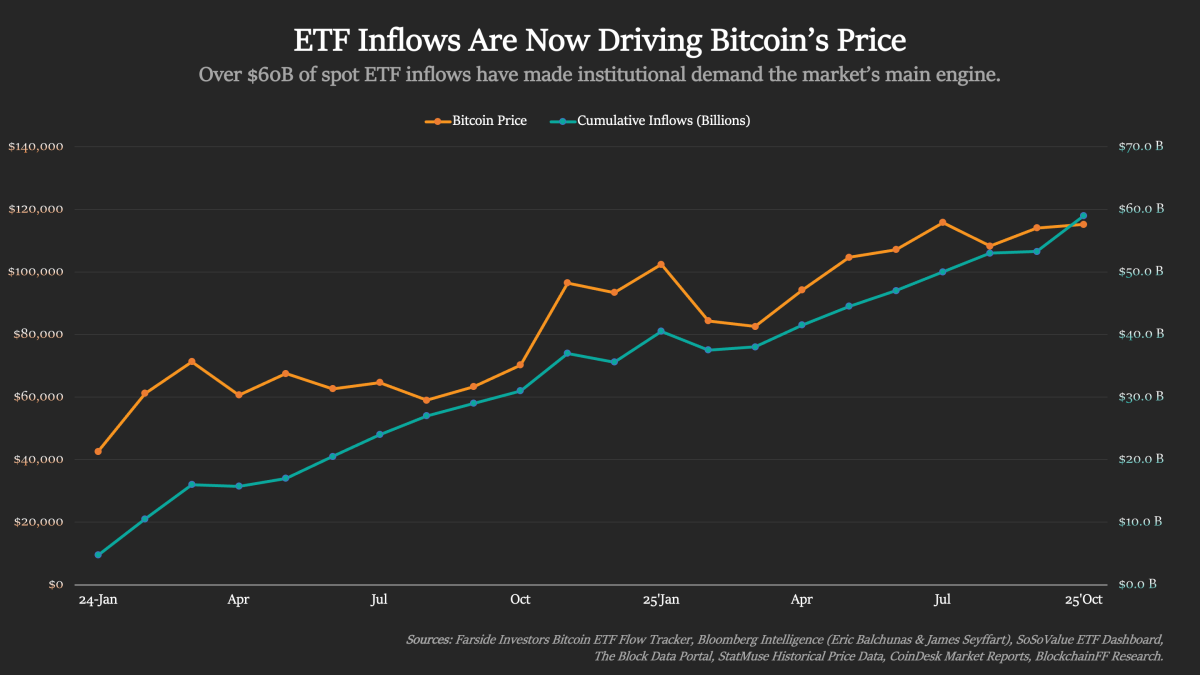

Two forces converged to make Bitcoin treasuries credible. First, spot Bitcoin ETFs institutionalized demand. BlackRock's IBIT and Fidelity's FBTC, launched in January 2024, brought daily creation and redemption, audited shares, and compliance infrastructure pension consultants already understood. Since launch, total capital inflows into Bitcoin reached $661B, with spot ETFs accounting for $34B (5.2%). These are mechanical, rules-based buyers that accumulate regardless of sentiment, not speculative retail flows.

The second shift was accounting. In late 2023, Financial Accounting Standards Board (FASB) approved fair value measurement for digital assets, effective in 2025. The old standard forced treasurers to recognize impairment charges on price declines but prohibited marking assets up on rallies. Reported earnings looked worse than economic reality. Fair value accounting aligns Generally Accepted Accounting Principles (GAAP) with market prices. Volatility remains, but the asymmetry is gone. Boards can now evaluate Bitcoin holdings the same way they evaluate equity positions or commodity hedges.

These two shifts eliminated the barriers that had kept corporate treasuries out of Bitcoin. If a public company can raise equity at a premium to net asset value or issue convertible debt below the expected return on Bitcoin, the arbitrage becomes straightforward corporate finance.

How the Playbook Unfolded

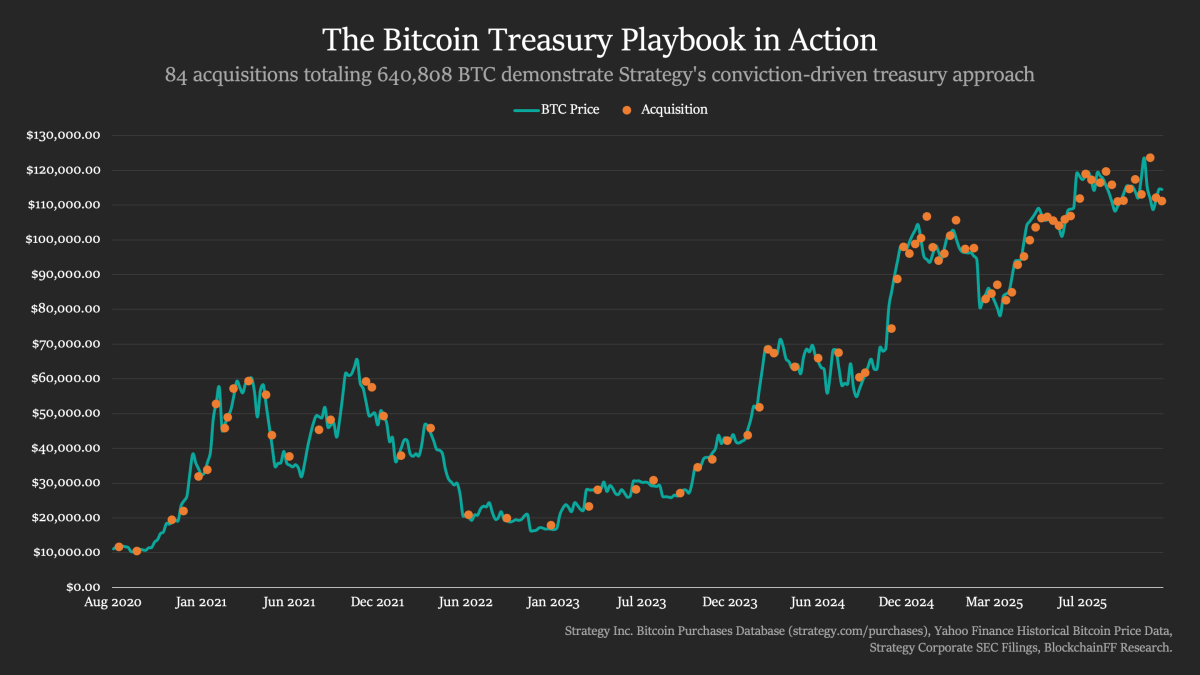

Strategy (formerly MicroStrategy) demonstrated the mechanics first. Beginning in 2020, the company issued convertible notes with coupons as low as 0% to 2.25% and used the proceeds to purchase Bitcoin. As the equity began trading partly as a software business and partly as a Bitcoin proxy, Strategy could raise additional capital through follow-on offerings while shares carried a premium to look-through value. Proceeds funded more purchases. The cycle repeated.

As of early December 2025, Strategy owns nearly 650K BTC, representing over 3% of the total supply and the largest concentration among public companies. When executed with disciplined disclosure and staggered maturities, the approach looked like classic capital-structure engineering applied to a new treasury asset.

Other firms followed. Metaplanet in Japan raised equity and directed proceeds into Bitcoin. In North America, KindlyMD merged with Nakamoto Holdings in August 2025 and repositioned as a Bitcoin treasury vehicle, raising approximately $763M including convertible notes. The company purchased 5.7K BTC and became the 16th largest corporate Bitcoin holder. The Bitcoin Standard Treasury Company has disclosed plans to list via a SPAC with more than 30K BTC at completion.

The pattern extends beyond Bitcoin. Several vehicles now hold mandates to accumulate ecosystem tokens tied to specific Layer 1 or Layer 2 networks. When these firms raise capital, they must deploy into predefined baskets. That hardwires buying pressure into the microstructure of those chains. In past cycles, Bitcoin appreciated first, then capital rotated into altcoins as traders chased beta. Today, mandate-driven treasuries create persistent programmatic buying that operates alongside ETF flows. The result is a structural bid that does not depend on sentiment.

This creates a reflexivity trap. When treasury stocks trade above NAV, issuance becomes accretive. Every new share sold buys more Bitcoin per share than existing holders own. The premium justifies more raises, which fund more purchases, which support the premium. But reflexivity cuts both ways. Once shares trade below NAV, the mechanism inverts. Issuance destroys value. Buybacks make sense, but they require selling the asset. The discount becomes self-reinforcing until an external catalyst breaks the cycle: rate cuts, ETF flows, or forced consolidation. The dynamic applies beyond Bitcoin treasuries. Any asset-backed vehicle that relies on premium issuance faces the same structural risk when sentiment shifts.

When Premiums Collapse Into Discounts

In 2025, the model hit a wall. Many treasury companies slipped from trading above net asset value to trading below it. The gap is not small. Some names trade at discounts exceeding 90%. Several forces converged. Sentiment shifted. When KindlyMD announced a $5B at-the-market program in September 2025, shares fell over 60% in a week as investors struggled to assess dilution impact. Investors who once rewarded aggressive accumulation now price in governance risk, execution uncertainty, and unclear deployment schedules. Confidence collapsed sector-wide.

Macro conditions turned unsympathetic. Higher interest rates lifted the cost of capital. Treasury firms that relied on constant fundraising faced a credit environment where new money became expensive and risk appetite limited. The Federal Reserve policy rate stands at 3.75%-4%, with a December decision pending, compressing the arbitrage between borrowing costs and expected Bitcoin returns.

Competition intensified. Spot Bitcoin ETFs gave investors direct, low-cost exposure without a corporate wrapper. Paying a premium for an intermediary that holds the same asset lost its logic. The same dynamic is emerging in Ethereum markets as institutions anticipate ETF products with staking yield. The space for listed treasury companies to justify premiums narrowed rapidly.

Execution quality diverged. Markets began differentiating between firms perceived as competent and those whose governance or disclosure invited doubt. Strategy's November 2025 mNAV read 0.856 basic and 0.954 diluted, indicating the stock trades slightly below the value of its Bitcoin holdings. The result is that even the category leader now trades near parity, while the majority of treasury firms linger in deeper discount territory.

What Trading Below NAV Actually Means

When a treasury company trades below net asset value, the entire structure inverts. A model built on issuing stock at a premium now finds its main accumulation engine halted. Selling new shares below NAV destroys value for existing holders. Most firms have paused or scaled back equity programs. The reflexive bid that once supported crypto prices has weakened.

Some companies shifted from accumulation to defense. They sell portions of their treasuries to fund share buybacks, attempting to close the valuation gap. Others have reduced operating costs or explored debt secured against digital assets to preserve liquidity without further dilution. A few have turned to consolidation. Larger players with premium-priced equity are positioned to acquire smaller treasury firms at discounts, effectively purchasing Bitcoin below market value. Analysts describe this phase as a likely shakeout, where the strongest balance sheets absorb weaker peers.

The risk is that widespread buybacks convert these vehicles from net buyers into net sellers. If multiple treasuries liquidate holdings to stabilize share prices, the resulting supply could weigh on the markets they were meant to strengthen.

Firms could also turn to higher leverage, but this remains the riskiest path. Borrowing against holdings or using derivatives amplifies returns when prices rise. In periods of stress, it magnifies losses and increases the likelihood of margin calls. Excess leverage could trigger forced liquidations that spill into the broader sector. For now, most firms have avoided significant new leverage beyond legacy arrangements. If discounts persist, the temptation may grow.

The Survival Checklist

The diligence calculus changes completely when treasuries trade at discounts. Three questions now dominate:

- Can they fund operations without selling BTC? Companies with meaningful operating revenue (Strategy's software business, miners' block rewards) can weather extended discounts. Pure treasury plays with burn rates above $10M annually face a clock. Below NAV, every Bitcoin sold to cover overhead destroys shareholder value.

- What's the debt maturity wall? Convertible notes issued at 2x premiums won't convert at 0.6x NAV. They become cash obligations. Companies with significant converts maturing in 2026-2027 face refinancing risk in a market that no longer prices treasury equity at premiums. Secured facilities against BTC holdings offer flexibility, but only if loan-to-value covenants hold through drawdowns.

- Do boards have buyback authorization? At 0.6x NAV, repurchasing shares is effectively buying Bitcoin at a 40% discount. The question is whether management has board approval, available cash or credit lines, and willingness to flip from accumulation to defense. Metaplanet's December 2025 $50M credit facility, which enables potential buybacks, signals this pivot. Others may lack the authorization or liquidity to follow.

Whether the Discount Cycle Resolves or Persists

The next phase depends on whether confidence returns to both sides of the balance sheet: the digital assets these companies hold and the equity they issue.

Early signs of stabilization exist. Metaplanet traded as low as 0.877x in November before recovering to near-parity by early December. Strategy, despite falling below 1.0x for the first time since January 2024, has stabilized rather than entering a death spiral. These moves suggest bargain hunters step in when spreads widen too far. Companies have begun rebuilding credibility through buybacks and transparency. Firms such as Bitmine Immersion and ETHZilla sold portions of holdings to repurchase shares, signaling management alignment with shareholders. While these measures reduce on-chain holdings, they may restore equilibrium between market cap and net assets, a necessary step before growth resumes.

Macro conditions will be decisive. Lower interest rates could reopen convertible debt markets and reduce funding costs for future issuances. Market expectations for December 2025 show approximately 80% odds of a rate cut, which could ease pressure on treasury companies. Persistent ETF inflows into Bitcoin would reinforce structural demand, indirectly supporting treasury balance sheets. Conversely, a risk-off environment or sharp crypto drawdowns could prolong discounts, testing how far companies can stretch liquidity before becoming forced sellers.

For now, new entrants are waiting. Michael Novogratz observed that the industry has likely passed peak treasury issuance. The next phase will be about survival and consolidation. Stronger firms will acquire weaker ones. Management teams must prove that a corporate structure adds value beyond simple coin custody. If confidence gradually returns and equity valuations normalize, a second wave of listings could follow, perhaps with more diversified mandates and clearer operating models.

The Reflexivity That Defines the Trade

This market remains a study in reflexivity. When prices rise, equity premiums can reappear, enabling new capital inflows that further strengthen treasuries and the broader digital asset market. When prices fall, the mechanism reverses. Discounts deepen, issuance halts, and buybacks create selling pressure.

The outcome will depend on whether today's treasury companies can navigate this cycle without losing their strategic purpose. For institutional allocators, the lesson is clear: a corporate wrapper around Bitcoin is not inherently valuable. It becomes valuable only when execution is disciplined, disclosure is transparent, and the cost of capital sits meaningfully below expected returns. When those conditions hold, the arbitrage works. When they break, the discount arrives quickly and persists longer than optimists expect.

The bridge between traditional capital markets and digital assets is real. Whether it becomes infrastructure or a write-off depends on one variable: whether these companies can sustain the arbitrage when the premium disappears. Until then, every treasury trading below NAV is a live test of whether corporate wrappers add value or simply add risk.