With MiniSend, Chris Oketch is building a better payment tool for Africa’s creator economy

DEFI

DEFI

-

-

USDC

USDC

SECURITY

SECURITY

P2P

P2P

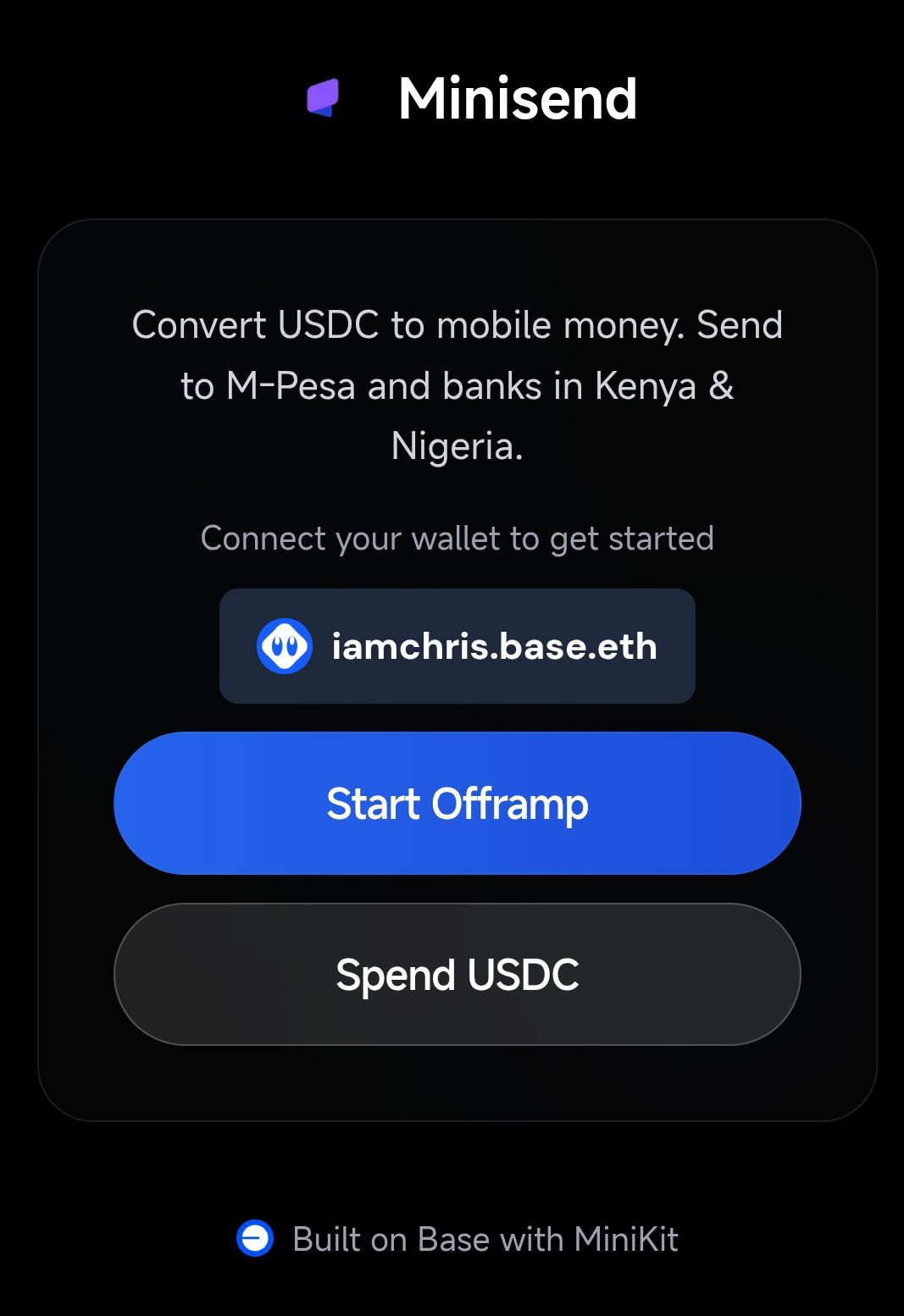

Like most creators, Chris Oketch got tired of waiting for his money. Each week, the Nairobi creator earned USDC online and watched it trapped behind gas fees and slow exchanges. So, he built MiniSend to become Africa’s most frictionless crypto-to-fiat off-ramp that turns digital dollars into real cash in under 60 seconds.

No gas fees. No KYC forms. Just money that moves as fast as the internet it’s earned on.

Before MiniSend, Oketch was just another Web3 creator. He earned in USDC on platforms like Farcaster but faced the same headaches most African crypto users know too well: slow transfers, high costs, and endless P2P hassles.

“It was hectic,” he said. “You’d have to move funds through Binance or OKX, pay a lot in fees, and risk sending to the wrong address. I just needed a way to cash out instantly.”

That frustration turned into a solution. MiniSend emerged as a lightweight, mobile-first off-ramp for creators, bridging digital tokens and local currencies with minimal friction. The premise was simple: send, convert, and settle, all in under 60 seconds.

What sets MiniSend apart isn’t just speed. It is the underlying philosophy: access without compromise.

The app uses Coinbase’s Base platform and integrates “Paymaster” technology from CDP to sponsor user gas fees, up to $500 monthly per person. “It sounds too good to be true,” Oketch admitted, “but it’s real. We sponsor users’ gas so the experience feels seamless.”

Even more radical is MiniSend’s approach to verification. Instead of traditional KYC, it relies on zero-knowledge proofs (ZKPs) to authenticate users without exposing personal data. “Most platforms call themselves decentralised but still demand your ID,” Oketch said. “We wanted to flip that. Security through cryptography, not bureaucracy.”

It’s a model that challenges conventional wisdom in fintech: that compliance and user protection must always come at the cost of convenience.

MiniSend, a new tool for Africa’s creator economy

In Lagos or Nairobi, a creator can now pay for dinner or a taxi directly in local currency, using only USDC from a Coinbase wallet. MiniSend handles the conversion and settlement in under a minute.

“You just ask for the account number,” Oketch explained. “It’s converted instantly to naira or shillings. No exchanges, no waiting.”

That kind of immediacy could change how creators and freelancers think about crypto. For years, stablecoins promised global liquidity but struggled at the last mile, turning digital earnings into spendable cash. MiniSend bridges that gap.

In its first ten weeks, the startup has processed over 75,000 USDC from more than a thousand users. The traction suggests not just curiosity but product–market fit, something few African DeFi experiments can claim this early.

At its core, MiniSend is less about crypto than control. It is a response to the inefficiencies of Africa’s payment rails, where cross-border transfers can take days and mobile money still dominates.

By embedding in the Base ecosystem, Oketch gains both global reach and technical resilience.

Also read: Inside Peter Maina’s plan to turn coffee trees into digital assets with Project Mocha

But his real insight is psychological: users don’t want another wallet; they want financial motion. The decision to build it as a “mini app”, not a full-fledged platform, reflects that ethos: lightweight, accessible, and fast.

This approach also signals a shift in African fintech. The continent’s next wave of innovation may not come from banks or big crypto exchanges, but from small, interoperable tools built by creators for creators. MiniSend’s zero-friction model shows that trust can be coded, not just regulated.

Building from the periphery

Oketch’s journey into Web3 began humbly. A former designer in Kenya’s Web2 scene, he took a 16-week software programme before encountering Base during a local hackathon. From there, he pivoted fully into blockchain development.

His biggest challenge today isn’t technology but visibility. “Market penetration in Africa isn’t easy,” he admitted. “You need resources, amplification, and trust. People want to see the product in action.” Regulatory clarity remains another hurdle, though recent moves like Kenya’s Virtual Assets Law have made experimentation less risky.

MiniSend’s roadmap remains partly under wraps, but Oketch hinted at a key upgrade: custodial wallets. It will allow users to store and spend directly from MiniSend without relying on external wallets like MetaMask or Coinbase.

The idea, once again, is to remove one more point of friction. “We’re building features that let users send and spend USDC directly,” he said. “We want to make crypto invisible, to make it feel like mobile money.”

If he succeeds, MiniSend won’t just be another Web3 startup. It could become a template for the continent’s next generation of financial tools, where DeFi meets design thinking and crypto finally feels local.